If you’re going through a divorce or separation and you have children, one of the important aspects to consider is child support. But how is child support calculated? It’s a question that many parents find themselves asking. Well, fear not! In this article, we’ll dive into the intricacies of child support calculations and help you understand the factors that come into play. So, grab a cup of coffee and let’s get started!

When it comes to determining child support, there are several factors that are taken into consideration. The most common factors include the income of both parents, the number of children involved, and the custody arrangement. But it doesn’t stop there! Other factors, such as healthcare costs, childcare expenses, and the child’s standard of living, may also be factored in. It’s a complex calculation, but don’t worry, we’ll break it down for you in simple terms. By the end of this article, you’ll have a clear understanding of how child support is calculated and how it can impact your family’s financial situation. So, let’s dive in and unravel the mystery behind child support calculations!

How is Child Support Calculated?

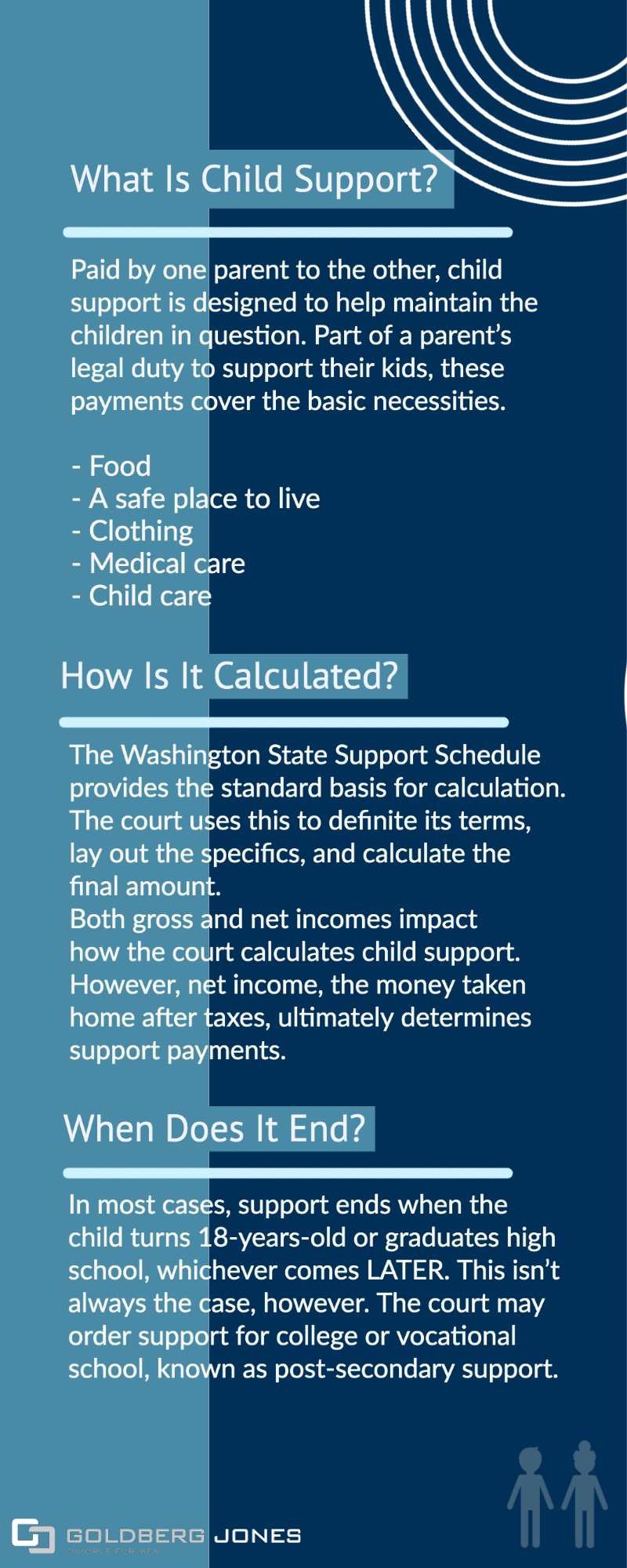

Child support is a crucial aspect of divorce or separation cases involving children. It is a financial obligation typically imposed on the noncustodial parent to ensure the well-being and proper upbringing of the child. The calculation of child support varies from jurisdiction to jurisdiction, but there are some common factors considered in most cases. Understanding how child support is calculated is essential for both parents to ensure a fair and reasonable arrangement for the child’s financial support.

