Divorce can be a complex and emotionally charged process, especially when it comes to dividing assets. Many people wonder if their separate property, which they acquired before the marriage, can be subject to division in a divorce. It’s a valid concern, and understanding the rules surrounding separate property can help alleviate some of the stress during this challenging time.

When it comes to divorce, the division of assets is often a hot topic. People want to know what they’re entitled to and what they may have to give up. But what about separate property? Can it be subject to division in a divorce? Separate property typically refers to assets owned by one spouse before the marriage or acquired during the marriage through inheritance or gift. While laws vary by jurisdiction, in general, separate property is not subject to division in a divorce. However, there are certain circumstances where separate property can become marital property and be subject to division. It’s important to understand these nuances to protect your assets and navigate the divorce process with confidence.

By crafting an engaging and informative introduction, we can capture the reader’s attention and provide a clear overview of the topic: Can separate property be subject to division in a divorce? This introduction sets the stage for an article that will delve deeper into the complexities of divorce law and provide valuable insights for those going through this challenging process. With a conversational and reader-friendly writing style, we can ensure that the article is not only informative but also enjoyable to read. And by incorporating relevant keywords and following SEO best practices, we can help the article rank high on Google and reach a wider audience in need of this valuable information.

Can Separate Property Be Subject to Division in a Divorce?

In a divorce, separate property is typically not subject to division. Separate property refers to assets that were acquired before the marriage or through inheritance or gift. However, there are situations where separate property can become commingled with marital property, making it eligible for division. For example, if separate funds are used to improve a marital home, those funds may be subject to division. It’s important to consult with a divorce attorney to understand the specific laws in your jurisdiction regarding separate property and division in a divorce.

Can Separate Property Be Subject to Division in a Divorce?

When going through a divorce, one of the major concerns for many couples is the division of assets. This includes determining who gets what property, including both shared and separate assets. However, when it comes to separate property, there may be some confusion as to whether or not it can be subject to division in a divorce.

Separate property typically refers to assets or properties that were acquired by one spouse before the marriage or were received as a gift or inheritance during the marriage. It is important to note that laws regarding separate property can vary depending on the jurisdiction, so it’s crucial to consult with a legal professional familiar with the laws in your specific area.

Understanding Separate Property and Marital Property

In a divorce, assets are generally categorized as either separate property or marital property. Marital property refers to assets that were acquired during the marriage and is subject to division between the spouses. On the other hand, separate property is typically not subject to division and remains with the owner.

However, it’s important to understand that there are certain situations where separate property can become subject to division. This can occur if separate property has been commingled with marital property or if it has been used to benefit the marriage or the marital estate. In these cases, the separate property may lose its separate status and be considered marital property.

Commingling of Separate and Marital Property

Commingling refers to the mixing of separate and marital property to the extent that it becomes difficult to distinguish between the two. For example, if one spouse uses funds from their separate bank account to pay for household expenses or mortgage payments, the separate funds may be considered commingled with marital funds.

In such cases, a court may determine that the separate property has lost its separate status and should be included in the division of assets. It’s important to keep clear records and documentation of any separate property transactions to avoid commingling and potential complications during the divorce process.

Using Separate Property to Benefit the Marriage

Another situation where separate property can become subject to division is if it has been used to benefit the marriage or the marital estate. For instance, if one spouse uses their separate property to make improvements to a marital home or to invest in a joint business, the court may consider the separate property as having contributed to the marital estate.

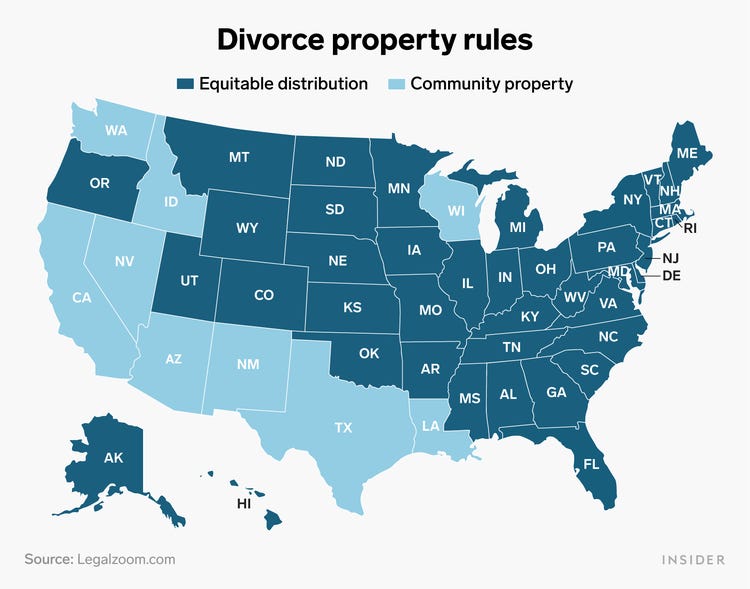

In such cases, the court may decide to award the other spouse a portion of the value or appreciation resulting from the use of separate property. This is known as the concept of “equitable distribution,” where the court aims to divide assets in a fair and just manner.

