When it comes to child support, one question that often arises is, “Who is responsible for setting child support guidelines?” It’s a topic that affects countless families and can have a significant impact on the financial well-being of the children involved. In this article, we’ll delve into this question and explore the various factors that contribute to the establishment of child support guidelines.

Child support guidelines are not simply determined by one person or entity. Instead, they are typically established by state laws or guidelines set forth by government agencies. These guidelines take into account a variety of factors, including the income of both parents, the number of children involved, and the specific needs of the children. By considering these factors, child support guidelines aim to ensure that children receive the financial support they need to thrive.

While the responsibility for setting child support guidelines ultimately lies with the government, it’s important to note that individual cases may also involve the input of judges or other legal professionals. These individuals review the specific circumstances of each case and make decisions based on the best interests of the child. By taking a comprehensive approach, child support guidelines strive to provide fair and equitable outcomes for everyone involved.

In conclusion, the responsibility for setting child support guidelines falls on a combination of state laws, government agencies, and legal professionals. By considering factors such as parental income and the needs of the children, these guidelines aim to ensure that children receive the financial support they require. Understanding who is responsible for setting child support guidelines can help parents navigate the often complex process and ensure the well-being of their children.

Who is Responsible for Setting Child Support Guidelines?

Child support is an essential aspect of ensuring the well-being of children whose parents are no longer together. It helps cover the costs of raising a child, including their basic needs, education, and healthcare. But who exactly is responsible for setting child support guidelines? In this article, we will explore the various entities and factors involved in determining child support.

Government Agencies

Government agencies play a crucial role in setting child support guidelines. In the United States, each state has its own agency responsible for establishing and enforcing child support rules. These agencies are often part of the state’s Department of Revenue or Department of Child Support Services. They work to ensure that child support payments are fair and consistent, taking into account the best interests of the child.

The guidelines set by these agencies are typically based on a variety of factors, including the income of both parents, the number of children involved, and the specific needs of the child. The goal is to create a system that is equitable and provides adequate support for the child’s upbringing.

State Laws and Legislation

Child support guidelines are also influenced by state laws and legislation. Each state has its own set of laws governing child support, which can vary in terms of calculations, formulas, and enforcement. These laws are often established based on research and studies on child-rearing costs, economic factors, and societal norms.

State legislatures regularly review and update these laws to ensure they remain relevant and effective. Changes in economic conditions, societal norms, and the needs of children can all prompt adjustments to child support guidelines. It is important for parents and legal professionals to stay informed about any changes in their state’s laws to ensure compliance and fairness.

Courts and Judges

When parents cannot agree on child support arrangements, the responsibility of determining child support often falls to the courts and judges. Family court judges have the authority to make decisions regarding child support based on the specific circumstances of the case. They take into account factors such as the income and assets of both parents, the child’s needs, and any existing custody arrangements.

Courts may deviate from the standard child support guidelines if they deem it necessary to meet the best interests of the child. This can occur in situations where the child has unique medical or educational needs that require additional financial support. Judges have the flexibility to consider these factors and make adjustments accordingly.

Factors Considered in Setting Child Support Guidelines

When establishing child support guidelines, several factors are typically taken into consideration. These factors can vary depending on the jurisdiction, but some common elements include:

1. Income of both parents: The income of each parent is a significant factor in determining child support. This includes wages, salaries, bonuses, commissions, and other sources of income.

2. Custody arrangements: The amount of time each parent spends with the child can impact child support calculations. In shared custody situations, child support may be adjusted to reflect the shared expenses of both parents.

3. Child’s needs: The specific needs of the child, such as healthcare, education, and extracurricular activities, are considered when determining child support. These expenses are often divided between the parents based on their proportional incomes.

4. Standard of living: The child’s standard of living prior to the separation or divorce is also taken into account. The goal is to maintain a similar standard of living for the child, even after the parents are no longer together.

