So, you and your significant other have decided to part ways, but there’s one burning question on your mind: “Can I file for divorce if we have significant assets or debts?” Well, my friend, I’m here to shed some light on this topic for you. Whether you’re sitting on a mountain of assets or sinking in a sea of debts, the answer is a resounding YES, you can absolutely file for divorce.

Divorce is never an easy process, especially when there are significant financial factors involved. But fear not, because the law is on your side. No matter the size of your bank account or the weight of your debts, you have the right to seek a divorce and ensure that your assets and debts are fairly divided. So, let’s dive into the nitty-gritty details of how you can navigate the complexities of divorce when significant assets or debts are at stake. Buckle up, my friend, because we’re about to embark on a journey through the world of divorce and finances.

Can I File for Divorce if We Have Significant Assets or Debts?

Divorce can be a complex and emotionally challenging process, especially when significant assets or debts are involved. Many couples wonder if it is possible to file for divorce under these circumstances, and the answer is yes. However, the division of assets and debts can become more complicated, requiring careful consideration and possibly the assistance of legal professionals.

When couples have significant assets or debts, it is important to understand the various factors that can come into play during the divorce process. This article will explore the options available to individuals facing divorce with significant assets or debts, the potential challenges they may encounter, and some tips for navigating this difficult situation.

Division of Assets

The division of assets is a crucial aspect of any divorce, but it becomes even more complex when significant assets are involved. In these cases, it is essential to properly identify and evaluate all assets, including real estate, investments, retirement accounts, businesses, and valuable personal property.

The first step in dividing assets is to determine which assets are considered marital property and which are separate property. Marital property typically includes assets acquired during the marriage, while separate property refers to assets owned by one spouse prior to the marriage or acquired through inheritance or gift. It is important to note that the laws regarding the division of assets vary by jurisdiction, so it is crucial to consult with an attorney who specializes in family law in your specific area.

Valuation of Assets

Once the assets have been identified, the next step is to determine their value. This can be a complex process, especially when dealing with assets such as businesses or real estate. In these cases, it may be necessary to hire appraisers or other experts to provide accurate valuations.

It is important to note that the value of assets can change over time, so it may be necessary to revisit the valuations at various stages of the divorce process. Additionally, some assets may have tax implications that need to be considered when dividing them.

Equitable Distribution

In most jurisdictions, assets are divided according to the principle of equitable distribution. This means that assets are divided in a fair and just manner, taking into account various factors such as the length of the marriage, the contributions of each spouse to the marriage, the earning potential of each spouse, and the needs of any children involved.

Equitable distribution does not necessarily mean equal distribution. In some cases, one spouse may be awarded a higher percentage of the assets based on the specific circumstances of the marriage and the needs of the parties involved.

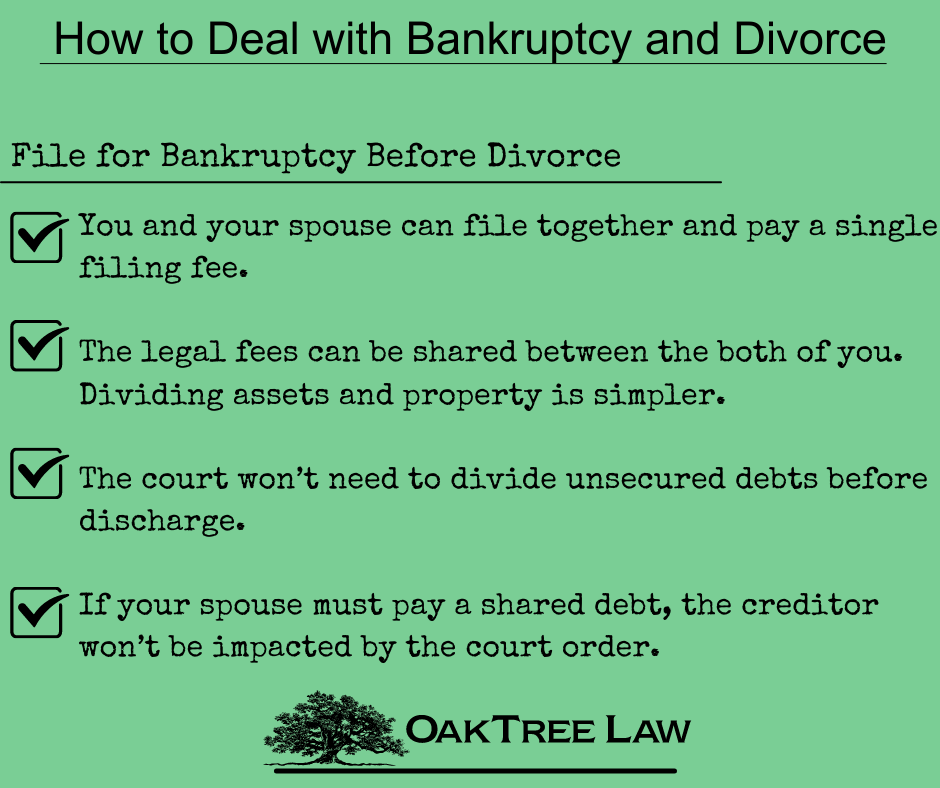

Division of Debts

Just as assets need to be divided, debts also need to be addressed during the divorce process. This can include mortgages, credit card debt, student loans, and other financial obligations.

