Did you know that child support enforcement agencies have the power to intercept tax refunds? It may come as a surprise, but this is a common practice used to ensure that parents fulfill their financial obligations towards their children. In this article, we will explore the topic of child support enforcement intercepting tax refunds and shed light on how it works.

When it comes to child support, the well-being of the child is always the top priority. Child support enforcement agencies play a crucial role in ensuring that parents meet their financial responsibilities. One effective method they employ is intercepting tax refunds. This means that if a parent owes child support payments, the enforcement agency can redirect their tax refund towards fulfilling those obligations.

Now, you might be wondering how exactly this process works and what it means for parents who owe child support. We will delve into the details and provide you with all the information you need to better understand this practice. So, keep reading to discover the ins and outs of child support enforcement intercepting tax refunds and how it impacts both parents and children.

Can Child Support Enforcement Intercept Tax Refunds?

Child support enforcement is a vital aspect of ensuring that children receive the financial support they need. One question that often arises is whether child support enforcement agencies have the authority to intercept tax refunds. The answer to this question is yes, child support enforcement can intercept tax refunds in certain circumstances. In this article, we will explore the process of intercepting tax refunds for child support, the requirements that must be met, and the implications for both the custodial and noncustodial parents.

The Process of Intercepting Tax Refunds for Child Support

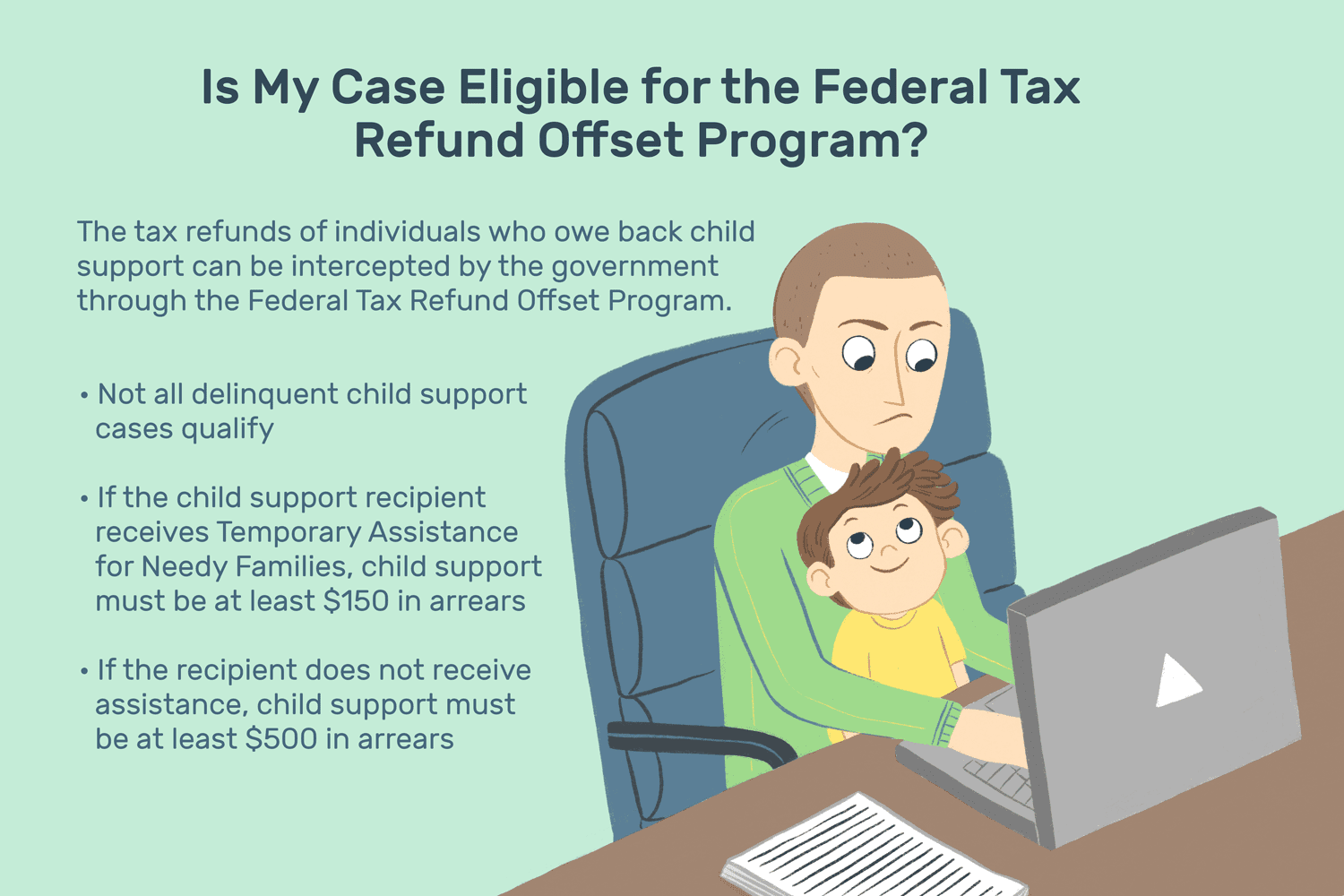

Intercepting tax refunds for child support involves a collaborative effort between the child support enforcement agency and the Internal Revenue Service (IRS). When a noncustodial parent owes child support arrears, the child support enforcement agency can request the IRS to intercept their tax refund. This process is known as the Tax Refund Offset Program.

To initiate the interception, the child support enforcement agency must submit a request to the IRS, providing the necessary information, such as the noncustodial parent’s Social Security number and the amount of child support owed. The IRS then reviews the request and determines whether the interception is appropriate. If approved, the IRS will deduct the owed amount from the noncustodial parent’s tax refund and send it directly to the child support enforcement agency.

Requirements for Intercepting Tax Refunds

Intercepting tax refunds for child support is subject to specific requirements and conditions. These requirements vary by jurisdiction, but there are common criteria that must be met. Firstly, there must be a child support order in place, and the noncustodial parent must owe past-due child support payments, also known as arrears.

