Ah, the age-old question of prenuptial agreements and their role in property division. It’s a topic that often sparks curiosity, concern, and even a hint of controversy. So, what role does a prenuptial agreement really play in the division of property? Let’s dive in and explore this intriguing topic.

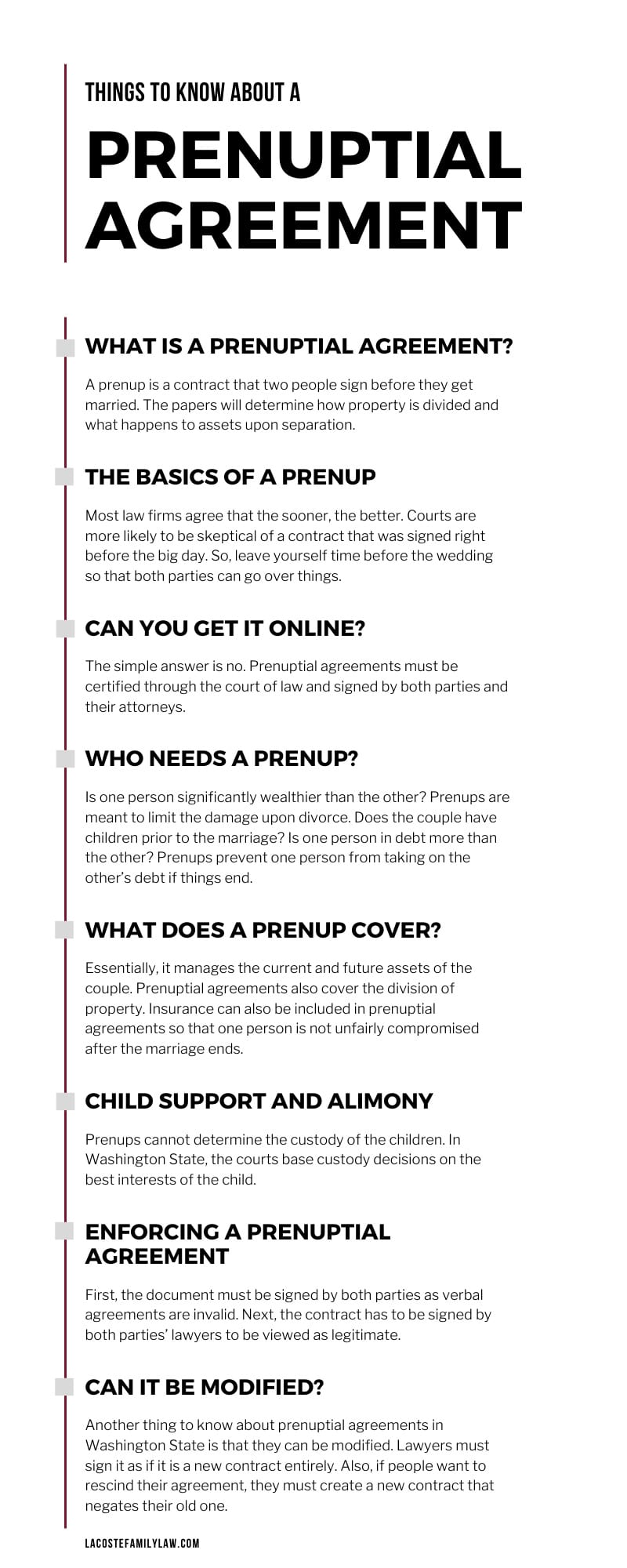

When it comes to matters of the heart and the law, it’s always wise to be informed and prepared. A prenuptial agreement, also known as a “prenup” for short, is a legal document that couples sign before they tie the knot. It outlines how their assets, debts, and properties will be divided in the event of a divorce or separation. Think of it as a safety net, a way to protect one’s hard-earned possessions and financial interests.

Now, you might be wondering why anyone would want to bring up such a sensitive topic before their happily ever after. Well, the truth is, a prenuptial agreement can actually bring peace of mind and clarity to both parties involved. It sets clear expectations and can help avoid messy legal battles down the road. Plus, it’s not just for the wealthy or famous. Prenups can be beneficial for anyone who wants to safeguard their assets, regardless of their net worth. So, whether you’re a high-profile celebrity or an everyday couple, a prenuptial agreement can play a crucial role in property division, ensuring a smoother path forward if the unexpected happens.

