If you’re going through a divorce or separation, one of the key questions that may come up is, “How is spousal support calculated?” It’s a topic that can be quite complex, and understanding the factors that go into determining spousal support can be crucial for both parties involved. In this article, we’ll dive into the intricacies of spousal support calculations, providing you with a comprehensive guide to help you navigate this often challenging aspect of divorce proceedings.

When it comes to calculating spousal support, there are several factors that are typically taken into consideration. These factors can include the length of the marriage, the earning capacity of each spouse, the standard of living during the marriage, and the financial needs of each party. Additionally, the court may also consider the age and health of the spouses, the contributions made by each spouse to the marriage, and any other relevant circumstances. By understanding how these factors come into play, you can gain a better understanding of how spousal support is calculated and what you might expect in your own situation.

In the following sections, we’ll explore each of these factors in more detail, providing you with valuable insights on how spousal support calculations work and how they can impact your divorce or separation. So, let’s dive in and unravel the mysteries of spousal support calculations together!

How is Spousal Support Calculated?

Spousal support, also known as alimony, is a financial arrangement that is often part of divorce proceedings. It is designed to help provide financial support to the spouse who may be economically disadvantaged after the end of the marriage. The calculation of spousal support can vary depending on various factors, such as the duration of the marriage, the income and earning capacity of each spouse, and the standard of living during the marriage. In this article, we will explore the different methods used to calculate spousal support and the key factors that are taken into consideration.

Factors Considered in Spousal Support Calculations

When determining the amount and duration of spousal support payments, courts typically consider several factors. One of the primary factors is the length of the marriage. In general, longer marriages are more likely to result in higher and longer-lasting spousal support payments. This is because the longer a couple has been married, the more likely it is that one spouse has become financially dependent on the other.

Another important factor is the income and earning capacity of each spouse. The court will typically assess the income of both spouses, including any potential income that could be earned in the future. This includes factors such as education, work experience, and job opportunities. If one spouse has a higher income or earning potential, they may be required to provide a higher level of support to the other spouse.

Other factors that may be considered include the standard of living during the marriage, the age and health of each spouse, and any childcare responsibilities. The court’s goal is to ensure that the supported spouse can maintain a similar standard of living to what they had during the marriage, taking into account their individual circumstances.

Methods Used to Calculate Spousal Support

There are several methods that can be used to calculate spousal support, and the specific method chosen may vary depending on the jurisdiction and the unique circumstances of the case. Here are a few common methods:

1. Percentage of Income

One method is to calculate spousal support as a percentage of the paying spouse’s income. For example, the court may determine that the supported spouse is entitled to 30% of the paying spouse’s income. This method is relatively straightforward and provides a clear guideline for determining the amount of support.

2. Needs-Based Approach

Another method is the needs-based approach, which takes into consideration the financial needs of the supported spouse. This method focuses on the expenses and financial obligations of the supported spouse, such as housing, healthcare, and living expenses. The court will assess the amount of support needed to meet these needs and may adjust the amount accordingly.

3. Duration-Based Approach

In some cases, spousal support may be calculated based on the length of time needed for the supported spouse to become self-supporting. The court will consider factors such as the supported spouse’s age, education, and job prospects. The duration-based approach aims to provide support for a specific period to allow the supported spouse to gain the necessary skills and resources to become financially independent.

Conclusion

Calculating spousal support is a complex process that takes into account various factors such as the length of the marriage, the income and earning capacity of each spouse, and the standard of living during the marriage. The specific method used to calculate spousal support can vary, but it is ultimately aimed at providing financial support to the economically disadvantaged spouse. It is important to consult with a legal professional to ensure that the spousal support calculation is fair and in accordance with the laws of your jurisdiction.

Key Takeaways: How is Spousal Support Calculated?

- Spousal support is calculated based on several factors, including the length of the marriage, the income and earning capacity of each spouse, and the standard of living during the marriage.

- The court considers the needs of the supported spouse and the ability of the supporting spouse to pay when determining the amount of spousal support.

- Spousal support can be awarded temporarily or permanently, depending on factors such as the age and health of the spouses and their ability to become self-supporting.