Factors Considered in Child Support Calculations

When determining child support, several factors are taken into account to ensure that the child’s needs are met adequately. These factors may include:

1. Income of Both Parents: The income of both parents is a fundamental consideration in child support calculations. The court considers the earning capacity, potential income, and actual income of each parent to determine their financial contribution.

2. Custodial Arrangement: The amount of time the child spends with each parent, known as the custodial arrangement, is also a crucial factor. The court considers the number of overnights the child spends with each parent to determine their respective financial responsibilities.

3. Child’s Expenses: The child’s needs and expenses, including education, healthcare, extracurricular activities, and other essential costs, are taken into account. The court considers these expenses to ensure the child’s financial support covers all necessary aspects of their upbringing.

4. Standard of Living: The standard of living the child would have enjoyed if the parents had not separated is also considered. The court aims to provide the child with a similar standard of living as they would have had if their parents were still together.

5. Additional Factors: Other factors that may influence child support calculations include the child’s age, special needs or medical requirements, and any existing child support obligations from previous relationships.

The Child Support Calculation Process

The process of calculating child support involves multiple steps and considerations. Each jurisdiction may have specific guidelines or formulas to determine the appropriate amount of child support payments. Here is a general overview of the calculation process:

1. Determine Income: Both parents’ incomes are assessed, including salary, wages, bonuses, commissions, and other sources of income. This may involve reviewing tax returns, pay stubs, and other financial documents.

2. Calculate Parental Obligations: The court determines the parents’ financial obligations based on their income and the custodial arrangement. Each parent’s income is proportionally allocated to reflect their share of the child’s financial support.

3. Factor in Child’s Expenses: The child’s needs and expenses, such as education, healthcare, and childcare costs, are taken into account. These expenses are added to the support calculation to ensure they are adequately covered.

4. Apply Guidelines or Formulas: Many jurisdictions have specific guidelines or formulas that provide a framework for calculating child support. These guidelines consider the relevant factors and provide a standardized approach to ensure consistency and fairness.

5. Adjustments and Deviations: In some cases, the court may make adjustments or deviations from the standard calculation based on unique circumstances. This could include considerations for shared parenting time, extraordinary medical expenses, or other factors that may impact the child’s financial needs.

It is important to note that child support calculations can be complex, and it is advisable to seek legal advice or consult with a family law professional to ensure accurate and fair calculations based on your specific circumstances.

Benefits of a Fair Child Support Calculation

A fair and accurate child support calculation is essential for several reasons:

1. Ensuring the Child’s Well-being: Child support provides financial stability to meet the child’s needs and ensure their overall well-being. A fair calculation ensures that the child’s expenses are adequately covered, including education, healthcare, and other essentials.

2. Promoting Co-Parenting Cooperation: A fair child support arrangement promotes cooperation between parents, as it establishes clear financial responsibilities for each. This can contribute to a healthier co-parenting relationship and minimize conflicts related to financial matters.

3. Mitigating Financial Strain: Child support helps alleviate financial strain on the custodial parent, who may bear the primary responsibility of meeting the child’s day-to-day needs. It provides financial support and ensures that both parents contribute to the child’s upbringing.

4. Encouraging Stability and Consistency: A fair child support calculation promotes stability and consistency in the child’s life. It helps maintain a similar standard of living the child would have experienced if their parents were still together.

5. Legal Protection: A proper child support calculation provides legal protection for both parents. It ensures that the financial obligations are legally enforceable, protecting the child’s rights and the custodial parent’s ability to provide for the child.

