When it comes to divorce settlements, one of the key factors that often comes into play is alimony. Alimony, also known as spousal support, refers to the financial support paid by one spouse to the other after a divorce. However, not all alimony payments are created equal. In fact, there are different types of alimony, including temporary and permanent alimony. So, if you’re wondering, “Are temporary alimony payments usually higher or lower than permanent alimony payments?” you’ve come to the right place for answers.

When it comes to the comparison between temporary and permanent alimony payments, there isn’t a straightforward answer. The amount of alimony awarded in each case can vary depending on a variety of factors, such as the length of the marriage, the income and earning capacity of both spouses, and the standard of living established during the marriage. However, it’s important to note that temporary alimony payments are typically designed to provide financial support during the divorce process and are often higher in amount than permanent alimony payments. Temporary alimony aims to maintain the status quo and ensure that both spouses can adequately support themselves while the divorce proceedings are ongoing. On the other hand, permanent alimony is usually awarded when one spouse is unable to become self-supporting and requires ongoing financial assistance even after the divorce is finalized. So, whether temporary alimony payments are higher or lower than permanent alimony payments ultimately depends on the specific circumstances of each individual case.

Are Temporary Alimony Payments Usually Higher or Lower Than Permanent Alimony Payments?

Temporary alimony and permanent alimony are two different types of financial support that may be awarded during a divorce or separation. Understanding the differences between these two forms of alimony can help individuals navigate the complexities of their financial arrangements. In this article, we will explore whether temporary alimony payments are usually higher or lower than permanent alimony payments, and the factors that contribute to these determinations.

