So you’ve found yourself wondering, “What is alimony and how is it determined?” Well, my friend, you’ve come to the right place. Alimony, also known as spousal support or maintenance, is a legal obligation that one spouse may have to provide financial support to the other after a divorce or separation. It is a topic that can be complex and emotionally charged, but fear not, I’m here to break it down for you in a way that’s easy to understand.

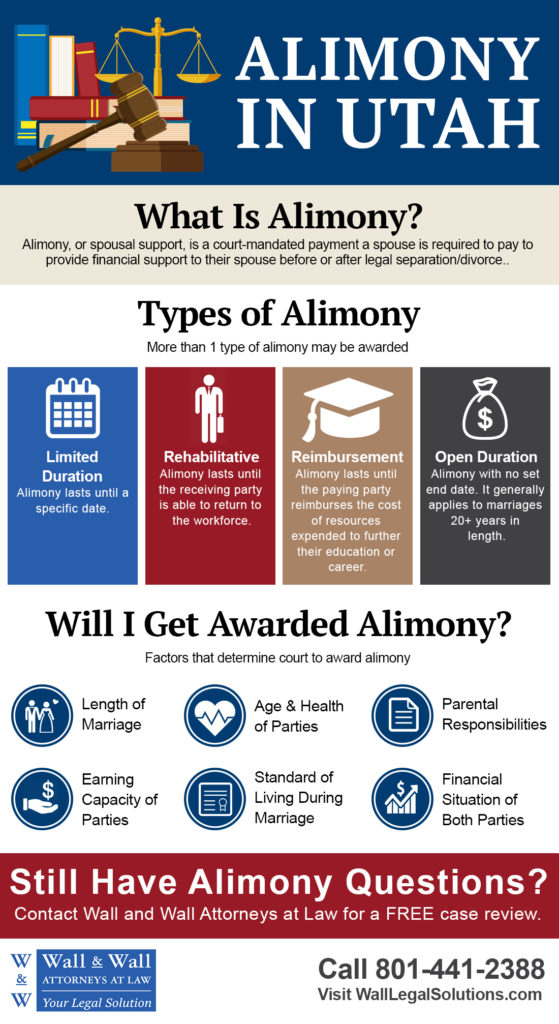

When it comes to determining alimony, there are several factors that come into play. It’s not as simple as a one-size-fits-all formula. The court takes various aspects into consideration, such as the length of the marriage, the income and earning capacity of each spouse, the standard of living during the marriage, and the needs and obligations of each party. It’s a delicate balancing act to ensure that both parties are treated fairly and that the financial support provided is reasonable and sustainable.

But wait, there’s more! In addition to these factors, the court may also consider the age and health of the parties involved, the contributions each spouse made to the marriage (both financial and non-financial), and any other relevant circumstances. The goal is to provide a fair and equitable outcome that takes into account the unique circumstances of each case.

So, whether you’re going through a divorce, curious about the ins and outs of alimony, or simply have a thirst for knowledge, join me as we dive into the world of alimony and unravel its mysteries. Get ready to learn, laugh, and maybe even shed a tear or two as we explore what alimony is and how it’s determined. Let’s get started!

Alimony, also known as spousal support, refers to the financial payments made by one spouse to the other after a divorce or separation. The determination of alimony depends on various factors such as the length of the marriage, the income and earning capacity of each spouse, the standard of living during the marriage, and the needs of the recipient spouse. Courts consider these factors to ensure a fair and reasonable distribution of financial resources. Alimony can be awarded as a lump sum or in regular payments.

Understanding Alimony: A Comprehensive Guide

Alimony is a critical aspect of divorce proceedings that often raises questions and concerns. Many individuals going through a divorce are unsure about what alimony is and how it is determined. In this article, we will delve into the intricacies of alimony, providing you with a clear understanding of this concept and how it affects divorce settlements.

What is Alimony?

Alimony, also known as spousal support or maintenance, is a legal obligation that requires one spouse to provide financial support to the other spouse after a divorce or separation. The purpose of alimony is to ensure that both parties can maintain a similar standard of living post-divorce, especially if one spouse earns significantly more than the other.

Alimony is not automatically awarded in every divorce case. Instead, it is typically determined based on various factors, including the length of the marriage, the income disparity between the spouses, and the financial needs of the receiving spouse.