5. Additional factors: Depending on the jurisdiction, additional factors such as the child’s age, special needs, and the parents’ financial obligations may also be considered.

The Importance of Consistent and Fair Child Support Guidelines

Consistent and fair child support guidelines are crucial for the well-being of children and the financial stability of both parents. By establishing clear guidelines, parents can understand their financial responsibilities and plan accordingly. This helps ensure that children receive the support they need to thrive and that both parents contribute to their upbringing.

Moreover, consistent guidelines promote fairness and reduce conflicts between parents. When child support is determined objectively and consistently, it minimizes disagreements and reduces the need for costly legal battles. This benefits both the parents and the child, fostering a more positive co-parenting dynamic.

In conclusion, the responsibility for setting child support guidelines lies with a combination of government agencies, state laws and legislation, and courts. These entities work together to establish guidelines that are fair, consistent, and in the best interests of the child. By considering factors such as income, custody arrangements, and the child’s needs, child support guidelines aim to provide financial stability and support for children whose parents are no longer together.

Key Takeaways: Who is Responsible for Setting Child Support Guidelines?

- State governments are responsible for setting child support guidelines.

- Each state has its own guidelines that determine how much child support should be paid.

- These guidelines take into account factors like the parents’ income, the child’s needs, and the custody arrangement.

- The guidelines are usually based on a percentage of the noncustodial parent’s income.

- Child support guidelines aim to ensure that children receive financial support from both parents.

Frequently Asked Questions

How are child support guidelines determined?

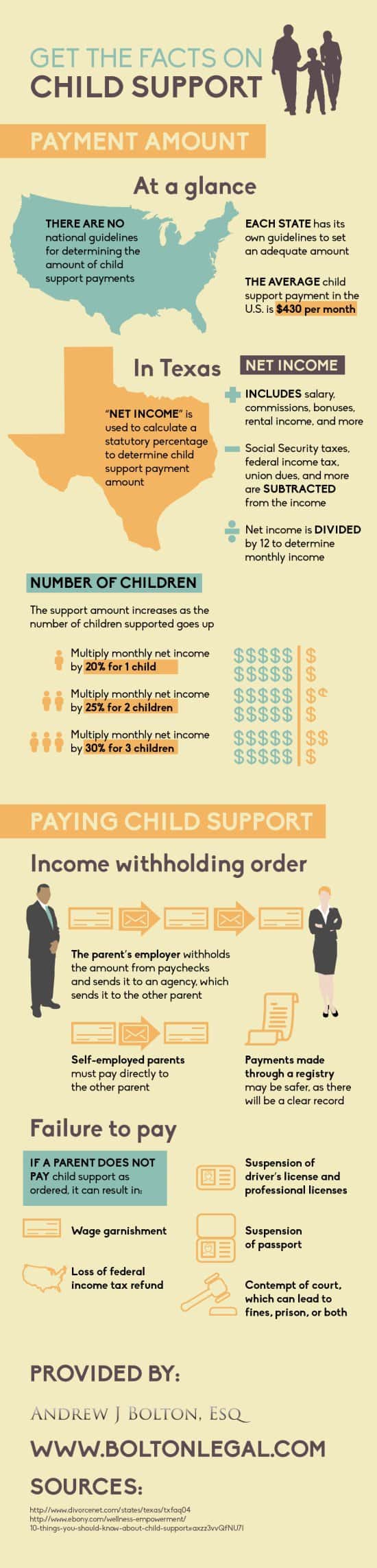

Child support guidelines are determined by each individual state in the United States. The guidelines may vary from state to state, but they are generally based on certain factors such as the income of the parents, the number of children involved, and the specific needs of the children. The guidelines are established to ensure that the child’s financial needs are met and to provide consistency in child support orders.

In order to determine the guidelines, states often have a specific formula or calculation that takes into account the income of both parents, the number of children, and any other relevant factors. This formula is used to calculate the amount of child support that should be paid by the noncustodial parent. It is important to note that the guidelines are not set in stone and can be modified in certain circumstances, such as when there are special needs or extraordinary expenses involved.