- The court may also take into account any child support obligations when calculating spousal support.

- Spousal support orders can be modified or terminated if there is a significant change in circumstances, such as a change in income or marital status.

Frequently Asked Questions

Spousal support, also known as alimony or maintenance, is an important aspect of divorce or separation proceedings. It is a payment made by one spouse to the other to provide financial support after the end of the marriage. The calculation of spousal support can vary depending on several factors. Here are some commonly asked questions about how spousal support is calculated:

Question 1: What factors are considered when calculating spousal support?

When calculating spousal support, several factors are taken into consideration. These factors may include the duration of the marriage, the income and earning capacity of each spouse, the standard of living during the marriage, the age and health of each spouse, and the contributions made by each spouse to the marriage. The court will also consider any special circumstances, such as the presence of children or any economic hardships faced by either spouse.

It is important to note that each jurisdiction may have its own guidelines and formulas for calculating spousal support, so it is advisable to consult with a family law attorney to understand how these factors are applied in your specific case.

Question 2: Is there a specific formula used to calculate spousal support?

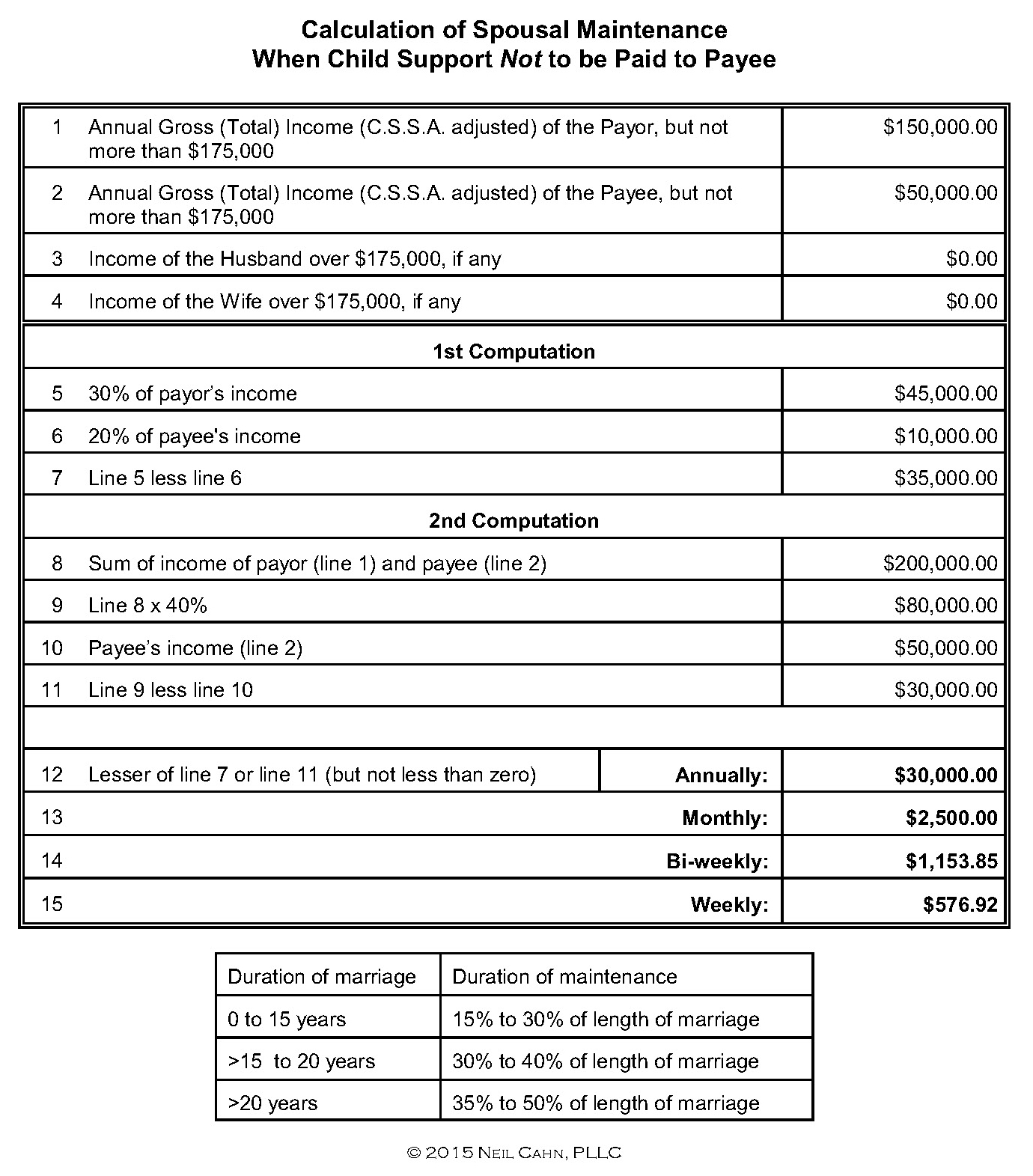

While some jurisdictions have specific formulas or guidelines to calculate spousal support, others may give judges more discretion in making the determination. In jurisdictions with formulas, the calculation may take into account factors such as the income of both spouses, the length of the marriage, and the presence of children. These formulas provide a starting point for calculating spousal support, but the court may make adjustments based on the unique circumstances of the case.

In jurisdictions without specific formulas, the court will consider the various factors mentioned earlier to determine a fair and reasonable amount of spousal support. This allows the court to take into account the specific needs and financial situation of each spouse.

Question 3: Can the amount of spousal support be modified?

Yes, the amount of spousal support can be modified under certain circumstances. If there is a significant change in the financial circumstances of either spouse, such as a change in income or employment, the court may consider modifying the spousal support order. Additionally, if the spouse receiving support remarries or enters into a new domestic partnership, it may also impact the amount of support.

It is important to note that any modification to the spousal support order must be approved by the court. It is advisable to consult with a family law attorney to understand the process and requirements for modifying spousal support in your jurisdiction.

Question 4: How long does spousal support typically last?