Factors Considered in Determining Alimony

When deciding on the amount and duration of alimony payments, courts take several factors into account. These factors may vary depending on the jurisdiction, but common considerations include:

- The length of the marriage: Longer marriages often result in higher alimony awards.

- The income and earning capacity of each spouse: If one spouse earns significantly more than the other, it may impact the amount of alimony awarded.

- The standard of living during the marriage: Courts strive to maintain a similar standard of living for both parties after the divorce.

- The age and health of each spouse: The overall physical and mental well-being of both parties can influence alimony determinations.

- The financial needs of the receiving spouse: If one spouse has limited earning potential or is unable to support themselves financially, alimony may be awarded.

It is important to note that alimony is not a punitive measure but rather a means to ensure fairness and financial stability for both parties involved.

Types of Alimony

There are different types of alimony that can be awarded based on the specific circumstances of the divorce. Let’s explore some of the common types:

1. Temporary Alimony

Temporary alimony, also known as pendente lite alimony, is awarded during the divorce proceedings to provide immediate financial support to the dependent spouse. This type of alimony is typically terminated once the divorce is finalized.

Temporary alimony aims to maintain the financial status quo until a final alimony decision is made.

2. Rehabilitative Alimony

Rehabilitative alimony is awarded to a spouse who requires financial support to acquire new skills or education to become self-sufficient. This type of alimony is often provided for a specific period to enable the receiving spouse to obtain the necessary training or education for future employment.

Rehabilitative alimony encourages the dependent spouse to become financially independent and self-sufficient.

3. Permanent Alimony

Permanent alimony is awarded when there is a significant income disparity between the spouses, and the receiving spouse is unlikely to become financially independent due to age, health, or other factors. This type of alimony continues until the death of either party or the remarriage of the receiving spouse.

Permanent alimony ensures long-term financial support for the dependent spouse.

The Role of Agreements in Alimony Determination

While courts have the authority to determine alimony, couples can also negotiate and create their own alimony agreements. These agreements, known as marital settlement agreements or separation agreements, allow couples to customize alimony terms that meet their specific needs and preferences.

Entering into a mutually agreed-upon alimony agreement can provide more control and flexibility for both parties involved.

Calculating Alimony: Understanding the Process

Calculating alimony involves a complex process that takes into account various factors and considerations. While there is no universal formula for determining alimony, we will explore some of the common methods used.

Income-Based Approach

One common approach to calculating alimony is the income-based method. This method involves determining the difference in income between the spouses and awarding a percentage of that difference as alimony.

For example, if one spouse earns $80,000 per year and the other spouse earns $40,000 per year, resulting in a $40,000 income disparity, the court may award alimony based on a percentage of this difference.

Considerations in the Income-Based Approach

When using the income-based approach, courts may consider additional factors such as:

- The financial needs of each spouse

- The earning capacity and potential of each spouse

- The lifestyle and standard of living during the marriage

- The duration of the marriage

These considerations help ensure a fair and reasonable alimony award that takes into account the specific circumstances of the divorce.

Needs-Based Approach

The needs-based approach focuses on the financial needs of the receiving spouse. This method takes into account the essential living expenses, including housing, healthcare, and other necessary costs.

By considering the reasonable needs of the dependent spouse, the court determines an alimony amount that enables them to maintain a similar standard of living post-divorce.

Modifying Alimony Awards

It is important to note that alimony awards are not set in stone. They can be modified if there are substantial changes in circumstances, such as a significant increase or decrease in income, job loss, or remarriage of the receiving spouse.

Courts have the authority to modify alimony awards to ensure they remain fair and equitable based on the current circumstances of both parties.

Conclusion

Understanding alimony is crucial for anyone going through a divorce or separation. By familiarizing yourself with the concept of alimony and the factors involved in its determination, you can navigate the divorce process with greater clarity and confidence.

Remember, alimony is designed to provide financial support and maintain a fair standard of living for both parties involved. Whether you are the paying or receiving spouse, it is essential to consult with legal professionals to ensure your rights and interests are protected throughout the alimony determination process.

Key Takeaways: What is Alimony and How is It Determined?

- Alimony is a financial support payment made by one spouse to the other after a divorce or separation.

