Ah, the infamous prenuptial agreement. What exactly is it, you may wonder? Well, let me break it down for you in a way that’s engaging and easy to understand. A prenuptial agreement, often referred to as a “prenup,” is a legal contract that couples enter into before they tie the knot. Now, hold on a minute! Before you start conjuring up images of cold-hearted individuals planning for the worst, let me assure you that prenups can actually be quite sensible and beneficial for both parties involved.

Picture this: a prenup is like an insurance policy for your marriage. It outlines how assets, debts, and even potential alimony will be divided in the event of a divorce. It may not be the most romantic topic to discuss, but it can provide peace of mind and clarity for couples who want to protect their individual interests. Think of it as a safety net, a way to navigate the choppy waters of marriage with a clear understanding of what would happen in the unfortunate event of a separation.

Now, before you start rolling your eyes and dismissing the idea entirely, let’s dive deeper into the world of prenuptial agreements. We’ll explore their purpose, their benefits, and address any misconceptions along the way. So, grab a cup of coffee, sit back, and let’s embark on this journey together.

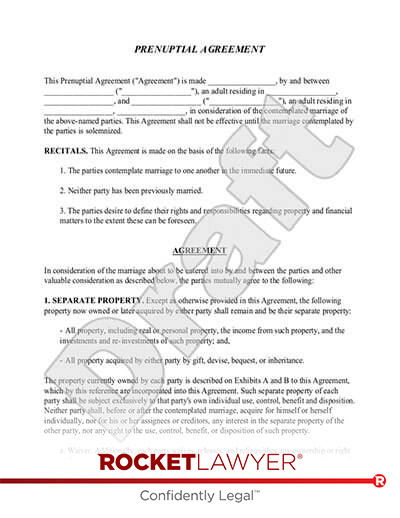

A prenuptial agreement, commonly known as a prenup, is a legal contract entered into by a couple before they get married or enter into a civil partnership. This agreement outlines how their assets, debts, and other financial matters will be divided in the event of a divorce or separation. Prenups can help protect individuals’ financial interests and provide clarity and certainty in case of a relationship breakdown. It is important to consult with a lawyer experienced in family law when considering a prenuptial agreement.

What is a Prenuptial Agreement?

A prenuptial agreement, often referred to as a prenup, is a legally binding contract entered into by a couple before they get married or enter into a civil partnership. It outlines the division of assets, property, and financial responsibilities in the event of a divorce or dissolution of the partnership. Prenuptial agreements are designed to protect the interests of both parties and provide clarity and security in the event of a relationship breakdown.

Why are Prenuptial Agreements Important?

Prenuptial agreements have become increasingly popular in recent years as more couples recognize the need for financial protection and security. These agreements can help to prevent lengthy and costly legal battles in the event of a divorce or separation by clearly defining the terms of the division of assets. By entering into a prenuptial agreement, couples can have peace of mind knowing that their financial interests are protected and that they have a clear plan in place for the future.

Prenuptial agreements also provide an opportunity for open and honest communication between partners about their financial expectations, goals, and obligations. This can help to establish a foundation of trust and understanding in the relationship, allowing both parties to have a clear understanding of each other’s financial circumstances and intentions.

What Should be Included in a Prenuptial Agreement?

A prenuptial agreement should cover a variety of financial aspects that may arise during a marriage or civil partnership. These can include:

1. Division of Assets

The agreement should outline how assets, such as property, investments, and personal belongings, will be divided in the event of a divorce or dissolution of the partnership. This can help to prevent disputes and ensure a fair and equitable distribution of assets.

2. Financial Responsibilities

The prenuptial agreement should address financial responsibilities, such as debts, loans, and ongoing financial obligations. This can include provisions for the payment of spousal support, child support, and any other financial commitments.

3. Inheritance and Estate Planning

Couples may choose to include provisions regarding inheritance and estate planning in their prenuptial agreement. This can help to protect individual assets and ensure that each party’s wishes are respected in the event of their death.

4. Business Interests

If one or both partners have business interests, the prenuptial agreement should address how these will be managed in the event of a divorce or dissolution. This can help to protect the integrity and value of the business and prevent disputes over ownership or control.

5. Dispute Resolution

It is important to include provisions for dispute resolution in the prenuptial agreement to outline how conflicts or disagreements will be resolved. This can help to avoid lengthy and costly legal battles and provide a clear process for resolving disputes.

The Benefits of a Prenuptial Agreement

There are several benefits to having a prenuptial agreement in place:

1. Financial protection: A prenuptial agreement can provide financial protection and security for both parties, ensuring a fair and equitable division of assets in the event of a divorce or dissolution.

2. Clarity and certainty: By outlining the terms of the division of assets and financial responsibilities, a prenuptial agreement provides clarity and certainty for both partners, reducing the risk of disputes and misunderstandings.

3. Open and honest communication: Creating a prenuptial agreement requires open and honest communication about financial matters, which can strengthen the relationship and foster trust and understanding.

4. Avoidance of lengthy legal battles: By clearly defining the terms of the division of assets and financial responsibilities, a prenuptial agreement can help to avoid lengthy and costly legal battles in the event of a divorce or dissolution.