In conclusion, understanding how child support is calculated is crucial for both parents involved in a divorce or separation. By considering factors such as income, custodial arrangement, and the child’s expenses, a fair and reasonable child support arrangement can be determined. This ensures the child’s well-being, promotes cooperation between parents, and provides financial stability for their upbringing. Seeking legal advice or consulting with a family law professional is recommended to ensure accurate calculations based on individual circumstances.

Key Takeaways: How is Child Support Calculated?

- Child support is calculated based on several factors, including the income of both parents.

- The number of children and their needs also play a role in determining child support payments.

- The court may consider the custodial parent’s expenses when calculating child support.

- Child support payments are typically made until the child reaches adulthood or finishes their education.

- It’s important to follow the guidelines set by the court when determining child support payments.

Frequently Asked Questions

Child support is an essential aspect of ensuring the well-being of children in cases of divorce or separation. Understanding how child support is calculated can help parents navigate this process. Here are some commonly asked questions about calculating child support:

Question 1: What factors are considered when calculating child support?

In determining child support, several factors are taken into account. These include the income of each parent, the number of children involved, the custody arrangement, and any special needs of the children. The court may also consider expenses such as medical costs, education expenses, and child care costs.

It is important to note that child support guidelines vary by jurisdiction, so it’s crucial to consult the specific laws and regulations of your state or country.

Question 2: How is income calculated for child support?

The calculation of income for child support purposes typically includes various sources, such as wages, salaries, bonuses, commissions, self-employment income, rental income, and investment income. Additionally, income can also encompass benefits like social security, disability payments, and unemployment compensation.

In cases where a parent is intentionally unemployed or underemployed, the court may impute income based on their earning potential or qualifications. This prevents individuals from avoiding their child support obligations by purposefully reducing their income.

Question 3: How does custody arrangement impact child support calculations?

The custody arrangement plays a significant role in determining child support payments. Generally, the parent with whom the child spends less time (non-custodial parent) will pay child support to the parent with whom the child spends more time (custodial parent). However, the exact amount will depend on the income of both parents and the specific guidelines set by the jurisdiction.

It is important to note that joint custody arrangements can also impact child support calculations. In such cases, the court may consider the income of both parents and adjust the support amount accordingly.

Question 4: Can child support be modified?

Child support orders can be modified under certain circumstances. If there is a substantial change in the financial situation of either parent, such as a significant increase or decrease in income, the court may consider modifying the child support amount. Changes in the custody arrangement or the child’s needs may also warrant a modification.

To modify a child support order, it is necessary to file a request with the court and provide evidence supporting the need for the modification. It is advisable to consult with a family law attorney to navigate this process effectively.

Question 5: What happens if a parent fails to pay child support?

If a parent fails to meet their child support obligations, legal consequences can ensue. Depending on the jurisdiction, enforcement measures can include wage garnishment, interception of tax refunds, suspension of driver’s licenses, and even imprisonment in extreme cases.

In situations where a parent consistently fails to pay child support, it may be necessary to seek legal assistance to enforce the support order and ensure the well-being of the children involved.

How Is Child Support Actually Calculated in Child Support Court? #childsupport

Final Thoughts

Calculating child support can be a complex and sensitive matter, but understanding the factors involved can make the process more manageable. By considering the income of both parents, the child’s needs, and any special circumstances, a fair and reasonable amount of child support can be determined. It’s important to remember that child support is intended to provide for the well-being and upbringing of the child, and it should be approached with this goal in mind.

While guidelines and formulas exist to help calculate child support, it’s crucial to remember that each case is unique. The court takes into account various factors to ensure that the child’s best interests are met. So, if you find yourself in a situation involving child support, it’s advisable to consult with a legal professional who can guide you through the process and ensure that your child’s needs are adequately addressed.

In conclusion, understanding how child support is calculated is essential for both parents involved. By knowing the factors that influence the determination of child support and seeking legal advice when necessary, parents can work towards a fair and reasonable arrangement that prioritizes the well-being of their child. Remember, the ultimate goal is to provide the necessary support to ensure a stable and nurturing environment for the child’s growth and development.