Divorce can be a challenging and emotional process, and it’s natural to have concerns about how it will impact your financial situation. One major question that often arises is, “What happens to our joint debts in a divorce?” It’s a valid concern, as joint debts can have a significant impact on both parties involved. In this article, we will explore the ins and outs of joint debts in divorce and provide you with the information you need to navigate this complex issue.

When it comes to joint debts in a divorce, there are several factors to consider. First and foremost, it’s important to understand that divorce laws vary from state to state, so the specific rules and guidelines may differ depending on where you live. However, in general, joint debts are typically divided between both parties in a divorce settlement. This means that both spouses will be responsible for paying off the debts incurred during the marriage, regardless of who initially took on the debt. It’s crucial to address these debts during the divorce process to ensure that both parties are aware of their financial obligations moving forward. So, let’s dive deeper into what happens to joint debts in a divorce and how you can protect yourself during this challenging time.

What Happens to Our Joint Debts in a Divorce?

In a divorce, the division of assets and debts can be a complex and contentious process. One important aspect that needs to be addressed is the division of joint debts. When a couple has accumulated debts together, it’s essential to understand how these debts will be allocated between the two parties. This article will explore the various factors involved in determining what happens to joint debts in a divorce and provide useful insights for individuals going through this challenging situation.

Understanding Joint Debts

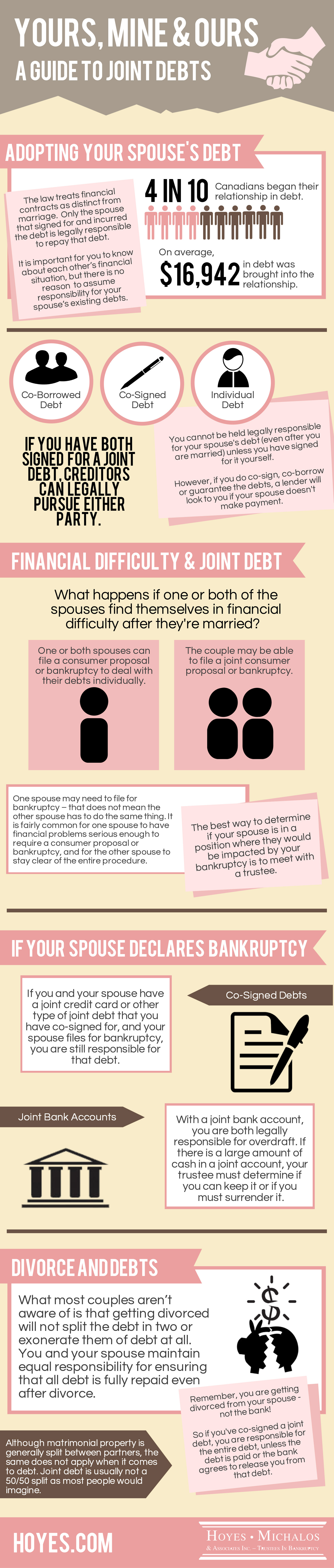

Joint debts are financial obligations that are shared by both spouses. These debts can include mortgages, car loans, credit card debt, personal loans, and any other debts that were jointly acquired during the marriage. When a couple decides to divorce, they must determine how to divide these debts fairly between them. The division of joint debts is typically addressed as part of the overall property division process.

It is important to note that joint debts are different from individual debts. Individual debts are the financial obligations that belong to one spouse solely and are not shared with the other party. In a divorce, individual debts are usually assigned to the spouse who incurred them, while joint debts are subject to division based on various factors.

Factors Affecting Division of Joint Debts

When determining how to divide joint debts in a divorce, several factors come into play. These factors may vary depending on the jurisdiction and specific circumstances of the case. Here are some common considerations:

1. State Laws: Each state has its own laws regarding the division of debts in a divorce. Some states follow community property laws, where debts are divided equally between spouses, while others follow equitable distribution, where debts are divided based on what the court deems fair.

2. Date of Incurrence: The timing of when the debts were accumulated can impact their division. Debts incurred before the marriage may be considered individual debts, while debts acquired during the marriage are typically classified as joint debts.

3. Purpose of the Debt: The purpose for which the debt was incurred can also be a significant factor. For example, debts used for household expenses or marital investments may be considered joint debts, while debts acquired for personal purposes may be treated as individual debts.

