When going through a divorce, one of the biggest concerns is the division of assets and debts. While it’s relatively straightforward to divide physical property, such as houses or cars, the question of how debts are divided can be a bit more complex. So, how are debts divided during property division in a divorce? Let’s delve into this topic and shed some light on the process.

When it comes to dividing debts during a divorce, it’s important to understand that each situation is unique, and there is no one-size-fits-all approach. However, there are some common factors that courts take into consideration. For instance, the court may consider the type of debt, who incurred the debt, and when it was incurred. Additionally, the court will often consider the financial circumstances of each spouse, including their income and ability to repay the debts. By taking all of these factors into account, the court aims to reach a fair and equitable division of debts between the divorcing spouses. Now, let’s explore this topic further and uncover some key insights about dividing debts during property division in a divorce.

How Are Debts Divided During Property Division in a Divorce?

Divorce is a challenging and emotional process, and one of the most important aspects to consider is the division of property and assets. When going through a divorce, it’s not just the assets that need to be divided, but also the debts that have been accumulated during the marriage. Determining how debts are divided can be a complex process, and it’s important to understand the factors that come into play.

Factors Considered in Debt Division

During a divorce, the court takes several factors into consideration when determining how to divide the debts. These factors may vary depending on the jurisdiction, but generally include the following:

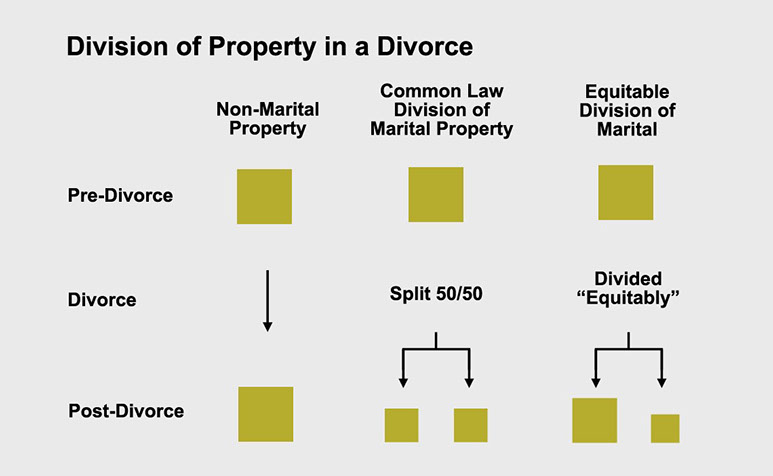

1. Community Property States: In community property states, debts incurred during the marriage are typically considered community debts, which means they are equally owned by both spouses. This includes debts such as credit card balances, mortgages, and car loans. The court will typically divide the debts equally between the spouses.

2. Equitable Distribution States: In equitable distribution states, debts are divided based on what the court deems fair and equitable. The court will consider factors such as the income and earning potential of each spouse, the length of the marriage, and the financial contributions made by each spouse during the marriage.

3. Debt Responsibility: The court will also consider which spouse is responsible for incurring the debt. If one spouse incurred a significant amount of debt without the knowledge or consent of the other spouse, the court may assign a larger portion of the debt to the responsible spouse.

4. Financial Circumstances: The court will take into account the financial circumstances of each spouse, including their income, assets, and ability to pay off the debts. If one spouse has a significantly higher income or greater assets, they may be required to take on a larger portion of the debt.

Impact of Pre-Nuptial Agreements

In some cases, couples may have a pre-nuptial agreement in place that outlines how debts will be divided in the event of a divorce. A pre-nuptial agreement can specify how debts will be allocated and can override the default rules of the jurisdiction. If a pre-nuptial agreement exists, the court will generally uphold its terms unless there are extenuating circumstances or the agreement is deemed unfair.

It’s important to note that not all debts incurred during a marriage are considered marital debts. If one spouse incurred a debt before the marriage or after separation, it may be considered separate debt and not subject to division. However, if one spouse used a joint credit card or took out a loan in both names, it may still be considered a marital debt.

Options for Dividing Debts

There are several options for dividing debts during a divorce:

1. Paying Off Debts Together: In some cases, couples may choose to pay off their debts together before finalizing the divorce. This can help ensure that both spouses are equally responsible for the debt and can provide a fresh financial start for both parties.

2. Dividing Debts Equally: If the debts cannot be paid off before the divorce, the court may divide them equally between the spouses. This means that each spouse will be responsible for paying off a portion of the debts.

3. Assuming Responsibility: In some cases, one spouse may assume responsibility for certain debts in exchange for receiving a larger portion of the marital assets. This can be a negotiation tactic used to reach a fair settlement.

4. Working with Mediation: Mediation can be a helpful process for couples who want to work together to come up with a debt division plan that is mutually beneficial. A mediator can help facilitate discussions and assist in finding a resolution that works for both parties.

Implications for Credit and Financial Stability

Divorce can have a significant impact on credit and financial stability. It’s important to be proactive in managing debts during and after the divorce process. Here are some steps to consider:

1. Close Joint Accounts: Close any joint credit card or loan accounts to prevent further accumulation of debt.

2. Monitor Credit Reports: Regularly check your credit report to ensure that all joint debts are being paid as agreed. This will also help identify any potential issues or errors.