The Importance of Legal Advice

Given the complexities surrounding the division of assets in a divorce, it is highly recommended to seek legal advice from a qualified attorney. They can provide guidance on the laws specific to your jurisdiction and help you navigate through the process.

Additionally, consulting with a financial advisor or a divorce mediator can also be beneficial in ensuring a fair and equitable division of assets. They can provide insights into the financial implications of different property division scenarios and help you make informed decisions.

Other Considerations in Property Division

Aside from the potential division of separate property, there are other factors that may come into play when dividing assets in a divorce. These include the length of the marriage, the financial contributions of each spouse, the earning potential of each spouse, and the needs of any children involved.

It’s essential to approach property division with a clear understanding of your rights and obligations. By seeking professional advice and working towards a fair and amicable resolution, you can help ensure a smoother transition into the next phase of your life.

Key Takeaways: Can Separate Property Be Subject to Division in a Divorce?

- Separate property can sometimes be subject to division in a divorce.

- Whether separate property is divided depends on various factors, such as state laws and the length of the marriage.

- Commingling separate and marital property can make it more difficult to determine what is separate and what is marital.

- Prenuptial agreements can help protect separate property from division in a divorce.

- Consulting with a divorce attorney can provide guidance on how separate property may be treated in your specific situation.

Frequently Asked Questions

Can Separate Property Be Subject to Division in a Divorce?

1. What is separate property in a divorce?

In a divorce, separate property refers to assets and debts that are considered exclusively owned by one spouse. These can include assets acquired before the marriage, inheritances, gifts, or property acquired through a separate business. It is important to note that laws regarding separate property may vary by jurisdiction.

In general, separate property is not subject to division during a divorce. However, it is crucial to provide evidence and documentation to prove that certain assets or debts are indeed separate property.

2. Can separate property become marital property?

In some cases, separate property can become marital property, subject to division during a divorce. This is known as “commingling” and occurs when separate property is mixed with marital property in a way that makes it difficult to distinguish between the two.

For example, if one spouse uses funds from their separate bank account to pay for joint expenses or to improve a marital home, it may be considered commingling. The courts may then determine that the separate property has been transformed into marital property and can be divided accordingly.

3. How can I protect my separate property in a divorce?

To protect your separate property in a divorce, it is essential to maintain clear documentation and evidence of its separate nature. This can include keeping records of ownership, receipts, bank statements, and any other relevant documents.

Additionally, it is crucial to avoid commingling separate property with marital property. This means refraining from using separate funds for joint expenses or making joint purchases with separate assets. By keeping your separate property separate and clearly documented, you can increase your chances of retaining it in a divorce.

4. Can a prenuptial agreement protect separate property?

Yes, a prenuptial agreement can be an effective way to protect separate property in a divorce. A prenuptial agreement is a legal contract entered into by both spouses before marriage, outlining how assets and debts will be divided in the event of a divorce.

By clearly stating which assets are considered separate property and how they should be treated in a divorce, a prenuptial agreement can provide added protection and certainty. It is important to consult with a qualified attorney to ensure that your prenuptial agreement is legally valid and enforceable.

5. What factors might influence the division of separate property in a divorce?

While separate property is generally not subject to division in a divorce, certain factors may influence the court’s decision. For example, if one spouse contributed significantly to the appreciation or maintenance of the other spouse’s separate property, they may be entitled to a portion of its value.

Additionally, if one spouse can demonstrate that they have a financial need or lack the resources to meet their post-divorce needs, the court may consider dividing some of the other spouse’s separate property to provide for their support. Each jurisdiction may have its own specific factors that can impact the division of separate property, so it is important to consult with a knowledgeable attorney regarding the laws in your area.

Final Summary: Can Separate Property Be Subject to Division in a Divorce?

And there you have it, the answer to the burning question: can separate property be subject to division in a divorce? Well, the short answer is, it depends. While separate property is typically not subject to division in a divorce, there are certain situations where it can become a part of the settlement.

In most cases, separate property refers to assets acquired before the marriage or through inheritance or gifts. These assets are considered individual property and are not typically subject to division during a divorce. However, if separate property has been commingled with marital property or used for the benefit of the marriage, it may be subject to division. This can happen if separate funds are used to pay joint expenses or if separate property is titled jointly.

So, it’s essential to keep track of your separate property and ensure it remains separate throughout the marriage. If you find yourself in a situation where the division of separate property is unclear, it’s best to consult with a qualified attorney who can guide you through the legal process and protect your rights.

Remember, each divorce case is unique, and the laws governing property division can vary depending on your jurisdiction. It’s crucial to seek professional advice tailored to your specific circumstances. By understanding the complexities of separate property division, you can navigate the divorce process with confidence and ensure a fair outcome for all parties involved.