When it comes to taxes and spousal support, there’s a lot of confusion and uncertainty. One major question that often arises is, “How are tax deductions for spousal support affected by the length of the marriage?” It’s a valid concern, as the length of a marriage can have significant implications on various aspects of divorce, including financial matters. In this article, we’ll dive into the details and explore how the length of a marriage can impact tax deductions for spousal support.

When it comes to taxes, it’s essential to understand how different factors can influence the deductions you’re eligible for. In the case of spousal support, the length of your marriage can play a crucial role. The tax laws surrounding spousal support deductions can vary depending on whether you were married for a short period or a more extended period. By understanding these nuances, you can make informed decisions and potentially optimize your tax situation during and after divorce. So, let’s delve into the fascinating world of tax deductions for spousal support and see how the length of your marriage can make a difference.

How Are Tax Deductions for Spousal Support Affected by the Length of the Marriage?

Tax deductions for spousal support, also known as alimony, can be influenced by various factors, and one of the key determinants is the length of the marriage. The duration of a marriage can have significant implications for how tax deductions are applied in the context of spousal support. In this article, we will explore the relationship between the length of a marriage and tax deductions for spousal support, providing valuable insights for individuals navigating this complex area of taxation.

The Impact of Marriage Length on Tax Deductions

The length of a marriage can have a substantial impact on tax deductions for spousal support. In general, the tax treatment of spousal support payments is influenced by whether the marriage is considered a long-term or short-term marriage. Long-term marriages are typically defined as those lasting ten years or more, while any marriage shorter than ten years is considered a short-term marriage.

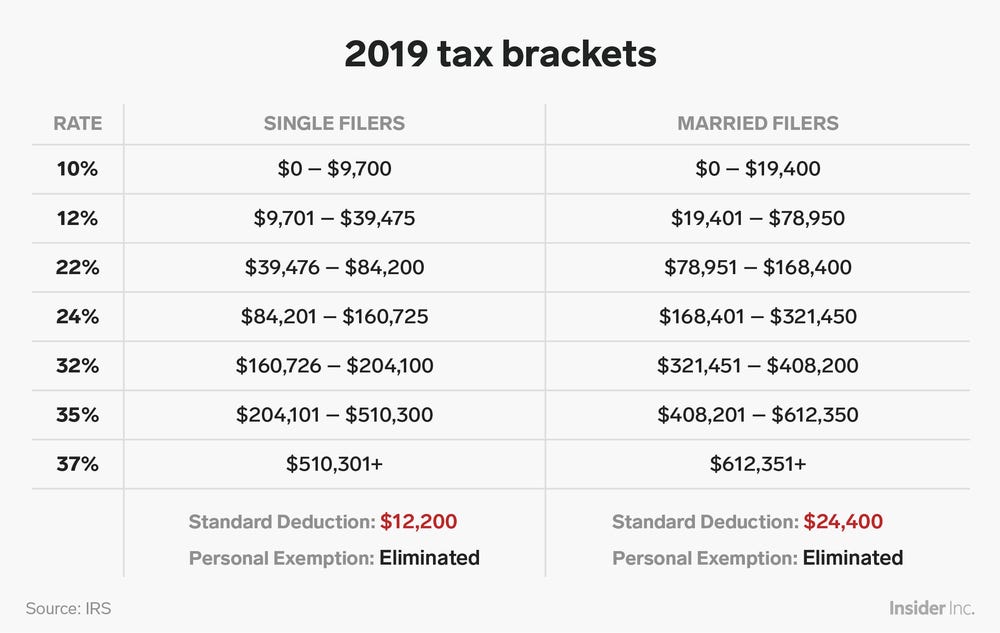

For long-term marriages, the Internal Revenue Service (IRS) allows the payor of spousal support to deduct the payments from their taxable income. This deduction can provide significant tax relief for the payor, reducing their overall tax liability. On the other hand, the recipient of spousal support must report the payments as taxable income on their tax return.

The Tax Treatment of Short-Term Marriages

In the case of short-term marriages, the tax treatment of spousal support payments differs from that of long-term marriages. In short-term marriages, both the payer and the recipient of spousal support are generally exempt from any tax obligations related to the support payments. This means that the payor cannot deduct the payments from their taxable income, and the recipient does not need to report the payments as taxable income.

It is important to note that the IRS considers the length of the marriage at the time the divorce or separation agreement is executed. If a marriage exceeds the ten-year threshold but ends in divorce or separation before the ten-year mark, it may still be treated as a long-term marriage for tax purposes. Conversely, if a marriage falls short of the ten-year mark but the divorce or separation occurs after the ten-year threshold, it may be considered a long-term marriage.

Factors Affecting Tax Deductions for Spousal Support

While the length of the marriage is a key factor in determining tax deductions for spousal support, it is not the only consideration. There are additional factors that can influence the tax treatment of spousal support payments. These factors include:

- State laws: State laws regarding spousal support can vary, and these laws can impact the tax treatment of support payments.

- Income levels: The income levels of both the payor and the recipient can affect the tax implications of spousal support payments.

- Other deductions: The presence of other deductions, such as child support payments or mortgage interest, can also impact the tax treatment of spousal support.

It is crucial for individuals involved in spousal support arrangements to consult with a qualified tax professional or attorney to fully understand the tax implications specific to their situation. This ensures compliance with applicable tax laws and maximizes the available deductions or exemptions.