3. Establish Separate Credit: If you don’t already have individual credit accounts, establish your own credit history by opening a credit card or obtaining a small loan in your name.

4. Create a Budget: Develop a budget to manage your finances and allocate funds towards debt repayment. This will help you stay on track and prioritize your financial obligations.

5. Seek Professional Help: If you’re struggling with debt after a divorce, consider seeking the assistance of a financial planner or credit counselor who can provide guidance and support.

In conclusion, the division of debts during a divorce is a complex process that takes into account various factors such as jurisdiction, responsibility for the debt, and financial circumstances of each spouse. It’s important to work with a knowledgeable attorney and consider all options for debt division to reach a fair and equitable outcome. Taking proactive steps to manage debts and protect your credit after a divorce is also crucial for long-term financial stability.

Key Takeaways: How Are Debts Divided During Property Division in a Divorce?

- Debts acquired during the marriage are typically considered marital debts and may be divided equally between both spouses.

- If one spouse incurred a debt before the marriage, it is generally considered separate debt and may not be divided.

- In community property states, debts are usually divided equally, regardless of who incurred them.

- In equitable distribution states, debts are divided based on factors like each spouse’s income and ability to pay.

- It’s important to gather all financial information and consult with a divorce attorney to ensure debts are divided fairly.

Frequently Asked Questions

Question 1: How are debts divided during property division in a divorce?

During a divorce, the division of debts can be a complex and contentious issue. In most cases, debts accumulated during the marriage are considered marital debts and are subject to division between the spouses. However, it’s important to note that each state has its own laws and guidelines regarding the division of debts in a divorce, so the specifics may vary.

Typically, the court will consider various factors when determining how to divide the debts. These factors may include the earning capacity of each spouse, the length of the marriage, the financial contributions of each spouse, and any agreements or arrangements made between the spouses regarding the debts. The court may also consider whether the debts were incurred for the benefit of the marital estate or for personal reasons.

Question 2: Can one spouse be held solely responsible for the debts?

In some cases, one spouse may be held solely responsible for certain debts. This can happen if the debt was incurred solely for the benefit of one spouse, such as if it was for their personal expenses or if it was a debt they brought into the marriage. However, it’s important to note that even if one spouse is held responsible for a debt, it can still have an impact on the overall division of assets and financial arrangements in the divorce.

If one spouse is unable to pay their share of the debts, the court may order the other spouse to take on a larger portion of the debts or make other arrangements to ensure the debts are paid. Ultimately, the goal is to reach a fair and equitable division of both assets and debts in the divorce.

Question 3: What if the debts are in one spouse’s name only?

Even if a debt is in one spouse’s name only, it can still be considered a marital debt and subject to division in a divorce. The court will look at various factors to determine how to divide the debt, including the purpose of the debt, the financial circumstances of both spouses, and any agreements or arrangements made between the spouses regarding the debt.

In some cases, if the debt was incurred for the benefit of the marital estate, the court may assign a portion of the debt to the other spouse. This is particularly true if the other spouse contributed to the payment of the debt or if they derived some benefit from it. However, if the debt was incurred for purely personal reasons, the court may be more likely to assign it solely to the spouse whose name is on the debt.

Question 4: How can debts be divided during property division?

There are several ways debts can be divided during property division in a divorce. One option is for each spouse to take on a portion of the debts based on their ability to pay. For example, if one spouse has a higher income or greater earning potential, they may be assigned a larger portion of the debts.

Another option is for the debts to be divided equally between the spouses. This can be a simple and straightforward approach, particularly if the debts are relatively small and manageable. However, it’s important to consider the financial circumstances of each spouse to ensure the division of debts is fair and equitable.

Question 5: What if one spouse refuses to pay their share of the debts?

If one spouse refuses to pay their share of the debts, it can create complications and conflicts during the divorce process. In such cases, the court may intervene and make orders to enforce the division of debts. This can include issuing judgments against the non-paying spouse, garnishing wages, or placing liens on their assets.

It’s important for both spouses to communicate and work towards a resolution regarding the debts. If necessary, they may need to seek legal advice or mediation to help facilitate the division of debts and ensure both parties fulfill their financial obligations.

Final Summary: Dividing Debts During Property Division in a Divorce

When it comes to the division of assets during a divorce, it’s not just the physical property that needs to be considered. Debts are also an important aspect that must be addressed. In this article, we explored how debts are divided during property division in a divorce, shedding light on the factors that influence the process.

In conclusion, the division of debts during a divorce is a complex matter that requires careful consideration. While each case is unique and subject to individual circumstances, the court generally aims for an equitable distribution of debts between spouses. Factors such as the nature of the debt, the contribution of each spouse, and the financial capabilities of each party are taken into account.

It’s essential to consult with a qualified attorney who specializes in family law to navigate this process successfully. By understanding the laws and regulations governing debt division, you can protect your interests and work towards a fair resolution. Remember, in the midst of the emotional and financial challenges of divorce, seeking professional guidance can make a significant difference in achieving a favorable outcome.