- The amount of alimony is determined by factors such as the length of the marriage, each spouse’s income and earning potential, and the standard of living during the marriage.

- Alimony can be awarded temporarily or permanently, depending on the circumstances.

- Courts consider the needs of the receiving spouse and the paying spouse’s ability to pay when determining alimony.

- Alimony can be modified or terminated if there are significant changes in the financial situation of either spouse.

Frequently Asked Questions

What factors are considered when determining alimony?

When determining alimony, also known as spousal support, several factors are taken into consideration. These may vary depending on the jurisdiction, but common factors include:

– Length of the marriage: Longer marriages may result in higher alimony amounts.

– Income and earning capacity of each spouse: The court will consider the income and potential for future earnings of both parties.

– Standard of living during the marriage: The court may seek to maintain a similar standard of living for the recipient spouse.

– Age and health of each spouse: The court may consider the age and health conditions of both parties, especially if it affects their ability to work and support themselves.

– Contributions to the marriage: Non-financial contributions, such as child-rearing or supporting the other spouse’s career, may also be taken into account.

Can alimony be modified?

Yes, alimony can be modified under certain circumstances. If there is a significant change in the financial situation of either party, such as a job loss or increase in income, a modification of alimony may be requested. Additionally, if there is a change in the recipient’s needs or the payer’s ability to pay, a modification may be considered. It’s important to consult with an attorney to understand the specific requirements and procedures for modifying alimony in your jurisdiction.

It’s worth noting that some divorce agreements may include provisions that prevent alimony from being modified, so it’s important to carefully review the terms of the agreement before seeking a modification.

Is alimony taxable?

Alimony, also known as spousal support, used to be taxable income for the recipient and tax-deductible for the payer. However, under the Tax Cuts and Jobs Act passed in 2017, alimony is no longer considered taxable income for the recipient, and the payer is no longer able to deduct it from their taxes. This change applies to divorce or separation agreements executed after December 31, 2018. It’s important to consult with a tax professional to understand the specific tax implications of alimony in your situation.

How long does alimony typically last?

The duration of alimony, also known as spousal support, can vary depending on the circumstances of the divorce and the jurisdiction. In some cases, alimony may be awarded for a specific period of time, such as a few years, to allow the recipient spouse to become financially independent. In other cases, alimony may be awarded for an indefinite period, especially in long-term marriages or when the recipient spouse has limited earning capacity.

The length of alimony may also be influenced by factors such as the recipient’s age, health, and ability to become self-supporting. It’s important to consult with an attorney to understand the specific laws and guidelines regarding the duration of alimony in your jurisdiction.

What happens if alimony payments are not made?

If alimony payments are not made as required by the divorce agreement or court order, the recipient spouse may take legal action to enforce the payments. This may involve filing a motion for contempt or seeking a judgment against the non-compliant spouse. Consequences for non-payment of alimony can vary depending on the jurisdiction, but they may include fines, wage garnishment, or even imprisonment in extreme cases.

If you are struggling to make alimony payments, it’s important to consult with an attorney as soon as possible to explore your options. In some cases, a modification of the alimony order may be possible due to a change in circumstances, such as job loss or financial hardship.

Final Thoughts

Now that we’ve taken a closer look at what alimony is and how it is determined, it’s clear that this topic is both complex and important. Alimony, also known as spousal support, is a legal obligation that one spouse may have to financially support the other after a divorce or separation. The amount of alimony and the duration of payments can vary widely depending on several factors, including the length of the marriage, the income and earning potential of each spouse, and the standard of living established during the marriage.

Understanding the ins and outs of alimony can be overwhelming, but it’s crucial to have a grasp of this topic if you find yourself in a divorce or separation situation. By familiarizing yourself with the different types of alimony, such as temporary, rehabilitative, or permanent, and the factors that courts consider when determining the amount, you can better navigate the legal process and ensure a fair outcome for both parties involved.

Remember, every divorce or separation case is unique, and the specific details and circumstances will ultimately influence the final decision on alimony. It’s advisable to consult with a qualified attorney who specializes in family law to guide you through the process and provide personalized advice based on your individual situation. With the right knowledge and guidance, you can approach the topic of alimony with confidence and make informed decisions that will shape your future financial stability.