Curious to know what happens if separate property is used to pay for marital expenses? Well, you’ve come to the right place! In this article, we’ll delve into the intriguing world of finances and relationships, exploring the potential consequences and implications when separate property is utilized to cover joint expenses. While it may seem like a straightforward matter, the intersection of individual assets and shared responsibilities can sometimes lead to unexpected outcomes. So, let’s buckle up and embark on this enlightening journey together.

When it comes to relationships, money can be a touchy subject. And when separate property enters the equation, things can get even more complicated. Imagine a scenario where one partner dips into their personal funds to pay for shared expenses like mortgage payments, utility bills, or even vacations. It may seem like a generous gesture, but what happens if the relationship takes a turn for the worse? Will the money spent from separate property be reimbursed? Can it be considered a gift to the marriage? These are the questions we’ll be exploring in this eye-opening article. So, grab a cup of coffee, sit back, and let’s unravel the mysteries that lie within the realm of finances and love.

What Happens if Separate Property is Used to Pay for Marital Expenses?

In a marriage, it is common for couples to pool their resources and share expenses. However, there may be situations where one spouse decides to use their separate property to pay for marital expenses. Separate property refers to assets or funds that are owned by one spouse individually, rather than being jointly owned by both spouses. This can include assets acquired before the marriage, inheritances, or gifts specifically designated for one spouse.

Using separate property to pay for marital expenses can have legal and financial implications. It’s important to understand the potential consequences and navigate these situations carefully to protect your separate property rights and ensure a fair division of assets in case of divorce or separation.

Implications of Using Separate Property for Marital Expenses

When separate property is used to pay for marital expenses, it can create a complex situation that may affect the classification of assets and the division of property in the event of a divorce or separation. Here are some key implications to consider:

1. Commingling of Assets

Using separate property for marital expenses can lead to commingling of assets, where separate and marital property become mixed together. Commingling can make it difficult to distinguish between separate and marital property, potentially jeopardizing the separate property rights of the contributing spouse. It is important to keep clear records and documentation of the source of funds used for each expense to avoid commingling.

2. Transmutation of Separate Property

Transmutation refers to the legal change in the classification of property from separate to marital. When separate property is used to pay for marital expenses, it may be considered a transmutation of that property, especially if there is no clear agreement or documentation stating otherwise. This means that the separate property could be treated as marital property and subject to division during a divorce or separation.

It’s crucial to seek legal advice and consider drafting a prenuptial or postnuptial agreement that clearly outlines the intentions regarding the use of separate property for marital expenses. This agreement can help protect the separate property rights of both spouses and provide a framework for how expenses should be handled.

Protecting Separate Property Rights

If you find yourself in a situation where you need to use separate property to pay for marital expenses, there are steps you can take to protect your separate property rights:

1. Maintain Clear Records

Keep detailed records of all expenses paid with separate property. This includes receipts, bank statements, and any other documentation that clearly shows the source of funds used. Having a clear paper trail can be essential in establishing the separate nature of the property in the future.

2. Consider a Postnuptial Agreement

If you are already married and did not have a prenuptial agreement in place, it may be wise to consider a postnuptial agreement. This legal document can outline the intentions regarding separate property and the use of funds for marital expenses, providing clarity and protection for both spouses.

By creating a postnuptial agreement, you can establish the separate property rights of each spouse and clearly define how expenses should be handled. This can help prevent any misunderstandings or disputes in the future.

Conclusion

Using separate property to pay for marital expenses can have significant legal and financial implications. It’s important to understand the potential consequences and take necessary steps to protect your separate property rights. By maintaining clear records and considering a postnuptial agreement, you can navigate these situations with confidence and ensure a fair division of assets in case of divorce or separation.

Key Takeaways: What Happens if Separate Property is Used to Pay for Marital Expenses?

- Using separate property to pay for marital expenses can result in the commingling of assets, making it difficult to distinguish between separate and marital property.

- If separate property is used to pay for marital expenses, it may be considered a gift to the marriage and could be subject to division in the event of a divorce.

- It is important to keep documentation and records of separate property contributions to marital expenses to help establish the intention behind the payments.

- In some cases, a court may determine that the separate property used for marital expenses should be reimbursed to the contributing spouse in the event of a divorce.

- Consulting with a knowledgeable attorney can help ensure that your rights and interests are protected when dealing with the use of separate property for marital expenses.

Frequently Asked Questions

Can separate property be used to pay for marital expenses?

Yes, it is possible for separate property to be used to pay for marital expenses. Separate property refers to assets or property that is owned by one spouse individually, rather than being jointly owned by both spouses. In some cases, one spouse may choose to use their separate property to contribute towards marital expenses, such as household bills, mortgage payments, or educational expenses for the couple’s children.