Understanding the Role of a Prenuptial Agreement in Property Division

A prenuptial agreement, commonly referred to as a prenup, is a legal contract signed by a couple before they get married or enter into a civil partnership. Its purpose is to establish the division of assets and liabilities in the event of a divorce or the dissolution of the partnership. While prenups are often associated with protecting the wealthier spouse, they can play a crucial role in property division for couples of all financial backgrounds.

Protecting Individual Assets

When a couple decides to marry, they typically merge their lives and finances. However, each partner may have certain assets they want to protect in the event of a divorce. A prenuptial agreement allows individuals to safeguard their personal belongings, investments, businesses, and other valuable assets. By clearly outlining what belongs to each party before the marriage, a prenup can prevent disputes and simplify property division proceedings.

A prenuptial agreement can also address debts and liabilities, ensuring that each partner is responsible for their own financial obligations. This is especially important if one partner has significant debts or a history of financial mismanagement. By separating the liabilities, a prenup can protect the other partner from being held responsible for debts they did not contribute to.

Establishing Property Division Guidelines

One of the main functions of a prenuptial agreement is to establish guidelines for property division in the event of a divorce or separation. Without a prenup, the division of assets and liabilities is typically determined by state laws, which may not align with the couple’s wishes or individual circumstances.

A prenuptial agreement allows couples to customize their property division plan based on their specific needs and preferences. They can decide how their assets will be divided, whether it’s an equal split or a different arrangement that takes into account various factors such as contributions to the marriage, individual financial circumstances, and future earning potential.

Factors Considered in Property Division

When creating a prenuptial agreement, couples can include specific factors that should be considered in the property division process. Some common factors include:

1. Contributions to the marriage: A prenup can outline how the contributions of each partner will be taken into account when dividing assets. This can include financial contributions, as well as non-financial contributions such as raising children or supporting a spouse’s career.

2. Future earning potential: If one partner has significantly higher earning potential than the other, a prenup can address how this should be considered in the property division. It can ensure that the lower-earning partner is adequately provided for in the event of a divorce.

3. Inheritance and family assets: Couples may want to address how inherited assets or family-owned properties should be handled in the event of a divorce. A prenup can protect these assets from being subject to division and ensure they remain within the family.

4. Marital agreements: A prenuptial agreement can also include provisions for future agreements between the spouses. For example, it can outline how a postnuptial agreement would be handled if the couple decides to create one during their marriage.

By considering these factors and establishing guidelines in a prenuptial agreement, couples can have more control over the property division process and ensure a fair and equitable outcome.

Benefits of a Prenuptial Agreement

While some may view prenuptial agreements as unromantic or pessimistic, they offer several benefits for couples:

1. Clarity and certainty: A prenup provides clarity and certainty about how assets and liabilities will be divided in the event of a divorce. This can help reduce conflict and ensure a smoother process.

2. Protection of individual interests: A prenuptial agreement allows individuals to protect their personal assets and financial interests, providing peace of mind and security.

3. Preservation of family assets: If one or both partners come from families with significant assets, a prenup can ensure that these assets remain within the family in the event of a divorce.

4. Financial planning: Creating a prenuptial agreement requires couples to have open and honest conversations about their finances, which can lead to better financial planning and communication throughout their marriage.

5. Cost and time savings: In the event of a divorce, having a prenuptial agreement in place can save couples the time, stress, and legal expenses associated with lengthy property division proceedings.

In conclusion, a prenuptial agreement plays a vital role in property division by protecting individual assets, establishing guidelines for division, and considering various factors that affect the process. While it may not be suitable for every couple, those who choose to create a prenup can benefit from the clarity, protection, and peace of mind it provides.

Key Takeaways: What Role Does a Prenuptial Agreement Play in Property Division?

- A prenuptial agreement is a legal document that helps determine how assets and debts will be divided in the event of a divorce.

- It is important to have open and honest communication with your partner when considering a prenuptial agreement.