5. Protection of business interests: If one or both partners have business interests, a prenuptial agreement can help to protect the integrity and value of the business and prevent disputes over ownership or control.

In conclusion, a prenuptial agreement is a legally binding contract that provides financial protection and security for couples entering into a marriage or civil partnership. It outlines the division of assets, financial responsibilities, and other important financial aspects in the event of a divorce or dissolution. By having a prenuptial agreement in place, couples can have peace of mind knowing that their financial interests are protected and that they have a clear plan in place for the future.

Key Takeaways: What is a Prenuptial Agreement?

- A prenuptial agreement is a legal document created by a couple before they get married.

- It outlines how their assets, debts, and property will be divided if they decide to separate or divorce in the future.

- Prenups can help protect each partner’s financial interests and provide clarity in case of a breakup.

- They are especially important for individuals with significant assets or businesses.

- Prenuptial agreements are not just for the wealthy; anyone can consider getting one to safeguard their financial future.

Frequently Asked Questions

What is the purpose of a prenuptial agreement?

A prenuptial agreement, also known as a prenup, is a legal contract that is signed by a couple before they get married or enter into a civil partnership. The main purpose of a prenuptial agreement is to outline how the couple’s assets, debts, and other financial matters will be divided in the event of a divorce or separation. It provides clarity and protection for both parties, ensuring that their individual rights and interests are respected.

Additionally, a prenuptial agreement can address other important issues such as spousal support, property division, and the handling of any future potential inheritances. It allows couples to have open and honest conversations about their financial expectations and responsibilities, promoting transparency and reducing conflicts in the future.

Are prenuptial agreements legally binding?

Yes, prenuptial agreements are generally considered legally binding as long as they meet certain requirements. To be enforceable, a prenup must be in writing, signed by both parties, and entered into voluntarily, without any signs of coercion or duress. Both parties should also have the opportunity to seek independent legal advice before signing the agreement.

However, it’s important to note that courts have the discretion to set aside or modify certain provisions of a prenuptial agreement if they are found to be unfair or against public policy. This is why it’s crucial to consult with an experienced family law attorney who can help you draft a comprehensive and fair prenuptial agreement that is more likely to be upheld in court.

Can a prenuptial agreement only address financial matters?

No, a prenuptial agreement can cover a wide range of issues beyond just financial matters. While the division of assets and debts is a common focus, couples can also include provisions regarding spousal support, child custody and visitation, and even the division of household chores and responsibilities.

However, it’s important to keep in mind that certain topics, such as child custody and support, may be subject to the court’s discretion and may not be entirely binding. It’s always a good idea to consult with an attorney who specializes in family law to ensure that your prenuptial agreement covers all the necessary aspects and adheres to the laws and regulations of your jurisdiction.

When should a couple consider getting a prenuptial agreement?

Couples may consider getting a prenuptial agreement if they have significant assets, own a business, have children from previous relationships, or if one or both partners have substantial debts. It can also be beneficial for couples who want to establish clear expectations and guidelines for their financial responsibilities and rights.

It’s important to have open and honest conversations about the need for a prenuptial agreement well in advance of the wedding or civil partnership ceremony. This allows both parties sufficient time to understand the implications and seek legal advice if necessary. It’s recommended to start the process at least several months before the wedding to ensure that there is ample time for negotiation, drafting, and review.

Can a prenuptial agreement be modified or revoked?

Yes, a prenuptial agreement can be modified or revoked after it has been signed. However, any changes or revocations must be made in writing and signed by both parties. It’s important to follow the proper legal procedures to ensure that the modifications or revocations are valid and enforceable.

If both parties agree to modify the agreement, they can work together to draft an amendment that reflects their new intentions. If one party wishes to revoke the prenuptial agreement entirely, they must communicate their intent to the other party in writing. It’s always recommended to consult with an attorney to ensure that any modifications or revocations are done properly and in accordance with the law.

A Basic Overview of Prenuptial Agreements

Final Summary: What is a Prenuptial Agreement?

So there you have it, a comprehensive overview of what a prenuptial agreement is all about. We’ve covered the basics, the benefits, and the considerations involved in creating one. A prenuptial agreement, often referred to as a “prenup,” is a legal document that couples sign before getting married or entering into a civil partnership. It outlines how assets, debts, and other financial matters will be divided in the event of a divorce or separation.

While some may view prenuptial agreements as unromantic or pessimistic, they can actually provide peace of mind and financial security for both parties. By clearly defining the terms of a potential future separation, couples can avoid lengthy and costly legal battles. Prenups can also protect individual assets acquired before the marriage and ensure that children from previous relationships are provided for.

However, it’s important to remember that a prenuptial agreement is not a one-size-fits-all solution. It requires careful consideration, open communication, and the involvement of legal professionals to ensure fairness and enforceability. Each couple’s situation is unique, and what works for one may not work for another. Ultimately, the decision to create a prenup should be based on individual circumstances and personal preferences.

In conclusion, whether you’re considering a prenuptial agreement or simply curious about what it entails, understanding its purpose and implications is crucial. By taking the time to educate yourself and consult with legal experts, you can make informed decisions that protect your interests and foster a healthy, transparent relationship. Remember, a prenup doesn’t have to be a negative or contentious topic; it can be a proactive and responsible step towards building a strong foundation for your future together.