When going through a divorce, one of the most complex and contentious issues that arises is the division of assets. It can be a challenging and emotionally charged process, as both parties seek a fair and equitable distribution of their shared property. But how exactly are assets valued during a divorce? In this article, we will delve into the intricacies of asset valuation and provide you with a comprehensive understanding of how this crucial aspect of divorce proceedings is handled.

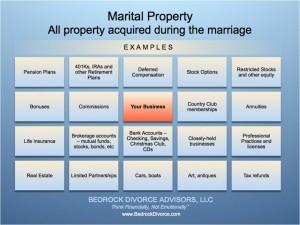

Valuing assets during a divorce involves determining the monetary worth of various properties, investments, and possessions that the couple accumulated during their marriage. This includes real estate, vehicles, bank accounts, retirement funds, businesses, and other valuable items. The purpose of asset valuation is to ensure that both parties receive a fair share of the marital estate. However, the process can be complicated, as it requires assessing the current market value of assets and considering factors like depreciation, liquidity, and tax implications.

As we explore the intricacies of asset valuation during a divorce, we will discuss the methods used by professionals to determine the value of different types of assets. From market appraisals to financial statements and expert opinions, there are various approaches that can be employed. Additionally, we will explore the role of forensic accountants and financial experts in assessing the value of complex assets, such as businesses or investments. By gaining insight into the valuation process, you will be better equipped to navigate this aspect of your divorce and ensure a fair division of assets. So let’s dive in and unravel the fascinating world of asset valuation in divorce cases!

How Are Assets Valued During a Divorce?

Divorce is a complex and emotionally challenging process, and one of the key aspects that needs to be addressed is the division of assets. When a couple decides to end their marriage, they must determine how their assets will be valued and divided between them. This can be a contentious issue, as each party may have different opinions on the value of certain assets. Understanding how assets are valued during a divorce is crucial for both parties to ensure a fair and equitable division.

The Role of Asset Valuation in Divorce

During a divorce, assets are valued to determine their worth in order to facilitate an equitable division. Asset valuation is the process of determining the fair market value of assets such as real estate, investments, businesses, retirement accounts, and personal property. The value assigned to each asset plays a significant role in the overall property settlement between the divorcing spouses.

In most cases, the valuation of assets is conducted by professional appraisers or experts who specialize in specific types of assets. These professionals take into account various factors such as market conditions, asset condition, potential for growth, and comparable sales to determine the fair market value of the assets. The goal is to arrive at a value that accurately reflects the current worth of the assets, ensuring a fair division between the spouses.

Valuating Real Estate

Real estate is often a major asset in a divorce, and its valuation can be complex. To determine the value of real estate, appraisers consider factors such as location, condition, size, comparable sales in the area, and market trends. They may also take into account any outstanding mortgages or liens on the property.

It’s important to note that the value assigned to real estate may not be the same as the purchase price or the assessed value for property tax purposes. The fair market value determined by the appraiser is used for the division of assets. In some cases, the divorcing couple may agree to sell the property and divide the proceeds, while in others, one spouse may keep the property and compensate the other spouse for their share of the value.

The Importance of Accurate Business Valuation

In cases where one or both spouses own a business, its valuation becomes a crucial step in the asset division process. Business valuation involves assessing various factors such as the company’s financial records, assets, liabilities, cash flow, market position, and potential for growth. The valuation is typically conducted by a business appraiser who specializes in evaluating businesses.

Accurate business valuation is essential to ensure a fair division of assets, especially if one spouse worked in or contributed to the growth of the business. It helps determine the value of the business and the portion that each spouse is entitled to. Depending on the circumstances, the divorcing couple may decide to sell the business and divide the proceeds or for one spouse to buy out the other’s share.

The Complexity of Valuing Investments and Retirement Accounts

Investments and retirement accounts are other assets that need to be valued during a divorce. These include stocks, bonds, mutual funds, 401(k) plans, IRAs, pensions, and other savings vehicles. Valuing these assets requires a thorough understanding of financial markets, tax implications, and future growth potential.

A financial expert or forensic accountant may be involved in assessing the value of these assets. They analyze factors such as the current market value, potential returns, tax consequences, and any restrictions or penalties associated with early withdrawal. The valuation helps determine the equitable division of these assets, ensuring that both parties receive a fair share of the investments and retirement savings.

Other Considerations in Asset Valuation

In addition to the major assets mentioned above, there are other considerations that may come into play when valuing assets during a divorce. These include:

1. Personal Property: This includes items such as furniture, appliances, vehicles, jewelry, artwork, and collectibles. Assigning value to personal property can be subjective, and disagreements may arise. In such cases, appraisers or experts may be consulted to determine the fair market value.