The Importance of Professional Guidance

Given the complexity of tax deductions for spousal support, seeking professional guidance is highly recommended. Tax professionals and attorneys experienced in family law can provide valuable insights tailored to individual circumstances. They can assist in understanding the tax implications of spousal support payments based on the length of the marriage and other relevant factors.

Additionally, professional guidance can help individuals navigate any changes in tax laws or regulations that may impact the tax treatment of spousal support. Staying informed and up-to-date on the latest tax rules is crucial to ensure compliance and optimize tax benefits.

Conclusion

In conclusion, the length of a marriage can significantly affect the tax deductions for spousal support. Long-term marriages generally allow the payor to deduct the support payments from their taxable income, while short-term marriages typically do not provide this deduction. However, various factors, such as state laws, income levels, and other deductions, can also influence the tax treatment of spousal support. Seeking professional guidance is essential to navigate these complexities and ensure compliance with tax laws while maximizing available deductions or exemptions.

Key Takeaways: How Are Tax Deductions for Spousal Support Affected by the Length of the Marriage?

- The length of the marriage can impact tax deductions for spousal support.

- If the marriage lasted less than one year, no tax deductions for spousal support are allowed.

- For marriages lasting one year or more, tax deductions for spousal support may be available.

- The amount of spousal support and the tax implications may vary based on the length of the marriage.

- It is important to consult with a tax professional to understand the specific rules and requirements for tax deductions related to spousal support.

Frequently Asked Questions

How does the length of marriage affect tax deductions for spousal support?

When it comes to tax deductions for spousal support, the length of the marriage can have an impact. The IRS has specific rules regarding the deductibility of spousal support payments, and the length of the marriage is one of the factors that can affect these deductions.

In general, if you are paying spousal support, also known as alimony, and your marriage lasted for more than one year, you may be eligible to deduct the payments from your taxable income. However, if the marriage lasted for less than one year, the IRS may not consider the payments as spousal support for tax purposes, and they may not be deductible.

What are the tax implications for spousal support in short-term marriages?

In short-term marriages, which are typically defined as marriages lasting less than one year, the tax implications for spousal support can be different. Since the IRS may not consider the payments as spousal support for tax purposes, the payments may not be deductible for the paying spouse. This means that the paying spouse will not be able to reduce their taxable income by the amount of spousal support paid.

On the other hand, the receiving spouse may not have to report the spousal support as taxable income. This can be beneficial for the receiving spouse, as they do not need to pay taxes on the support payments they receive. However, it’s important to consult with a tax professional to understand the specific tax implications in your situation.

How does the length of marriage impact tax deductions for long-term marriages?

In long-term marriages, which are typically defined as marriages lasting more than one year, the tax deductions for spousal support can come into play. If you are paying spousal support in a long-term marriage, you may be eligible to deduct the payments from your taxable income, subject to certain IRS rules.

However, it’s important to note that the length of the marriage is just one factor that the IRS considers when determining the deductibility of spousal support payments. Other factors, such as the payment arrangement and the purpose of the payments, may also come into play. Consulting with a tax professional can help you understand the specific tax implications in your situation.

Are there any exceptions to the tax deductions for spousal support based on the length of marriage?

While the length of marriage is an important factor when it comes to tax deductions for spousal support, there can be exceptions to the general rules. The IRS takes into account various factors when determining the deductibility of spousal support payments, and it’s possible that certain circumstances may warrant exceptions.

For example, if the spousal support payments are part of a larger property settlement or are deemed as child support by the IRS, they may not be eligible for tax deductions, regardless of the length of the marriage. It’s crucial to consult with a tax professional to understand the specific rules and exceptions that may apply to your situation.

What should I do if I have questions about tax deductions for spousal support based on the length of marriage?

If you have questions or concerns about tax deductions for spousal support based on the length of your marriage, it’s recommended to consult with a tax professional. A tax professional can provide guidance tailored to your specific situation and help you navigate the complex tax rules surrounding spousal support payments.

They can help you understand whether your spousal support payments are deductible, based on factors such as the length of your marriage and the purpose of the payments. Additionally, a tax professional can assist you in properly reporting your spousal support payments and ensuring compliance with IRS regulations.

Final Summary: How the Length of the Marriage Impacts Tax Deductions for Spousal Support

In conclusion, the length of a marriage can have a significant impact on tax deductions for spousal support. Understanding these implications is crucial for those going through a divorce or separation. When it comes to tax deductions for spousal support, the length of the marriage determines whether the payments are considered alimony or child support.

For marriages that lasted longer than one year and end in divorce or separation, spousal support payments are generally classified as alimony. These payments can be tax-deductible for the paying spouse and taxable for the recipient. However, for marriages that lasted less than one year or for couples who are still legally married but living apart, the payments are typically treated as child support. In such cases, the paying spouse cannot claim a tax deduction, and the recipient does not need to report the payments as income.

It is important to note that tax laws can be complex, and the specific circumstances of each case may impact the tax implications of spousal support. Seeking the advice of a tax professional or legal expert is highly recommended to ensure compliance with relevant laws and to optimize the tax benefits available.

In summary, understanding how the length of the marriage affects tax deductions for spousal support is crucial for couples navigating the complexities of divorce or separation. By being aware of the tax implications, individuals can make informed decisions about spousal support arrangements and maximize their financial benefits. Remember to consult with professionals who specialize in tax and family law matters to ensure compliance with the ever-changing regulations and to receive personalized advice tailored to your specific situation.