Divorce can be a challenging and emotional process, especially when it comes to dividing assets. Many couples wonder, “What factors are considered when dividing assets in a divorce?” Well, fear not, because I’m here to shed some light on this complex topic. Whether you’re going through a divorce yourself or just curious about the process, understanding the factors that come into play can help you navigate this tricky terrain.

When it comes to dividing assets in a divorce, there are several key factors that are typically taken into consideration. First and foremost is the concept of equitable distribution. In most jurisdictions, including the United States, assets are divided in a way that is considered fair and equitable, although not necessarily equal. This means that the court will consider various factors such as the length of the marriage, each spouse’s financial contributions, the standard of living during the marriage, and the needs of each party moving forward. By taking these factors into account, the court aims to ensure a fair division of assets that considers the unique circumstances of each case.

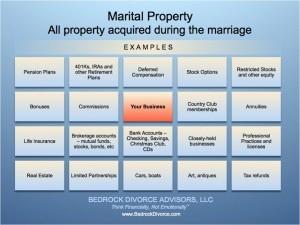

Another important factor that comes into play is the type of assets involved. Different types of assets may be treated differently when it comes to dividing them in a divorce. For example, marital property, which includes assets acquired during the marriage, is typically subject to division. On the other hand, separate property, which includes assets owned by one spouse prior to the marriage or acquired through inheritance or gift, may be excluded from the division. However, keep in mind that the rules regarding separate and marital property can vary depending on the jurisdiction. It’s always best to consult with a legal professional who can provide guidance tailored to your specific situation.

In conclusion, when it comes to dividing assets in a divorce, there are several factors that are considered. Equitable distribution, the length of the marriage, financial contributions, the standard of living, and the type of assets involved all play a role in determining how assets will be divided. By understanding these factors, you can better navigate the complexities of asset division and work toward a fair and equitable resolution. Remember, seeking the advice of a knowledgeable attorney is crucial to ensure that your rights and interests are protected throughout the divorce process.

What Factors Are Considered When Dividing Assets in a Divorce?

When going through a divorce, one of the most challenging and complex aspects is dividing assets. Determining how to fairly distribute property, investments, and other financial resources can be a contentious process. However, there are specific factors that courts consider when making decisions about asset division. Understanding these factors can help individuals navigate the divorce process more effectively and ensure a fair outcome.

1. Length of the Marriage

The duration of the marriage is a crucial factor in asset division. Typically, the longer the marriage, the more likely it is that assets will be divided equally. This is because a longer marriage often means that both spouses have contributed equally to the acquisition of assets and financial stability. However, in some cases, the length of the marriage may not be the sole determining factor, and other considerations may come into play.

In cases of short marriages, the court may be more inclined to return each party to their pre-marital financial state, with minimal division of assets. However, this may vary depending on the specific circumstances of the marriage and the financial contributions made by each spouse.

2. Financial Contributions

Another critical factor in asset division is the financial contributions made by each spouse during the marriage. This includes income earned, investments made, and other financial resources acquired. Courts consider the contributions of both spouses, regardless of whether one spouse was the primary breadwinner or if both spouses contributed equally.

Financial contributions can include income earned from employment, businesses owned, or investments made during the marriage. The court will also consider non-financial contributions, such as homemaking and child-rearing, which can be equally valuable and impactful to the marital estate.

2.1 Income and Earning Potential

The court may also consider each spouse’s income and earning potential when dividing assets. If one spouse has a significantly higher income or earning potential than the other, the court may award a larger share of the assets to the spouse with the lower income. This is often done to ensure that both parties are financially secure after the divorce.

It’s important to note that the court may also consider the effort and sacrifices made by a spouse to support the other spouse’s career or education. For example, if one spouse worked to put the other spouse through school or supported their career advancement, the court may take this into account when dividing assets.

2.2 Debts and Liabilities

In addition to considering financial contributions, the court will also examine any debts and liabilities accrued during the marriage. Debts, such as mortgages, loans, and credit card debt, will also be divided between the spouses. The court will take into account who incurred the debt, the purpose of the debt, and the ability of each spouse to repay the debt.

It’s essential to note that the court may also consider any hidden assets or attempts to dissipate marital property. If one spouse has attempted to hide assets or deplete marital property in anticipation of the divorce, the court may adjust the division of assets accordingly.

3. Custody Arrangements

When children are involved in a divorce, custody arrangements play a significant role in asset division. The court will consider the best interests of the children and may allocate a larger portion of the assets to the custodial parent to ensure the children’s well-being and stability.

Custodial arrangements can impact asset division in various ways. For example, if one parent is awarded primary custody, they may be awarded the family home to provide stability for the children. In such cases, the other spouse may receive a larger portion of other assets to ensure an equitable division.

3.1 Child Support and Alimony

Child support and alimony payments can also impact asset division. The court may consider the financial needs of the custodial parent and the children when determining the division of assets. If one spouse will receive child support or alimony payments, the court may allocate a larger portion of the assets to the other spouse to account for these future obligations.

It’s important to note that child support and alimony calculations vary by jurisdiction and depend on factors such as income, expenses, and the needs of the children. Consulting with a family law attorney can provide guidance on how these factors may impact asset division.

4. Future Financial Stability

Lastly, the court will consider the future financial stability of both spouses when dividing assets. This includes factors such as age, health, employability, and retirement plans. The goal is to ensure that both parties can maintain a reasonable standard of living after the divorce.