Who is responsible for setting child support guidelines?

The responsibility for setting child support guidelines lies with each individual state in the United States. The guidelines are typically established by state legislatures or administrative agencies tasked with family law matters. These entities take into account various factors such as the best interests of the child, the financial capabilities of the parents, and the overall goal of ensuring that children receive adequate financial support.

It is important to understand that child support guidelines can vary from state to state. This means that the specific factors and calculations used to determine child support amounts may differ depending on where you live. It is always advisable to consult with a family law attorney or utilize online resources provided by your state to obtain accurate and up-to-date information regarding child support guidelines in your jurisdiction.

Are child support guidelines the same in every state?

No, child support guidelines are not the same in every state. Each state in the United States has the authority to establish its own guidelines for determining child support payments. While there may be some similarities among states, such as considering the income of both parents and the number of children, the specific calculations and factors used can vary.

It is important to note that child support guidelines can also change over time. States may periodically review and update their guidelines to reflect changes in economic conditions or new legislative developments. Therefore, it is crucial to stay informed about the child support guidelines in your state to ensure that you are complying with the law and providing appropriate support for your children.

Can child support guidelines be modified?

Yes, child support guidelines can be modified under certain circumstances. While the guidelines provide a framework for determining child support amounts, they are not set in stone and can be adjusted if there are significant changes in the financial circumstances of either parent or the needs of the child.

To modify child support, a parent must typically file a motion with the court and demonstrate a substantial change in circumstances. This can include factors such as a significant increase or decrease in income, a change in custody arrangements, or the incurrence of new expenses related to the child’s well-being. The court will then review the evidence presented and make a decision on whether to modify the child support order.

It is important to follow the proper legal procedures when seeking a modification of child support. Consulting with a family law attorney can help ensure that you understand the requirements and increase the likelihood of a successful modification request.

What happens if child support guidelines are not followed?

If child support guidelines are not followed, the consequences can vary depending on the jurisdiction and the specific circumstances. Generally, failing to comply with a child support order can result in legal consequences such as fines, wage garnishment, suspension of driver’s licenses, or even imprisonment.

It is important for both parents to understand their obligations under the child support order and fulfill them accordingly. If there are legitimate reasons for not being able to meet the child support obligations, such as a temporary financial hardship, it is advisable to communicate with the appropriate authorities or seek a modification of the order.

Noncustodial parents should keep accurate records of child support payments, such as receipts or bank statements, to demonstrate compliance in case of any disputes or misunderstandings. Custodial parents who are not receiving the court-ordered child support may need to seek legal remedies to enforce the order and ensure their children receive the financial support they are entitled to.

CHILD SUPPORT GUIDELINES AND SEPARATION AGREEMENTS

Final Summary: Who Holds the Responsibility for Setting Child Support Guidelines?

When it comes to determining child support guidelines, the responsibility falls on the government and legal authorities. However, it is important to note that the specific entity responsible may vary depending on the country or jurisdiction. In many cases, it is the legislative bodies that pass laws and regulations outlining the guidelines for child support. These guidelines are designed to ensure fairness and consistency in determining the financial support necessary for children in cases of separation or divorce.

In the United States, for example, the responsibility for setting child support guidelines lies with each individual state. State legislatures establish child support laws and guidelines based on various factors such as the needs of the child, the income of the parents, and the standard of living the child was accustomed to before the separation. These guidelines are then used by the courts to calculate the amount of child support that should be paid.

While the responsibility for setting child support guidelines ultimately lies with the government, it is important for parents to understand their rights and obligations regarding child support. Seeking legal advice and understanding the specific laws and guidelines in their jurisdiction can help parents navigate this often complex and sensitive issue. By ensuring that child support is determined fairly and in the best interest of the child, we can provide the necessary financial support for their well-being and upbringing.