Divorce can be a challenging and emotionally charged experience, especially when it comes to dividing assets. If you’re going through a divorce in California, you may be wondering how assets are divided in this state. Well, fret not! In this article, we’ll dive into the nitty-gritty of asset division in a California divorce and provide you with the information you need to navigate this process smoothly.

When it comes to dividing assets in a California divorce, the state follows the principle of community property. Now, what does that mean? It means that any property acquired during the marriage is generally considered community property and is subject to equal division between the spouses. However, there are exceptions to this rule, and it’s important to understand the nuances involved. So, whether you’re curious about how the family home, bank accounts, retirement savings, or even debts are divided, we’ve got you covered. Let’s dive in and uncover the ins and outs of asset division in a California divorce!

How Are Assets Divided in a Divorce in California?

Divorce can be a challenging and emotional process, especially when it comes to dividing assets. In California, the division of assets is based on community property laws, which means that any property acquired during the marriage is generally considered to be owned equally by both spouses. However, there are several factors that can influence how assets are divided in a divorce. In this article, we will explore the process of asset division in a divorce in California and provide you with valuable information to help you navigate this complex process.

Understanding Community Property Laws

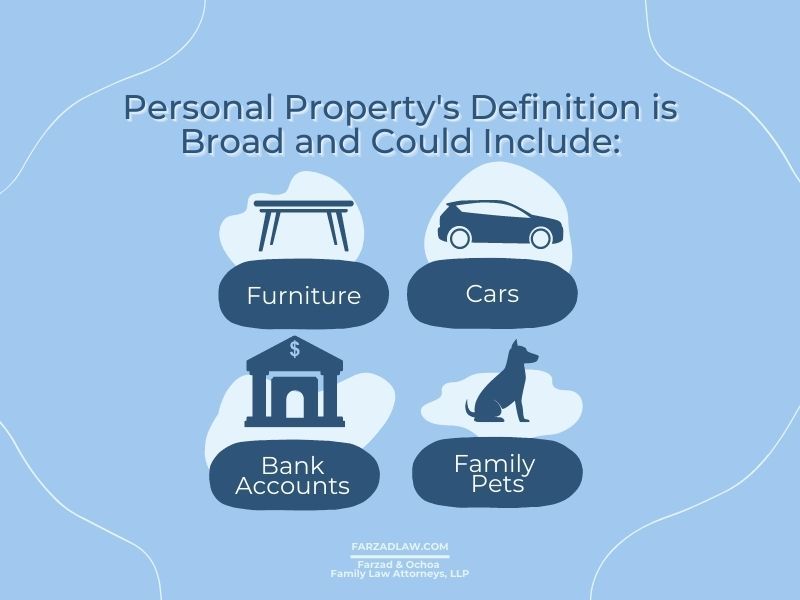

In California, community property laws dictate that any property acquired by either spouse during the marriage is considered to be community property, which is owned equally by both spouses. This includes not only physical assets such as real estate, vehicles, and personal belongings, but also financial assets such as bank accounts, investments, and retirement accounts. It’s important to note that community property laws only apply to assets acquired during the marriage and do not include property owned by either spouse prior to the marriage or acquired through inheritance or gifts.

When it comes to dividing community property in a divorce, the goal is to achieve a fair and equitable distribution of assets. This does not necessarily mean that assets will be divided equally between the spouses, but rather in a manner that takes into account the unique circumstances of the marriage and the financial needs of each spouse.

Factors That Influence Asset Division

While community property laws provide a general framework for asset division in California, there are several factors that can influence how assets are divided in a divorce. These factors include:

1. Length of the marriage: The duration of the marriage can play a role in asset division. In general, the longer the marriage, the more likely it is that assets will be divided equally between the spouses.

2. Earning capacity and financial needs of each spouse: The court will consider the earning capacity and financial needs of each spouse when determining how assets should be divided. For example, if one spouse has a significantly higher earning capacity than the other, they may be awarded a larger share of the assets to ensure their financial stability post-divorce.

3. Contributions to the marriage: The court will also take into account the contributions of each spouse to the marriage, both financial and non-financial. This can include factors such as homemaking, child-rearing, and career sacrifices made for the benefit of the marriage.

4. Child custody and support: If there are children involved in the divorce, child custody and support arrangements can also impact asset division. The court may take into consideration the financial needs of the custodial parent when determining how assets should be divided.

5. Separate property claims: If one spouse claims that certain assets are their separate property, meaning they were acquired prior to the marriage or through inheritance or gift, the court will evaluate the validity of these claims and determine whether these assets should be excluded from the community property.

It’s important to note that asset division in a divorce can be a complex and contentious process. It is highly recommended to consult with an experienced divorce attorney who can guide you through the legal proceedings and help protect your rights and interests.

The Process of Asset Division

In California, the process of asset division begins with both spouses disclosing all their assets and debts. This includes providing documentation such as bank statements, tax returns, property deeds, and investment account statements. Full disclosure is crucial to ensure a fair and accurate assessment of the marital estate.