- Prenuptial agreements can protect individual property and assets that were acquired before the marriage.

- They can also establish guidelines for spousal support and alimony in case of divorce.

- A prenuptial agreement can provide peace of mind and clarity regarding property division, reducing potential conflicts in the future.

Frequently Asked Questions

What is a prenuptial agreement?

A prenuptial agreement, commonly referred to as a prenup, is a legally binding contract entered into by a couple before they get married or enter into a civil partnership. It outlines the division of assets and property in the event of a divorce or separation, providing both parties with financial protection.

Prenups can cover a wide range of issues, including the division of property, spousal support, and debt allocation. They can also address other matters such as child custody and visitation rights, although these provisions may not always be enforceable.

What role does a prenuptial agreement play in property division?

A prenuptial agreement plays a crucial role in property division during a divorce or separation. Without a prenup, the division of assets and property is typically determined by the laws of the state or country in which the couple resides. This can result in an equal division of assets, regardless of who brought what into the marriage.

However, a prenuptial agreement allows couples to dictate their own terms and conditions for property division. They can specify which assets are considered separate or marital property, and how they should be divided in the event of a divorce. This can help protect individual assets and prevent lengthy and costly legal battles over property division.

Are prenuptial agreements legally binding?

Yes, prenuptial agreements are generally considered legally binding, provided they meet certain requirements. To be enforceable, a prenup must be in writing, signed by both parties, and entered into voluntarily. It is also important that both parties have had the opportunity to seek independent legal advice and fully understand the terms and implications of the agreement.

However, it’s worth noting that the enforceability of a prenuptial agreement can vary depending on the jurisdiction and the specific circumstances of the case. In some cases, a court may refuse to enforce certain provisions of a prenup if they are deemed unfair or contrary to public policy.

Can a prenuptial agreement be challenged in court?

Yes, a prenuptial agreement can be challenged in court under certain circumstances. Common reasons for challenging a prenup include fraud, coercion, duress, or lack of full and fair disclosure of assets. If any of these factors can be proven, a court may invalidate some or all of the provisions in the agreement.

It’s important to remember that the burden of proof lies with the party seeking to challenge the prenup. They must provide sufficient evidence to support their claims and convince the court that the agreement should be set aside. Consulting with an experienced family law attorney is crucial if you are considering challenging a prenuptial agreement.

When should a couple consider a prenuptial agreement?

A couple should consider a prenuptial agreement if they have significant assets, own property, or have other financial interests they wish to protect in the event of a divorce. It can also be beneficial in situations where one or both parties have children from a previous relationship and want to ensure that their assets are preserved for their children’s inheritance.

Additionally, couples with significant income disparities or varying levels of debt may find a prenup helpful in establishing financial expectations and protections. Ultimately, the decision to pursue a prenuptial agreement should be made based on the unique circumstances and needs of the couple, and it is advisable to seek legal advice when considering this option.

How A [Prenup Impacts Property Division In Divorce] – Michigan Law

Final Thoughts

Now that we’ve explored the role of a prenuptial agreement in property division, it’s clear that this legal document plays a significant role in protecting the assets and interests of both parties involved in a marriage. While it may not be the most romantic topic to discuss before tying the knot, a prenuptial agreement can provide peace of mind and financial security for couples.

By setting out clear guidelines for how property will be divided in the event of a divorce or separation, a prenuptial agreement helps to eliminate ambiguity and potential conflicts. It allows couples to make informed decisions about their assets and debts, ensuring that they maintain control over their individual financial futures.

In addition to its practical benefits, a prenuptial agreement can also strengthen communication and trust between partners. It encourages open and honest discussions about finances, goals, and expectations, promoting a healthy foundation for the relationship.

In conclusion, while a prenuptial agreement may not be necessary for every couple, it can be a valuable tool for those who want to protect their assets and clarify property division in the event of a divorce. By understanding the role of a prenuptial agreement and engaging in open conversations about finances, couples can establish a solid foundation for a successful and secure marriage. Remember, it’s always important to consult with a legal professional to ensure that your prenuptial agreement meets all legal requirements and addresses your specific needs.