However, it is important to note that using separate property to pay for marital expenses does not automatically convert the property into marital property. The separate property still retains its individual ownership, even if it is used for the benefit of the marriage. It is advisable for couples to consult with a legal professional to understand the specific laws and implications regarding the use of separate property for marital expenses in their jurisdiction.

What are the implications of using separate property for marital expenses?

Using separate property to pay for marital expenses can have legal and financial implications. While it may be a way to contribute towards the well-being of the marriage, it is important to understand the consequences. In some cases, using separate property for marital expenses may be considered a gift to the marriage, which could affect property division in the event of a divorce.

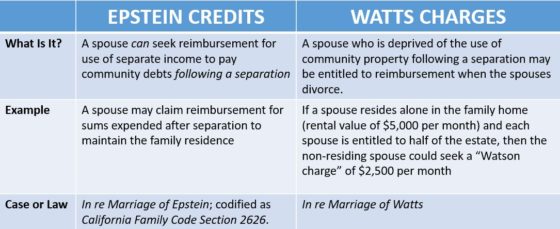

If a couple decides to divorce, the use of separate property for marital expenses may be taken into consideration when determining the division of assets. The spouse who used their separate property to pay for marital expenses may seek reimbursement or a credit for their contribution. The specific laws regarding the treatment of separate property in divorce proceedings can vary, so it is advisable to seek legal advice to understand the implications in your jurisdiction.

Is there a risk of commingling separate property with marital property when using it for expenses?

There is a risk of commingling separate property with marital property when using it for expenses. Commingling refers to the mixing of separate property with marital property, making it difficult to distinguish between the two. When separate property is commingled with marital property, it may lose its separate status and become part of the marital estate.

To minimize the risk of commingling, it is important to keep clear records and documentation of the separate property used for marital expenses. This can include keeping separate bank accounts, maintaining receipts and invoices, and clearly labeling any assets or property that are separate. By keeping a clear paper trail, it can be easier to establish the separate nature of the property in the event of a divorce or legal dispute.

What if one spouse refuses to use their separate property for marital expenses?

If one spouse refuses to use their separate property for marital expenses, it can create tension and financial strain within the marriage. In such situations, it may be beneficial for the couple to have open and honest communication about their financial goals and responsibilities. They can explore alternative options for managing marital expenses, such as creating a joint budget or seeking professional financial advice.

Ultimately, the decision to use separate property for marital expenses should be a mutual agreement between both spouses. It is important to respect each other’s individual ownership of separate property and find a solution that works for both parties. If conflicts arise, it may be helpful to seek guidance from a mediator or counselor to facilitate productive discussions and find a resolution.

How can a prenuptial agreement impact the use of separate property for marital expenses?

A prenuptial agreement, also known as a prenup, is a legal document that outlines the rights and responsibilities of each spouse in the event of a divorce or death. It can also address the use of separate property for marital expenses. A prenup can specify whether separate property can be used for marital expenses and how it will be treated in case of a divorce.

By having a prenuptial agreement in place, couples can clarify their intentions regarding separate property and avoid potential conflicts or misunderstandings in the future. It provides a legally binding framework for the use and division of separate property, giving both spouses peace of mind and clarity. If you are considering using your separate property for marital expenses, it is advisable to consult with a legal professional who can help you draft a prenuptial agreement that aligns with your specific needs and circumstances.

Final Thought: Can Separate Property Be Used to Pay for Marital Expenses?

After exploring the topic of using separate property to cover marital expenses, it is clear that this is a complex issue with various legal and financial implications. While each situation may differ, it is important to consider the potential consequences before making any decisions.

In general, if separate property is used to pay for marital expenses, it can become commingled with marital assets, thereby losing its separate status. This means that in the event of a divorce or separation, the separate property may be subject to division between the spouses. However, it is crucial to consult with a legal professional who specializes in family law to fully understand the specific laws and regulations in your jurisdiction.

It is also worth noting that there may be exceptions or ways to protect separate property from becoming marital property. These can include entering into a prenuptial or postnuptial agreement, clearly documenting the intention behind using separate property for marital expenses, or keeping detailed records of the transactions involved. Again, seeking professional guidance is essential to ensure you make informed decisions that align with your unique circumstances.

In conclusion, while using separate property to pay for marital expenses is possible, it is important to proceed with caution and seek legal counsel to fully understand the potential implications. By doing so, you can make informed choices that protect your interests and assets in the long run. Remember, every situation is unique, so it is crucial to consult with professionals who can provide personalized advice based on your specific circumstances.