Additionally, the child support enforcement agency must have made efforts to collect the owed child support through other means, such as wage garnishment or asset seizure. Intercepting tax refunds is typically considered a last resort when other methods of collection have been unsuccessful.

It is important to note that tax refunds can only be intercepted for the purpose of child support payment. They cannot be intercepted for other types of debts, such as credit card bills or student loans. The funds intercepted from the tax refund are used to satisfy the outstanding child support arrears and provide financial support for the child.

Implications for Custodial and Noncustodial Parents

The interception of tax refunds for child support has significant implications for both the custodial and noncustodial parents. For the custodial parent, the interception provides a means of receiving the owed child support payments. It can alleviate financial burdens and ensure that the child’s needs are met. The intercepted funds can be used for various expenses, such as education, healthcare, and basic living costs.

On the other hand, for the noncustodial parent, the interception of tax refunds can result in a reduced refund or even a complete offset of the refund. This can be challenging, particularly if the noncustodial parent was relying on the refund for other financial obligations. It is essential for noncustodial parents to stay informed about their child support obligations and make timely payments to avoid the interception of their tax refunds.

In conclusion, child support enforcement agencies do have the authority to intercept tax refunds in order to collect past-due child support payments. This process involves cooperation between the child support enforcement agency and the IRS. By intercepting tax refunds, custodial parents can receive the financial support they are owed, while noncustodial parents are reminded of their responsibility to fulfill their child support obligations. It is important for both parents to understand the implications of tax refund interception and work towards resolving any outstanding child support arrears.

Key Takeaways: Can Child Support Enforcement Intercept Tax Refunds?

- Child support enforcement agencies have the power to intercept tax refunds to collect unpaid child support.

- This means that if a noncustodial parent owes child support, their tax refund can be taken to cover the owed amount.

- Intercepting tax refunds is one of the ways child support agencies work to ensure children receive the financial support they need.

- However, not all tax refunds are subject to interception. It depends on the amount owed and the specific laws in each state.

- If you owe child support and are expecting a tax refund, it’s important to be aware that it could be intercepted to satisfy your unpaid child support obligations.