Similar to the division of assets, debts are typically categorized as either marital or separate. However, unlike assets, which can often be sold or liquidated to divide the value, debts are typically assigned to one spouse or the other. It is important to note that while a divorce decree may assign responsibility for a particular debt to one spouse, it does not relieve the other spouse of liability with the creditor. Therefore, it is crucial to work with an attorney to ensure that debts are properly addressed and that both parties are protected.

Considerations for Debt Division

When dividing debts, it is important to consider several factors. These can include the purpose of the debt, the ability of each spouse to pay, and any agreements or arrangements made during the marriage. Additionally, it is important to review credit reports and statements to ensure that all debts are accounted for and properly addressed in the divorce settlement.

In some cases, it may be necessary to work with creditors to refinance or restructure debts to ensure that each party is protected and can move forward with their financial lives after the divorce. This can be a complex process, so it is important to work with professionals who specialize in divorce and financial planning.

Conclusion

Divorce is never easy, especially when significant assets or debts are involved. However, with careful planning and the guidance of experienced professionals, it is possible to navigate this challenging process. By understanding the complexities of asset and debt division and working towards a fair and equitable resolution, individuals can move forward with their lives and begin the next chapter with confidence.

Key Takeaways: Can I File for Divorce if We Have Significant Assets or Debts?

- Yes, you can file for divorce even if you and your spouse have significant assets or debts.

- The division of assets and debts can be complex and may require the help of a professional, such as a divorce attorney or financial advisor.

- It is important to gather all relevant financial documents, such as bank statements, tax returns, and property deeds, to accurately assess your financial situation.

- A prenuptial agreement, if you have one, can have a significant impact on the distribution of assets and debts during divorce proceedings.

- Consulting with a legal professional can help you understand your rights and options when it comes to dividing assets and debts in a divorce.

Frequently Asked Questions

Question 1: What factors determine whether I can file for divorce if we have significant assets or debts?

When it comes to filing for divorce with significant assets or debts, several factors come into play. The laws regarding division of assets and debts vary depending on the jurisdiction, so it’s important to consult with a divorce attorney who is familiar with the laws in your specific area.

Generally, the court will consider factors such as the length of the marriage, the contributions of each spouse to the acquisition of assets or debts, the earning potential of each spouse, and the needs of any children involved. Additionally, prenuptial agreements or postnuptial agreements, if applicable, may also impact the division of assets and debts.

Question 2: Can I file for divorce if our assets and debts are jointly owned?

Yes, you can still file for divorce even if your assets and debts are jointly owned. In such cases, the court will typically divide the assets and debts equitably between the spouses. It’s important to note that equitable division does not necessarily mean equal division. The court will consider various factors to determine what is fair and equitable in your specific situation.

It’s advisable to work with a divorce attorney who can help you navigate the complexities of dividing jointly owned assets and debts. They can assist you in gathering the necessary documentation and presenting your case to the court to ensure a fair division.

Question 3: What steps should I take to protect my interests in a divorce with significant assets or debts?

If you are considering filing for divorce and have significant assets or debts, it’s crucial to take certain steps to protect your interests. First, consult with a divorce attorney who specializes in complex asset and debt division. They can guide you through the process and provide valuable advice tailored to your specific situation.

Next, gather all relevant financial documents, including bank statements, investment account statements, mortgage documents, and credit card statements. These documents will help establish the value of your assets and debts and can be used as evidence during the divorce proceedings.

Question 4: Can I negotiate a settlement for the division of assets and debts?

Yes, you can negotiate a settlement for the division of assets and debts with your spouse. This can be done through mediation, collaborative divorce, or direct negotiations with the assistance of your respective attorneys. Negotiating a settlement allows you and your spouse to have more control over the outcome and can help minimize the costs and emotional toll of a lengthy court battle.

During the negotiation process, it’s important to prioritize your goals and be open to compromise. Your divorce attorney can provide guidance and advocate for your interests throughout the negotiations. Remember, reaching a mutually agreeable settlement is often in the best interest of both parties involved.

Question 5: What happens if we can’t agree on the division of assets and debts?

If you and your spouse are unable to reach an agreement on the division of assets and debts, the court will make the final decision. The court will consider the relevant factors, such as the contributions of each spouse, the needs of any children involved, and the overall fairness of the division.

It’s important to be prepared for a potentially lengthy court process if you cannot reach an agreement. Your divorce attorney will play a crucial role in presenting your case and advocating for your interests. Remember, the court’s decision may not align with your desired outcome, so it’s always advisable to explore settlement options before resorting to litigation.

Final Thoughts

After delving into the question of whether you can file for divorce when significant assets or debts are involved, it’s clear that the answer is a resounding yes. The division of assets and debts can undoubtedly complicate the divorce process, but it is by no means an insurmountable obstacle. With the right legal guidance and a fair understanding of the laws in your jurisdiction, you can navigate through the complexities and achieve a satisfactory resolution.

When it comes to divorce, the presence of significant assets or debts shouldn’t deter you from taking the necessary steps to end your marriage. It’s important to consult with a knowledgeable attorney who specializes in family law and has experience handling cases involving complex financial situations. They can help you understand your rights, assess the value of your assets, and negotiate a fair division of property and debts.

Remember, the key to a successful divorce is open communication, cooperation, and a willingness to compromise. By approaching the process with a level head and seeking professional guidance, you can protect your interests and ensure a smoother transition into the next chapter of your life. So, don’t let the fear of complex financial matters hold you back from pursuing the divorce you need and deserve. Take the necessary steps to reclaim your happiness and move forward with confidence.