If one spouse is nearing retirement age or has health issues that may impact their ability to work and earn income, the court may award a larger share of the assets to that spouse. Similarly, if one spouse has a higher earning potential or better job prospects, the court may adjust the division of assets to ensure a more equitable outcome.

In conclusion, when dividing assets in a divorce, several factors come into play. The length of the marriage, financial contributions, custody arrangements, and future financial stability all play a role in determining how assets will be divided. Understanding these factors and seeking professional legal advice can help individuals navigate the complexities of asset division and ensure a fair outcome.

Key Takeaways: What Factors Are Considered When Dividing Assets in a Divorce?

- 1. Length of the marriage plays a role in asset division.

- 2. Contributions made by each spouse during the marriage are considered.

- 3. The earning capacity and financial needs of each spouse are taken into account.

- 4. The age and health of each spouse can impact asset division.

- 5. The presence of any prenuptial or postnuptial agreements can affect how assets are divided.

Frequently Asked Questions

1. How is the division of assets determined in a divorce?

In a divorce, the division of assets is typically determined through a process called equitable distribution. This means that the court will divide the assets in a way that is fair and just, taking into consideration a variety of factors. It’s important to note that “fair” does not necessarily mean an equal split, as each case is unique and the division of assets will depend on the specific circumstances.

The court will consider factors such as the length of the marriage, the financial contributions of each spouse, the earning potential of each spouse, the non-financial contributions of each spouse (such as caregiving or homemaking), the age and health of each spouse, and any prenuptial or postnuptial agreements that may be in place. By evaluating these factors, the court aims to divide the assets in a way that is fair and reasonable for both parties involved.

2. What role does the length of the marriage play in asset division?

The length of the marriage is often a significant factor in determining how assets will be divided in a divorce. Generally, the longer the marriage, the more likely it is that the assets will be divided equally. This is because a longer marriage typically involves a greater level of financial interdependence and shared contributions.

However, the length of the marriage is not the sole determining factor. Even in shorter marriages, the court will consider other relevant factors to ensure a fair division of assets. For example, if one spouse made significant financial contributions or sacrificed their career opportunities for the benefit of the marriage, they may be entitled to a larger share of the assets, regardless of the length of the marriage.

3. How does the earning potential of each spouse affect asset division?

The earning potential of each spouse is an important factor in asset division during a divorce. If one spouse has a significantly higher earning potential than the other, they may be required to provide financial support, such as alimony or spousal support, to the lower-earning spouse. This can impact the division of assets.

For example, if one spouse has a high-paying job and the other spouse has limited income prospects, the court may allocate a larger share of the assets to the lower-earning spouse to ensure they have a reasonable financial foundation post-divorce. The goal is to provide both parties with a fair and equitable outcome, taking into account their respective earning potentials.

4. What role do prenuptial or postnuptial agreements play in asset division?

Prenuptial or postnuptial agreements can have a significant impact on asset division in a divorce. These agreements are legally binding contracts that outline how assets will be divided in the event of a divorce or separation. If a couple has a valid and enforceable prenuptial or postnuptial agreement, the court will generally follow its terms when dividing assets.

However, it’s important to note that not all prenuptial or postnuptial agreements are enforceable. The court will carefully review the agreement to ensure it was entered into voluntarily, with full disclosure of assets, and that it is not unconscionable or unfair to one party. If the agreement meets these criteria, it will be given considerable weight in the asset division process.

5. Are non-financial contributions considered when dividing assets in a divorce?

Yes, non-financial contributions are certainly considered when dividing assets in a divorce. While financial contributions are often more easily quantifiable, the court recognizes the value of non-financial contributions made by a spouse, such as caregiving, homemaking, or supporting the other spouse’s career.

These non-financial contributions can have a significant impact on the division of assets. For example, if one spouse stayed at home to raise children while the other spouse pursued a career, the court may allocate a larger share of the assets to the stay-at-home spouse to compensate for their non-financial contributions. It is important for the court to acknowledge and fairly evaluate all contributions made by each spouse, both financial and non-financial, when dividing assets in a divorce.

Division of Assets Illustrated, How Assets are Divided in Divorce

Conclusion: Dividing Assets in a Divorce

In the tumultuous journey of divorce, one of the most crucial and contentious aspects is the division of assets. It’s a process that requires careful consideration of various factors to ensure a fair and equitable distribution. From financial resources to contributions during the marriage, numerous elements come into play. Understanding these factors is essential to navigate the complexities of asset division and achieve a satisfactory outcome for both parties.

When dividing assets in a divorce, the court takes into account several key factors. First and foremost, the financial resources of each spouse are evaluated. This includes income, property, investments, and any other assets owned individually or jointly. The court will also consider the length of the marriage and the standard of living established during that time. Additionally, the contributions made by each spouse to the marriage, both financial and non-financial, are taken into consideration. This can encompass factors such as childcare, homemaking, and career sacrifices. Furthermore, the court considers the future financial needs of each spouse, including their earning potential and any ongoing financial obligations.

It is important to note that the division of assets can vary depending on the jurisdiction and the specific circumstances of the case. Therefore, it is advisable to consult with a qualified attorney who specializes in family law to ensure a fair and favorable outcome. By understanding and addressing the factors involved in asset division, individuals can navigate the complexities of divorce with greater clarity and reach a resolution that provides them with a solid foundation for the next chapter of their lives.