4. Financial Contributions: The financial contributions of each spouse during the marriage can also influence the division of joint debts. If one spouse contributed more to the repayment of a particular debt, they may be entitled to a larger share of the assets to offset the imbalance.

5. Agreement between Parties: In some cases, couples may be able to reach an agreement on how to divide their joint debts without court intervention. By coming to a mutual agreement, they can avoid the uncertainty and costs associated with litigation.

6. Court Discretion: Ultimately, if the couple cannot agree on the division of joint debts, the court will have the authority to make a decision based on the specific circumstances of the case. The court will consider various factors to determine an equitable division of debts.

Options for Dividing Joint Debts

When it comes to dividing joint debts in a divorce, there are several options available:

1. Paying Off Joint Debts: One option is for both parties to agree to pay off their joint debts jointly or individually. They can work out a plan to either sell assets and use the proceeds to pay off the debts or continue making payments until the debts are fully settled.

2. Transferring Debts: Another option is to transfer specific debts to one spouse’s name. This can be done by refinancing the debt solely in one spouse’s name or negotiating with the creditor to remove one spouse’s liability from the debt.

3. Debt Offset: Debt offset involves balancing the division of assets and debts. For example, if one spouse receives a larger share of the marital property, they may also be responsible for a larger portion of the joint debts.

4. Selling Assets: In some cases, selling assets such as a house or a car can help generate funds to pay off joint debts. The proceeds from the sale can be used to settle the debts, ensuring a clean break for both parties.

5. Bankruptcy: In extreme situations, one or both spouses may consider filing for bankruptcy to eliminate or reduce their joint debts. However, bankruptcy should be approached with caution and only after consulting with a legal professional.

Protecting Your Credit

During the divorce process, it’s crucial to take steps to protect your credit. Here are some tips to consider:

1. Monitor Your Credit Report: Regularly check your credit report to ensure that all joint debts are being paid as agreed. Look for any discrepancies or errors that could negatively affect your credit score.

2. Close Joint Accounts: Close any joint credit card accounts or other joint accounts that could potentially incur further debt. It’s important to notify the creditor in writing and request that the account be closed.

3. Establish Individual Credit: If you don’t already have individual credit in your name, start building it by opening a credit card or taking out a small loan. Establishing a solid credit history will be essential for your financial future.

4. Consult with a Financial Advisor: Seeking guidance from a financial advisor can help you navigate the complexities of dividing joint debts and ensure that your financial interests are protected.

5. Follow Court Orders: If the court has issued specific orders regarding the division of joint debts, make sure to comply with them promptly. Failure to follow court orders can have serious consequences.

Additional Resources

For more information on navigating the financial aspects of divorce, consider these helpful resources:

- Divorce and Money: How to Make the Best Financial Decisions During Divorce by Violet Woodhouse

- Divorce and Your Money: The No-Nonsense Guide by Shawn Leamon

- Financial Planning for Divorce Workbook by BDF Law Group

In conclusion, the division of joint debts in a divorce can be a complex process, but with careful consideration and the guidance of professionals, it is possible to reach a fair and equitable resolution. Understanding the factors that influence the division of debts and exploring various options can help individuals navigate this challenging aspect of divorce and protect their financial well-being.

Key Takeaways: What Happens to Our Joint Debts in a Divorce?

- In a divorce, joint debts are typically divided between both spouses.

- If both spouses are listed as co-signers on a loan or credit card, both are responsible for the debt.

- It’s important to review all joint debts and come to an agreement on how they will be handled in the divorce.

- If one spouse fails to pay their share of a joint debt, the other spouse may still be held responsible.

- Consulting with a divorce attorney can help you navigate the complexities of dividing joint debts.

Frequently Asked Questions

Question 1: How are joint debts divided in a divorce?

In a divorce, joint debts are typically divided between the spouses. However, the specific division depends on various factors, including the laws of the jurisdiction, the financial circumstances of each spouse, and any prenuptial or postnuptial agreements. It is important to note that the court’s primary concern is to ensure a fair and equitable division of assets and debts.