Temporary Alimony: An Overview

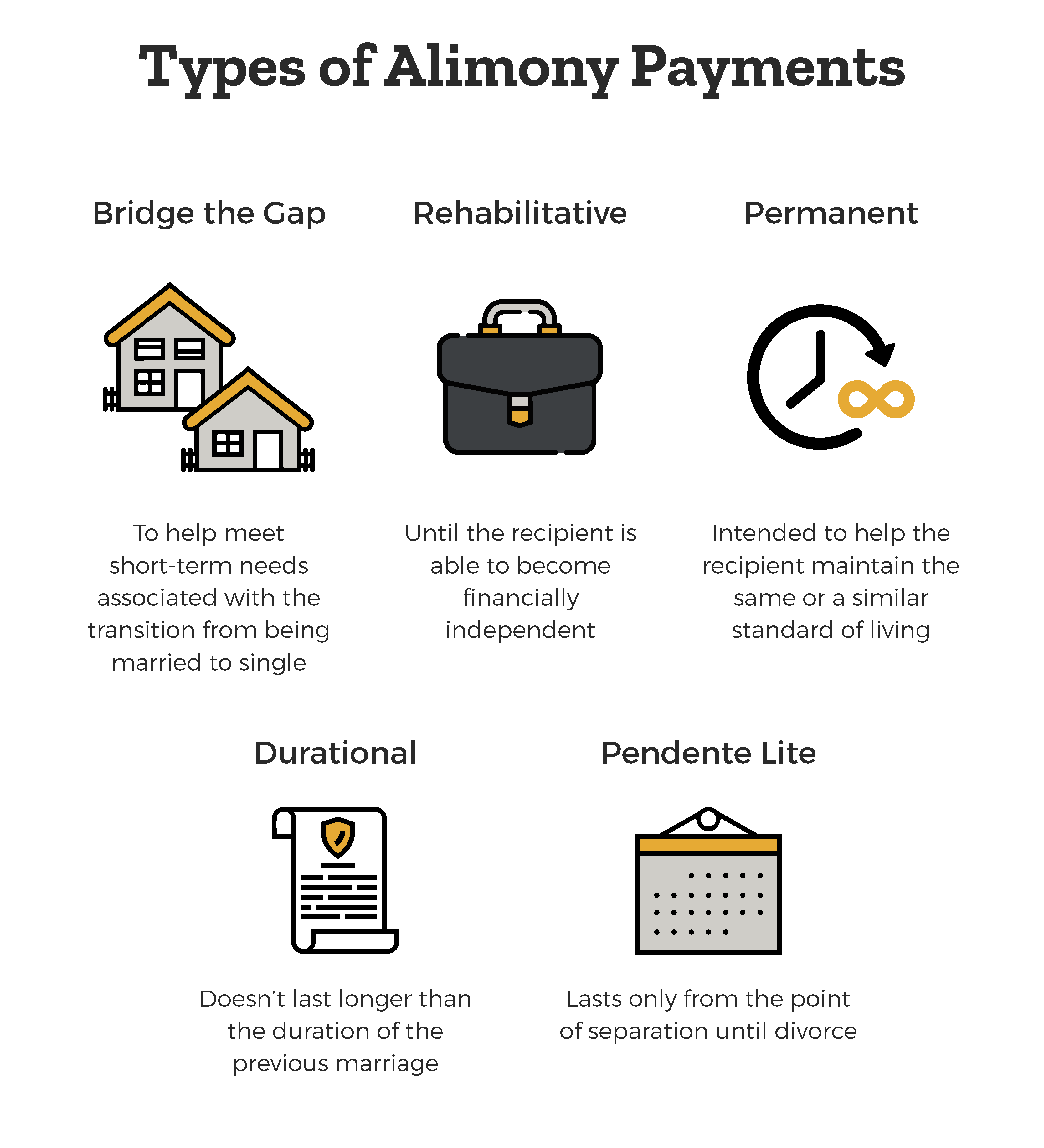

Temporary alimony, also known as pendente lite alimony, is awarded during the divorce process to provide financial support to the lower-earning spouse or the spouse who may require assistance to maintain their standard of living. It is intended to be a temporary solution until a final decision is made regarding the division of assets and the awarding of permanent alimony, if applicable.

Temporary alimony payments are often based on a formula or a set of guidelines provided by the state. These guidelines typically consider factors such as the duration of the marriage, the income disparity between the spouses, and the standard of living established during the marriage. The purpose of temporary alimony is to ensure that both spouses have the financial means to cover their expenses during the divorce proceedings.

Temporary alimony payments are typically lower than permanent alimony payments. This is because temporary alimony is intended to be a temporary solution and does not take into account the long-term needs of the recipient spouse. The amount of temporary alimony may be adjusted as the divorce proceedings progress and more information about the couple’s financial situation becomes available.

Factors Affecting Temporary Alimony Payments

Several factors can influence the amount of temporary alimony awarded. These factors may vary depending on the state’s laws and the specific circumstances of the case. Here are some common factors considered in determining temporary alimony payments:

1. Income Disparity: The difference in income between the spouses is a significant factor in determining the amount of temporary alimony. The higher-earning spouse may be required to provide financial support to the lower-earning spouse to help maintain their standard of living during the divorce process.

2. Standard of Living: The standard of living established during the marriage is often considered when calculating temporary alimony. The goal is to ensure that the lower-earning spouse can maintain a similar lifestyle during the divorce proceedings.

3. Duration of the Marriage: The length of the marriage may also impact the amount of temporary alimony awarded. Longer marriages may result in higher temporary alimony payments, as there is often a greater financial interdependence between the spouses.

4. Financial Needs: The financial needs of both spouses, including housing, healthcare, and daily living expenses, are taken into account when determining temporary alimony payments. The court aims to ensure that both parties have the necessary financial resources to meet their needs during the divorce process.

It is important to note that temporary alimony payments are not set in stone and may be subject to modification as the divorce proceedings progress. Once a final decision is made regarding the division of assets and the awarding of permanent alimony, the temporary alimony order may be terminated or adjusted accordingly.

Permanent Alimony: An Overview

Permanent alimony, as the name suggests, is awarded for a longer duration or indefinitely, depending on the circumstances of the case. It is typically awarded when one spouse is financially dependent on the other and requires ongoing financial support to maintain their standard of living after the divorce.

Permanent alimony payments are usually higher than temporary alimony payments. This is because permanent alimony takes into account the long-term needs of the recipient spouse, including their ability to support themselves and any ongoing financial obligations they may have.

Factors Affecting Permanent Alimony Payments

The determination of permanent alimony payments involves a comprehensive analysis of various factors. These factors may differ from state to state, but here are some common considerations:

1. Income Disparity: The difference in income between the spouses is a crucial factor in determining permanent alimony payments. The higher-earning spouse may be required to provide ongoing financial support to the lower-earning spouse to help them maintain their standard of living post-divorce.

2. Standard of Living: The standard of living established during the marriage is often a key factor in determining permanent alimony payments. The goal is to ensure that the lower-earning spouse can continue to enjoy a similar lifestyle after the divorce.

3. Duration of the Marriage: The length of the marriage plays a significant role in determining permanent alimony. Longer marriages may result in higher permanent alimony payments, as there is often a greater financial interdependence between the spouses.

4. Financial Needs: The financial needs of both parties, including housing, healthcare, and daily expenses, are considered when deciding permanent alimony payments. The court aims to provide the lower-earning spouse with the necessary financial support to meet their ongoing needs.

It is important to consult with a legal professional to understand the specific laws and guidelines regarding alimony in your jurisdiction. Each case is unique, and the court will consider various factors to determine the appropriate amount and duration of alimony payments.

In summary, temporary alimony payments are usually lower than permanent alimony payments. Temporary alimony serves as a temporary solution to provide financial support during the divorce process, while permanent alimony considers the ongoing financial needs of the recipient spouse. The amount of alimony awarded, whether temporary or permanent, depends on factors such as income disparity, standard of living, duration of the marriage, and financial needs. It is essential to seek legal advice to understand your rights and obligations regarding alimony during a divorce or separation.

