Divorce can be a challenging and emotional time, especially when one spouse owns a business. So, what happens if one spouse owns a business during a divorce? Well, buckle up, because we’re about to dive into the nitty-gritty of this complex situation. Whether you’re a business owner worried about how your business will be affected or a spouse wondering what rights you have, we’re here to shed light on this topic and provide you with some valuable insights.

When it comes to divorce, the division of assets can be a contentious issue. And when a business is involved, things can get even more complicated. The fate of the business will depend on various factors, such as whether it was started before or during the marriage, the level of involvement of the non-owner spouse, and the applicable laws in your jurisdiction. So, let’s explore the different scenarios that can unfold when a business is part of a divorce settlement and how you can navigate this challenging terrain.

SEO Keyword: “What Happens if One Spouse Owns a Business During a Divorce?”

What Happens if One Spouse Owns a Business During a Divorce?

Divorce can be a complicated and emotionally challenging process, especially when one spouse owns a business. In such cases, the division of assets and liabilities becomes even more complex, as the business is considered a valuable asset that needs to be properly evaluated and divided. Understanding what happens if one spouse owns a business during a divorce is essential for both parties involved.

When one spouse owns a business during a divorce, several factors come into play. These factors include the valuation of the business, the division of assets, and the determination of each spouse’s financial contributions to the business. Let’s explore these aspects in more detail to gain a better understanding of the implications.

Valuation of the Business

During a divorce, the first step in dealing with a business owned by one spouse is to determine its value. This is necessary to assess the business’s worth and ensure a fair division of assets. Valuing a business can be a complex process, involving the assessment of various factors such as revenue, profits, assets, liabilities, and market conditions.

It is common for both spouses to hire independent business valuation experts to provide an unbiased opinion on the business’s value. These experts consider financial statements, tax returns, market analysis, and other relevant information to arrive at an accurate valuation. The valuation process may also involve examining the business’s goodwill, brand reputation, and potential for growth.

Determining the Division of Assets

Once the business’s value is determined, the next step is to decide on the division of assets. This process can vary depending on the jurisdiction and the specific circumstances of the divorce. In some cases, the business may be considered a marital asset, subject to division between both spouses.

In other instances, the non-owning spouse may be entitled to a share of the business’s value based on their contributions to its success. This can include direct contributions, such as working in the business, or indirect contributions, such as supporting the owning spouse in their business endeavors. The court will consider factors such as the length of the marriage, each spouse’s financial contributions, and the non-owning spouse’s role in the business when determining the division of assets.

Financial Contributions to the Business

When one spouse owns a business, it is essential to determine each spouse’s financial contributions to the business. This includes not only the owning spouse’s direct investment but also the non-owning spouse’s contributions, both financial and non-financial. Financial contributions may include investing money in the business or providing loans, while non-financial contributions can include supporting the business by taking care of household expenses or childcare.

The court will consider these contributions when determining the division of assets. In some cases, the non-owning spouse may be entitled to a share of the business’s profits or future earnings as part of their contribution to the business’s success.

Protecting the Business During Divorce

As a business owner going through a divorce, there are steps you can take to protect your business’s interests. It is crucial to consult with a qualified attorney who specializes in family law and understands the complexities of business ownership during divorce proceedings.

One option is to negotiate a buyout agreement with your spouse, where you purchase their share of the business or exchange it for other assets. This can help ensure that the business remains intact and under your control. Another option is to establish a prenuptial or postnuptial agreement that outlines the division of assets in case of divorce, including the treatment of the business.

Additionally, it is essential to maintain accurate and up-to-date financial records for your business. This includes keeping separate bank accounts, financial statements, and tax returns. By demonstrating the business’s financial standing and separate ownership, you can strengthen your position during the division of assets.

Conclusion

Divorce can be a challenging and complex process when one spouse owns a business. Understanding the valuation of the business, the division of assets, and each spouse’s financial contributions is crucial for a fair and equitable resolution. By seeking guidance from legal professionals and taking proactive measures to protect your business’s interests, you can navigate the complexities of divorce while safeguarding your business’s future.

Key Takeaways: What Happens if One Spouse Owns a Business During a Divorce?

- When one spouse owns a business during a divorce, it may be considered marital property and subject to division.

- The value of the business will need to be determined, which can involve hiring a professional business appraiser.

- In some cases, the non-owning spouse may be entitled to a portion of the business’s value or future profits.

- If the business was started before the marriage, it may be considered separate property and not subject to division.

- The division of a business during divorce can be complex, requiring the expertise of attorneys and financial professionals.

Frequently Asked Questions

Can a business be considered marital property in a divorce?

In many cases, a business owned by one spouse can be considered marital property in a divorce. This means that the business may be subject to division between both spouses. However, the classification of the business as marital property can vary depending on several factors, such as when the business was established and whether it was started before or during the marriage.

Additionally, the involvement of the non-owning spouse in the business and their contributions to its success may also impact how the business is treated during the divorce proceedings. It’s important to consult with a divorce attorney who specializes in business-related divorces to understand how the laws in your jurisdiction may apply to your specific situation.

How is the value of a business determined during a divorce?

When determining the value of a business during a divorce, various factors are taken into consideration. This typically involves a thorough assessment of the business’s financial records, assets, liabilities, and future earning potential. Valuation methods such as the income approach, market approach, or asset-based approach may be used to determine the fair market value of the business.