Once all assets and debts have been disclosed, the spouses can either reach a mutually agreed-upon settlement or proceed to court for a judge to make a determination. If the spouses are able to reach a settlement, it is recommended to have the agreement reviewed by an attorney to ensure that it is fair and legally binding.

If the case goes to court, the judge will consider the aforementioned factors, as well as any additional evidence presented, to make a decision on how assets should be divided. The judge has the discretion to deviate from an equal division if they determine it to be fair and just based on the unique circumstances of the case.

It’s important to note that assets are not the only consideration in a divorce. Debts and liabilities acquired during the marriage are also subject to division. This includes mortgages, credit card debts, student loans, and other financial obligations.

In conclusion, asset division in a divorce in California is based on community property laws, which generally dictate that assets acquired during the marriage are owned equally by both spouses. However, there are several factors that can influence how assets are divided, including the length of the marriage, earning capacity and financial needs of each spouse, contributions to the marriage, child custody and support arrangements, and separate property claims. The process of asset division involves full disclosure of assets and debts, negotiation or court proceedings, and the consideration of various factors to ensure a fair and equitable distribution of assets. It is essential to seek the guidance of a qualified divorce attorney to navigate this process and protect your rights and interests.

Key Takeaways: How Are Assets Divided in a Divorce in California?

- Assets acquired during marriage are generally considered community property and are subject to equal division.

- However, certain assets may be classified as separate property if they were acquired before the marriage or through inheritance or gift.

- The court considers various factors, such as the length of the marriage, each spouse’s financial situation, and contributions to the marriage, when dividing assets.

- Spouses can negotiate and agree on their own division of assets through a marital settlement agreement.

- If a fair agreement cannot be reached, the court will make a decision based on California’s community property laws.

Frequently Asked Questions

In a divorce in California, the division of assets can be a complex process. Here are some commonly asked questions and answers regarding how assets are divided in a divorce in California.

Q: What is community property?

A: In California, community property refers to the assets and debts acquired by a couple during their marriage. This includes both income and property. When a couple divorces, community property is typically divided equally between the spouses, unless they come to a different agreement.

However, it’s important to note that not all property is considered community property. Gifts and inheritances received by one spouse, as well as property acquired before the marriage, are generally considered separate property and may not be subject to equal division.

Q: How is property valued for division?

A: The value of assets is an important factor in the division process. When determining the value of property, it is typically based on the fair market value at the time of divorce. This can be determined through appraisals, expert opinions, or other valuation methods.

It’s important to accurately assess the value of assets to ensure a fair division. This may involve obtaining professional appraisals for real estate, businesses, or other valuable assets. In some cases, spouses may need to work together or consult with experts to determine the value of certain assets.

Q: What factors are considered when dividing assets?

A: California follows the principle of equitable distribution, which means that assets are divided in a fair and just manner. The court will consider various factors when determining how to divide assets, including:

– The length of the marriage

– The age and health of each spouse

– The earning capacity of each spouse

– The contributions of each spouse during the marriage

– The needs of each spouse

– Any agreements made by the spouses regarding the division of assets

– Any other relevant factors

Q: Can the spouses reach their own agreement on asset division?

A: Yes, spouses have the option to reach their own agreement on how to divide their assets. This can be done through negotiation, mediation, or collaborative divorce. If the spouses are able to come to a mutually satisfactory agreement, they can present it to the court for approval.

It’s important to note that any agreement reached by the spouses should be fair and equitable. It’s recommended to consult with a family law attorney to ensure that the agreement protects your rights and interests.

Q: What happens if the spouses cannot agree on asset division?

A: If the spouses are unable to reach an agreement on asset division, the court will make the decision for them. The court will consider the relevant factors mentioned earlier and make a determination based on what it deems to be fair and just.

In such cases, it’s important to have legal representation to advocate for your interests and ensure that your rights are protected during the court proceedings.

Final Thoughts

After delving into the complex world of asset division in a California divorce, it’s clear that the process can be challenging and emotionally charged. However, understanding the key factors that influence how assets are divided can help alleviate some of the stress and uncertainty. While California follows the principle of community property, which generally means a 50-50 split, there are various exceptions and considerations that come into play.

It’s important to remember that the court aims to achieve a fair and equitable distribution of assets, taking into account factors such as each spouse’s contribution to the marriage, the duration of the marriage, and the financial needs of each party. Additionally, prenuptial agreements can have a significant impact on asset division, as they provide a predetermined arrangement for how assets will be divided in the event of a divorce.

Navigating the intricacies of asset division in a California divorce can be overwhelming, but seeking the guidance of a knowledgeable attorney can help ensure that your rights and interests are protected. Remember to consult with a legal professional who can provide personalized advice based on your unique circumstances and help you navigate the complexities of the legal system. With the right support, you can navigate the process with confidence and move forward towards a brighter future.