Key Takeaways: Are Temporary Alimony Payments Usually Higher or Lower Than Permanent Alimony Payments?

- Temporary alimony payments are usually higher than permanent alimony payments.

- The purpose of temporary alimony is to provide financial support during the divorce process.

- Permanent alimony is typically awarded after the divorce is finalized and is meant to provide ongoing support.

- The amount of temporary alimony is often based on the higher-earning spouse’s income during the marriage.

- Permanent alimony is determined by various factors, including the length of the marriage and the financial needs of both parties.

Frequently Asked Questions

Question 1: How do temporary alimony payments compare to permanent alimony payments?

Temporary alimony payments are typically lower than permanent alimony payments. Temporary alimony is awarded to provide financial support to a spouse during the divorce process, until a final alimony agreement is reached or the divorce is finalized. The purpose of temporary alimony is to maintain the financial status quo and ensure that both spouses can meet their basic needs during this transitional period.

Permanent alimony, on the other hand, is awarded after the divorce is finalized and is meant to provide ongoing financial support to a spouse who is unable to become self-supporting due to factors such as age, health, or lack of job skills. Permanent alimony is often higher than temporary alimony as it is intended to support the recipient spouse for a longer duration.

Question 2: What factors determine the amount of temporary alimony payment?

The amount of temporary alimony payment is determined by several factors, including the income and earning capacity of both spouses, the length of the marriage, the standard of living during the marriage, and the financial needs and obligations of each spouse. Temporary alimony is calculated based on these factors to ensure that both parties can maintain a similar standard of living during the divorce process.

The court will also consider any additional factors that may be relevant to the case, such as the health, age, and job skills of each spouse. The goal is to ensure that the temporary alimony payment is fair and reasonable, taking into account the specific circumstances of the divorcing couple.

Question 3: Can temporary alimony be modified?

Yes, temporary alimony can be modified under certain circumstances. If there is a significant change in either spouse’s financial situation during the divorce process, such as a job loss or increase in income, either party can request a modification of the temporary alimony payment. The court will review the request and consider any relevant factors before making a decision.

It’s important to note that temporary alimony is subject to change once the divorce is finalized and a permanent alimony agreement is reached. The terms of the permanent alimony may be different from the temporary alimony, depending on the final settlement or court decision.

Question 4: Are temporary alimony payments tax-deductible?

Temporary alimony payments are generally tax-deductible for the paying spouse and taxable for the recipient spouse. This means that the paying spouse can deduct the amount of temporary alimony paid from their taxable income, while the recipient spouse must include the alimony as part of their taxable income.

However, it’s important to consult with a tax professional or attorney to understand the specific tax implications of temporary alimony in your situation, as tax laws may vary and change over time.

Question 5: How long do temporary alimony payments last?

The duration of temporary alimony payments varies depending on the specific circumstances of the case. In some cases, temporary alimony may only last until the divorce is finalized or a final alimony agreement is reached. In other cases, it may continue for a specific period of time, such as several months or years.

The length of temporary alimony is determined by factors such as the length of the marriage, the financial needs and obligations of each spouse, and any other relevant considerations. Once the divorce is finalized, temporary alimony will typically end or be replaced by a permanent alimony arrangement.

Will I Have To Pay My Ex-Wife Lifetime Alimony?

Final Thought: Are Temporary Alimony Payments Usually Higher or Lower Than Permanent Alimony Payments?

After exploring the topic of temporary and permanent alimony payments, it is clear that there is no definitive answer to whether temporary alimony payments are usually higher or lower than permanent alimony payments. The determination of alimony amounts depends on a variety of factors, including the specific circumstances of the divorcing couple and the laws in their jurisdiction. It is essential to consult with a legal professional to understand how alimony is calculated in your specific situation.

While some may assume that temporary alimony payments are generally higher due to the immediate financial needs of the receiving spouse, this is not always the case. Temporary alimony is typically awarded during the divorce process to provide financial support until a final settlement or judgment is reached. The purpose of temporary alimony is to maintain the status quo and ensure that both parties can maintain their standard of living throughout the divorce proceedings.

On the other hand, permanent alimony is typically awarded after the divorce is finalized and is intended to provide ongoing financial support to the dependent spouse. The determination of permanent alimony is based on various factors, such as the length of the marriage, the earning capacity of each spouse, and the standard of living established during the marriage. In some cases, permanent alimony may be higher than temporary alimony if there are significant disparities in income and financial needs.

Ultimately, the decision regarding alimony payments is made on a case-by-case basis, taking into account the unique circumstances of each couple. It is important to seek professional legal advice to fully understand your rights and obligations regarding alimony.