During the divorce process, both spouses will be required to disclose all their financial information, including joint debts. The court will consider factors such as the size of the debt, each spouse’s income and earning capacity, and the contributions made by each spouse to the acquisition of the debt. Based on these factors, the court may divide the debt equally between the spouses, allocate a larger share to the spouse with greater financial means, or assign the debt to one spouse entirely.

Question 2: Can joint debts be assigned to one spouse in a divorce?

Yes, it is possible for joint debts to be assigned to one spouse in a divorce. If one spouse is better equipped to handle the debt or has a greater ability to repay it, the court may allocate the entire debt to that spouse. This can be based on factors such as income, earning capacity, and financial resources.

However, it is important to note that assigning a joint debt to one spouse does not absolve the other spouse of their legal responsibility. If the spouse assigned the debt fails to make payments, the creditor can still pursue the other spouse for the outstanding balance. It is crucial for both spouses to understand the implications of joint debts and work towards a fair and mutually beneficial resolution.

Question 3: What happens if a joint debt is not paid after a divorce?

If a joint debt is not paid after a divorce, both spouses will still be legally responsible for the debt. Even if the divorce decree assigns the debt to one spouse, creditors can pursue the other spouse for payment if the assigned spouse fails to make payments. This is because creditors are not bound by the terms of the divorce decree.

If the assigned spouse defaults on the debt, the creditor may take legal action against both spouses to collect the outstanding balance. This can result in negative consequences such as wage garnishment, property liens, or damaged credit scores. It is essential for both spouses to communicate and work out a plan to ensure that joint debts are paid in a timely manner to avoid any legal and financial complications.

Question 4: Can joint debts be included in a divorce settlement?

Yes, joint debts can be included in a divorce settlement. During the divorce process, both spouses have the opportunity to negotiate and reach an agreement on the division of assets and debts. This can include a provision for the allocation of joint debts.

Including joint debts in a divorce settlement allows both spouses to have a clear understanding of their financial responsibilities post-divorce. It can provide for the payment of joint debts by one spouse or specify a plan for the joint repayment of the debts. By including joint debts in the settlement, spouses can avoid potential disputes and ensure a smoother transition into their individual financial lives.

Question 5: What steps can be taken to protect oneself from joint debts in a divorce?

To protect oneself from joint debts in a divorce, it is important to take certain steps:

1. Close joint accounts: Close joint credit cards and bank accounts to prevent any additional debts from being incurred.

2. Separate finances: Establish separate bank accounts and credit cards to maintain individual financial independence.

3. Pay off debts: If possible, work towards paying off joint debts before the divorce to minimize financial obligations.

4. Consider legal advice: Consult with a divorce attorney to understand the specific laws and options available in your jurisdiction.

5. Include joint debts in the settlement: Ensure that joint debts are addressed in the divorce settlement to establish clear responsibilities and avoid future disputes.

By taking these proactive measures, individuals can protect themselves from the potential negative impacts of joint debts during and after a divorce.

⭐️ What Happens To Property (& Joint Debts) In A Divorce? (2022) | Jennifer Hargrave Show E49

Final Summary: What Happens to Our Joint Debts in a Divorce?

So, we’ve talked about the complexities of dividing joint debts during a divorce, and it’s clear that it’s not a straightforward process. However, there are a few key takeaways to keep in mind. First and foremost, communication is absolutely crucial. Openly discussing your financial situation with your soon-to-be ex-spouse and working together to come up with a plan is essential. This can help avoid any surprises or misunderstandings down the line.

Another important point to remember is the legal aspect of debt division. Consulting with a qualified attorney who specializes in family law is highly recommended. They can guide you through the legal intricacies, help you understand your rights and responsibilities, and ensure that the division of debts is fair and equitable.

Lastly, don’t forget about the impact of your credit score. Joint debts can affect both parties’ credit, so it’s essential to monitor your credit reports regularly and take steps to protect your financial standing. This may involve closing joint accounts, refinancing loans, or establishing a payment plan to ensure that debts are being paid off in a timely manner.

In conclusion, navigating the division of joint debts in a divorce is no easy task. It requires open communication, legal guidance, and a proactive approach to protecting your financial well-being. By following these steps and seeking professional advice, you can minimize the stress and uncertainty that often accompany this process. Remember, divorce is already emotionally challenging, so taking control of your financial situation can provide some much-needed peace of mind.