Frequently Asked Questions

How does child support enforcement intercept tax refunds?

Child support enforcement agencies have the authority to intercept tax refunds to collect overdue child support payments. When a parent owes child support, the agency can submit a request to the Internal Revenue Service (IRS) to intercept the parent’s tax refund. The IRS then deducts the owed child support amount from the refund and sends it directly to the child support agency. This process is known as tax refund offset.

The child support agency must follow specific procedures to initiate the intercept. They typically send a notice to the parent informing them of the intention to intercept their tax refund. The parent has the opportunity to contest the intercept if they believe it is in error. However, if the owed child support is valid, the agency can proceed with intercepting the tax refund.

What are the requirements for child support enforcement to intercept tax refunds?

In order for child support enforcement to intercept tax refunds, several conditions must be met. First, the parent must owe overdue child support payments. The specific amount owed can vary depending on state laws and individual circumstances. Second, the child support agency must have an active case and a valid court order for child support. This court order establishes the obligation for the parent to make regular payments.

Additionally, the child support agency must follow proper procedures and provide notice to the parent before intercepting their tax refund. The parent has the right to contest the intercept if they believe there is an error or if they have made alternative payment arrangements. However, if the owed child support is valid and the requirements are met, the agency can proceed with intercepting the tax refund.

Can child support enforcement intercept tax refunds for any amount owed?

Child support enforcement can intercept tax refunds for any amount owed in overdue child support payments. Whether the owed amount is large or small, the agency has the authority to request the intercept from the IRS. The specific amount that can be intercepted is determined by the outstanding child support debt.

It’s important to note that child support enforcement agencies prioritize the collection of overdue child support and may take action to intercept tax refunds even for relatively small amounts. The interception of tax refunds serves as an enforcement measure to ensure parents fulfill their financial obligations towards their children.

What happens to the intercepted tax refund?

When a tax refund is intercepted by child support enforcement, it is sent directly to the child support agency. The agency then applies the intercepted funds towards the parent’s overdue child support debt. The intercepted tax refund helps to reduce the outstanding balance and brings the parent closer to fulfilling their financial obligations.

If the intercepted tax refund is not sufficient to cover the entire amount owed, the parent will still have an outstanding balance. In such cases, the child support agency will continue to pursue other enforcement measures to collect the remaining debt, such as wage garnishment or seizure of assets.

Can child support enforcement intercept tax refunds without notice?

No, child support enforcement cannot intercept tax refunds without providing notice to the parent. The agency is required to follow specific procedures and notify the parent before intercepting their tax refund. This notice informs the parent about the intention to intercept and provides them with an opportunity to contest the intercept if they believe there is an error or if they have made alternative payment arrangements.

Providing notice is an important part of the due process to ensure fairness in the enforcement of child support obligations. It allows the parent to have a chance to address any concerns or issues before their tax refund is intercepted. If the parent does not contest the intercept or if the owed child support is valid, the agency can proceed with intercepting the tax refund.

Final Summary: Can Child Support Enforcement Intercept Tax Refunds?

After delving into the topic of child support enforcement and tax refunds, it is clear that child support enforcement agencies do have the authority to intercept tax refunds in order to collect overdue child support payments. This measure is taken to ensure that parents fulfill their financial obligations towards their children. The process involves the state child support agency working with the Internal Revenue Service (IRS) to intercept any tax refunds owed to parents who are behind on their child support payments.

It is important for parents who owe child support to understand that their tax refunds can be intercepted. This enforcement tool allows child support agencies to effectively collect the outstanding payments and provide financial support for the children involved. By intercepting tax refunds, the agencies can ensure that parents fulfill their responsibilities and prioritize the well-being of their children.

In conclusion, the ability of child support enforcement agencies to intercept tax refunds serves as a powerful tool in ensuring that parents meet their financial obligations towards their children. It is essential for parents to be aware of this enforcement measure and take the necessary steps to fulfill their child support responsibilities. By doing so, they not only support the financial stability of their children but also contribute to a more equitable and supportive society.