The duration of spousal support can vary depending on the circumstances of the case. In some cases, spousal support may be awarded for a specific period of time, such as a few years, to allow the receiving spouse to become financially independent. In other cases, spousal support may be awarded for an indefinite period, especially in cases where the receiving spouse is unable to support themselves due to age, health, or other factors.

The length of the marriage is often a significant factor in determining the duration of spousal support. Shorter marriages may result in shorter durations of support, while longer marriages may result in longer durations. However, this can vary depending on the specific circumstances of the case and the jurisdiction in which the divorce or separation is taking place.

Question 5: What happens if the paying spouse fails to make spousal support payments?

If the paying spouse fails to make spousal support payments as required by the court order, the receiving spouse has legal options to enforce the support order. This may include seeking enforcement through the court, which can result in penalties for the paying spouse, such as wage garnishment, seizure of assets, or even contempt of court charges.

If you are facing issues with spousal support payments, it is important to consult with a family law attorney to understand your rights and options for enforcement.

How is Spousal Support Calculated?

Final Summary: Understanding How Spousal Support is Calculated

After delving into the intricacies of spousal support calculations, it becomes clear that there is no one-size-fits-all approach. The calculation process varies depending on the jurisdiction and the specific circumstances of the divorcing couple. However, a few key factors consistently come into play when determining spousal support.

First and foremost, the duration of the marriage plays a significant role. Long-term marriages often result in higher spousal support amounts, as there is a greater financial interdependence built over time. Additionally, the income and earning potential of each spouse are crucial considerations. The court will examine the income disparity between the spouses and evaluate the recipient’s ability to become self-supporting over time.

Other factors that influence spousal support calculations include the standard of living during the marriage, the age and health of each spouse, and the contributions made by each spouse to the marriage, such as childcare or career sacrifices. Moreover, the court may assess the presence of any prenuptial or postnuptial agreements that outline spousal support arrangements.

In conclusion, while the specific calculations for spousal support may vary, the underlying principles remain constant. The goal is to ensure fairness and financial stability for both parties involved in the divorce. By considering factors such as marriage duration, income disparity, and contributions made during the marriage, courts strive to reach equitable spousal support arrangements. Remember, it’s always crucial to consult with a qualified attorney who can provide guidance tailored to your unique situation.