In some cases, it may be necessary to hire a professional business valuator who specializes in divorce cases to provide an unbiased and accurate assessment of the business’s value. This expert will consider all relevant factors and provide a comprehensive valuation report that can be used in the divorce proceedings.

What are the options for dividing a business during a divorce?

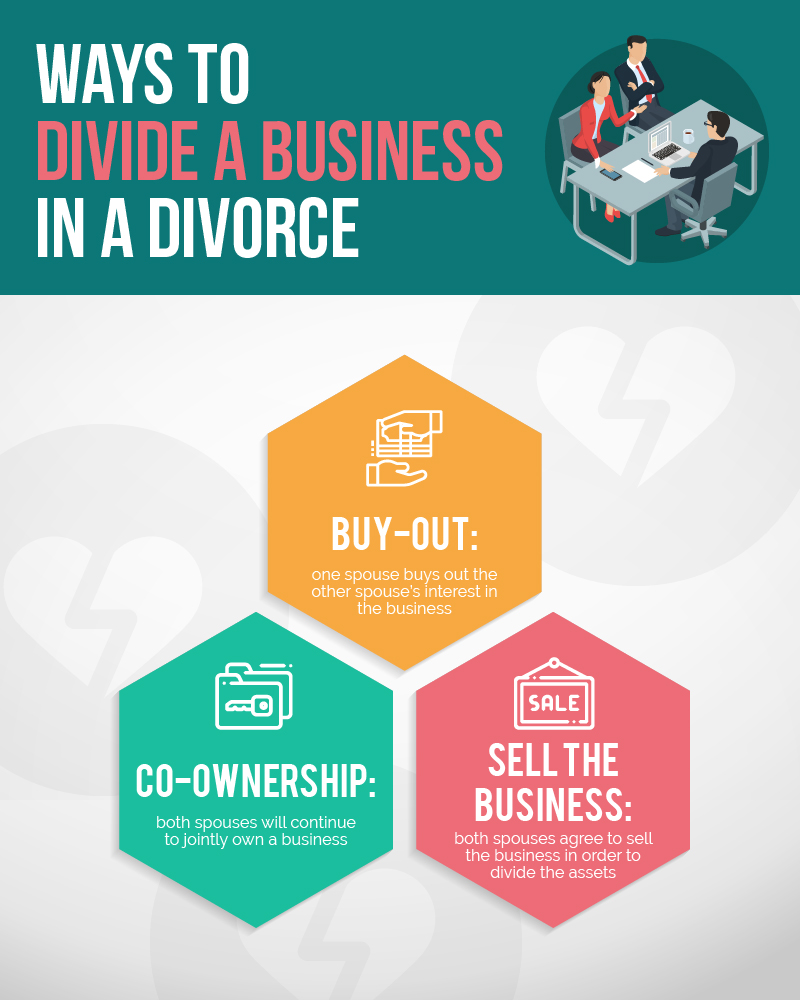

When it comes to dividing a business during a divorce, there are several options available. One option is for one spouse to buy out the other spouse’s share of the business. This can be done by negotiating a fair price and arranging for the transferring spouse to receive their share of the business’s value in cash or other assets.

If both spouses wish to remain involved in the business, they may choose to continue as co-owners or establish a partnership or shareholder agreement that outlines their roles, responsibilities, and ownership percentages. Alternatively, the business may be sold, and the proceeds divided between the spouses according to their ownership interests.

How can a prenuptial or postnuptial agreement protect a business in a divorce?

A prenuptial or postnuptial agreement can be an effective way to protect a business in the event of a divorce. These agreements can outline how the business will be treated in the event of a separation or divorce, including specifying that it remains separate property and is not subject to division.

To ensure the enforceability of a prenuptial or postnuptial agreement, it’s important to consult with a family law attorney who can help draft a legally sound document. Both parties should also fully disclose their assets, liabilities, and financial information, and each should have their own independent legal representation to ensure the agreement is fair and valid.

What factors can influence the division of a business during a divorce?

Several factors can influence the division of a business during a divorce. These factors may include the length of the marriage, the financial contributions of each spouse to the business, the non-owning spouse’s involvement in the business, and the impact of the business’s value on the overall division of marital assets.

Additionally, the laws of the jurisdiction where the divorce is taking place can also play a role in determining how the business will be divided. Some jurisdictions follow community property laws, which generally result in an equal division of marital property, while others follow equitable distribution laws, which aim to divide property fairly but not necessarily equally.

What happens in a divorce if my spouse owns a business?

Final Summary: What Happens if One Spouse Owns a Business During a Divorce?

So, what happens if one spouse owns a business during a divorce? Well, it’s a complex situation that requires careful consideration. Throughout this article, we’ve explored the various factors that come into play when a business is involved in a divorce. From determining the value of the business to dividing its assets, there are many important decisions to be made.

In conclusion, the outcome of a divorce involving a business largely depends on the specific circumstances of the case and the jurisdiction in which it is being handled. It’s crucial for both spouses to seek legal advice and guidance from professionals who specialize in divorce and business law. By doing so, they can navigate the complexities of the situation and work towards a fair and equitable resolution. Whether it involves selling the business, buying out the other spouse, or finding alternative solutions, the ultimate goal is to ensure a smooth transition and protect the interests of both parties involved.

Remember, every divorce is unique, and there is no one-size-fits-all answer to what happens if one spouse owns a business. It’s essential to approach the situation with patience, open communication, and a willingness to compromise. With the right guidance and a focus on fairness, a positive resolution can be achieved, leading to a new chapter for both spouses as they move forward in their individual lives.