2. Debts and Liabilities: Along with assets, debts and liabilities are also considered during the valuation process. These can include mortgages, credit card debts, loans, and other financial obligations. The division of debts should be taken into account when determining the overall asset division.

3. Hidden Assets: In some cases, one spouse may attempt to hide assets to avoid their inclusion in the division. This can complicate the valuation process and require the assistance of forensic accountants or investigators to uncover any hidden assets.

4. Pre and Post-Nuptial Agreements: If the couple has a pre or post-nuptial agreement in place, the terms outlined in these agreements may impact the asset division process. The agreement may specify how assets are valued and divided, potentially simplifying the process.

5. Mediation or Litigation: The method chosen to resolve the divorce, whether through mediation or litigation, can also influence the asset valuation process. Mediation allows the couple to work together with a neutral third party to reach a mutually agreed-upon settlement, while litigation involves court proceedings and decisions made by a judge.

Conclusion

Valuing assets during a divorce is a critical aspect of the property division process. It ensures a fair and equitable distribution of assets between the divorcing spouses. By understanding the role of asset valuation and the complexities involved in valuing different types of assets, individuals going through a divorce can navigate the process more effectively. Seeking the guidance of professionals such as appraisers, business valuators, and financial experts can help ensure an accurate valuation and a smoother asset division process.

Key Takeaways: How Are Assets Valued During a Divorce?

- Assets are valued during a divorce to determine their worth and how they should be divided between the spouses.

- Typically, assets are valued based on their fair market value, which is the price they would sell for in the current market.

- Appraisers are often hired to assess the value of assets such as homes, vehicles, businesses, and investments.

- The valuation process can be complex and may involve considering factors like depreciation, outstanding debts, and future earning potential.

- It’s important for both spouses to provide accurate and complete information about their assets to ensure a fair valuation.

Frequently Asked Questions

Question 1: How are assets valued during a divorce?

During a divorce, the valuation of assets is an important step in the process of dividing property between spouses. Assets can include both tangible and intangible items such as real estate, vehicles, investments, and even intellectual property. The valuation process involves determining the fair market value of these assets, which is the price they would sell for in the current market.

To determine the value of assets, various methods can be used. For tangible assets like real estate or vehicles, an appraiser or expert may be hired to assess their value based on factors such as condition, location, and comparable sales. For financial assets like investments or retirement accounts, their current market value or potential future value may be considered.

Question 2: What factors are considered when valuing assets during a divorce?

When valuing assets during a divorce, several factors are taken into consideration. First, the type of asset itself plays a role in its valuation. For example, real estate may be valued based on factors such as location, market demand, and comparable sales. On the other hand, investments may be valued based on their current market value or potential future growth.

In addition to the type of asset, other factors that may be considered include ownership interests, any debts or liabilities associated with the asset, and the duration of the marriage. For example, if one spouse owned a business prior to the marriage, the increase in value during the marriage may be subject to division. Similarly, if one spouse incurred debts during the marriage, those debts may be considered in the overall valuation of assets.

Question 3: Can both spouses hire their own appraisers to value assets?

Yes, both spouses have the right to hire their own appraisers to value assets during a divorce. This can be beneficial as it ensures that both parties have a fair and unbiased assessment of the assets. Each spouse’s appraiser will independently evaluate the assets and provide their own valuation.

However, it’s important to note that if both appraisers come up with significantly different valuations, the court may need to intervene to determine a fair value. In such cases, the court may appoint its own expert or rely on additional evidence to make a final determination.

Question 4: What happens if the value of assets is disputed?

If the value of assets is disputed during a divorce, the court may need to intervene to resolve the disagreement. In such cases, both parties will have the opportunity to present evidence and arguments supporting their proposed valuations.

The court may consider various factors such as the credibility of the appraisers, the methodology used to determine the value, and any other relevant evidence. Ultimately, the court will make a decision based on what it deems to be a fair and equitable valuation of the assets.

Question 5: Can assets be valued differently for different purposes, such as property division and spousal support?

Yes, assets can be valued differently for different purposes during a divorce. The valuation for property division may focus on the fair market value of the assets, taking into account factors such as potential appreciation or depreciation.

On the other hand, the valuation for spousal support or alimony purposes may consider the income-generating potential of the assets. For example, if one spouse is awarded a rental property, the value may be determined based on the rental income it can generate.

It’s important to work with an experienced attorney or financial advisor who can help ensure that the assets are valued appropriately for each specific purpose and that your rights and interests are protected.

Division of Assets Illustrated, How Assets are Divided in Divorce

Final Thoughts

Now that we’ve explored the intricacies of how assets are valued during a divorce, it’s clear that this process can be complex and emotionally charged. It’s important to approach asset valuation with a level head and seek professional guidance to ensure a fair and equitable outcome.