Have you ever wondered if your business interests could be considered marital property? It’s an important question to ask, especially when it comes to the division of assets during a divorce. The classification of business interests as marital property can have significant implications for both parties involved. In this article, we will delve into this topic and explore the factors that determine whether or not business interests are considered marital property.

When it comes to divorce proceedings, the division of assets can be a complex and contentious issue. One key factor that determines whether or not business interests are considered marital property is the timing of their acquisition. If the business interests were acquired during the course of the marriage, they are more likely to be considered marital property. However, if the business interests were acquired prior to the marriage or after the separation, they may be classified as separate property.

Another important consideration is the level of involvement of the non-owner spouse in the business. If the non-owner spouse actively participated in the business or made significant contributions to its growth and success, the business interests may be deemed marital property. On the other hand, if the non-owner spouse had little to no involvement in the business, it may be more likely to be considered separate property.

In conclusion, the classification of business interests as marital property can vary depending on factors such as the timing of their acquisition and the level of involvement of the non-owner spouse. It is crucial to consult with a legal professional who specializes in family law to understand how these factors may apply to your specific situation. By gaining a clear understanding of the rules and regulations surrounding business interests and marital property, you can make more informed decisions during the divorce process.

Are Business Interests Considered Marital Property?

In the context of divorce and property division, one of the key questions that arises is whether business interests should be considered marital property. This is an important issue as it can have significant financial implications for both spouses. In this article, we will explore the factors that determine whether business interests are considered marital property, the potential impact on divorce settlements, and the ways in which couples can navigate this complex issue.

Understanding Marital Property and Business Interests

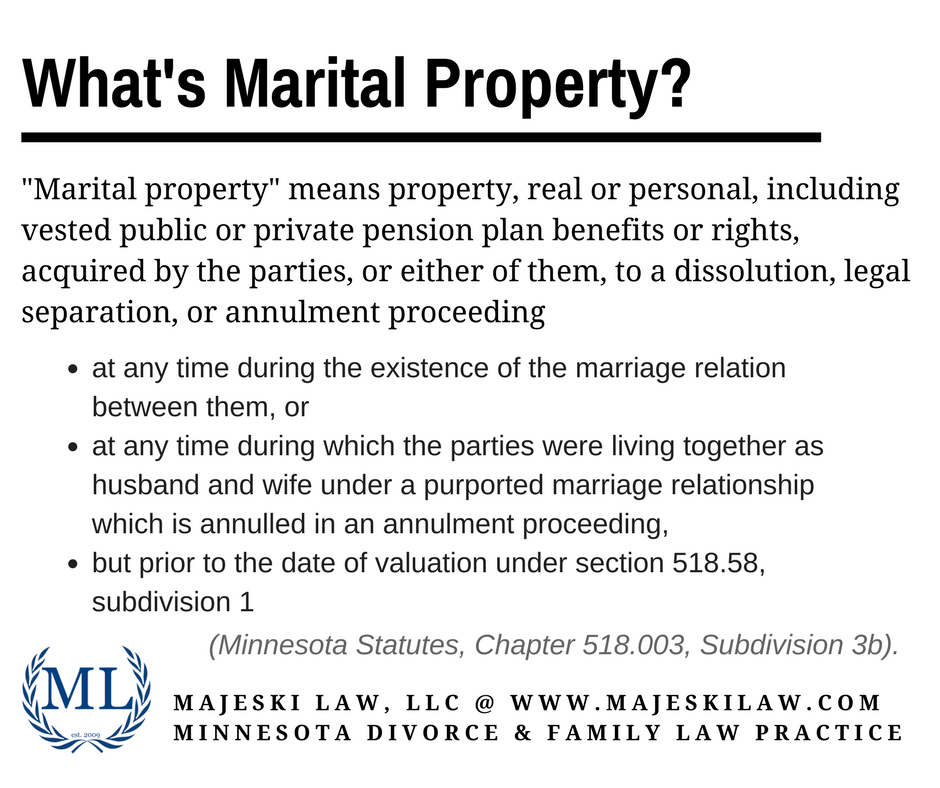

In order to determine whether business interests are considered marital property, it is essential to understand the concept of marital property itself. Marital property refers to all assets and liabilities acquired by either spouse during the course of the marriage. This typically includes income, real estate, investments, and personal possessions. However, the classification of business interests as marital property can vary depending on several factors.

When it comes to business interests, the key consideration is whether the business was established or acquired during the marriage. If the business was started or acquired by one spouse before the marriage, it may be considered separate property. However, if the business was established or acquired during the marriage, it is more likely to be considered marital property, subject to equitable distribution.

Factors Affecting the Classification of Business Interests

Several factors come into play when determining whether business interests are considered marital property. These factors can vary depending on the jurisdiction and the specific circumstances of the case. Here are some common factors that courts may consider:

- Contributions of Each Spouse: Courts may consider the contributions of each spouse to the business. This includes both financial contributions and non-financial contributions, such as labor and expertise.

- Source of Funding: The source of funding for the business can also be a relevant factor. If marital funds were used to start or support the business, it may strengthen the argument for classifying the business as marital property.

- Intention of the Parties: The intention of the parties regarding the classification of the business can also be considered. For example, if there was a prenuptial agreement that explicitly addresses the treatment of business interests, it may influence the court’s decision.

- Marital Efforts: If both spouses actively participated in the management and growth of the business during the marriage, it may be more likely to be classified as marital property.

It is important to note that the classification of business interests as marital property is not always straightforward. Courts have discretion in making these determinations and will consider the unique circumstances of each case.

The Impact on Divorce Settlements

The classification of business interests as marital property can have a significant impact on divorce settlements. If the business is considered marital property, it will be subject to equitable distribution, which means that it will be divided between the spouses in a fair and just manner. This does not necessarily mean an equal division, but rather a division that takes into account various factors, such as the length of the marriage, the financial contributions of each spouse, and the future earning potential of the spouses.

If the business is classified as separate property, it may not be subject to division during the divorce proceedings. However, the non-owning spouse may still be entitled to receive a portion of the value of the business as part of the overall settlement. This can be achieved through other means, such as offsetting assets or providing spousal support.

Options for Navigating Business Interests in Divorce

Given the complexities involved in determining the classification of business interests as marital property, couples going through a divorce have several options for navigating this issue:

- Negotiation and Mediation: Couples can choose to negotiate and mediate their divorce settlement, including the division of business interests. This allows them to have more control over the outcome and can result in a mutually agreed-upon resolution.

- Valuation by Experts: In cases where the value of the business is disputed, it may be necessary to enlist the services of experts, such as business appraisers or forensic accountants, to determine the fair market value of the business.

- Collaborative Divorce: Collaborative divorce is another option that allows couples to work together with professionals, including financial experts, to reach a settlement that considers the unique circumstances of their case.

Ultimately, the best approach for navigating the classification of business interests as marital property will depend on the specific circumstances of each case. It is advisable for couples to seek legal advice and explore their options to ensure a fair and equitable resolution.

Key Takeaways

When it comes to the classification of business interests as marital property, there is no one-size-fits-all answer. The determination will depend on various factors, including the contributions of each spouse, the source of funding for the business, and the intention of the parties. Understanding the impact of classifying business interests as marital property is crucial for both spouses, as it can significantly affect the outcome of the divorce settlement. By exploring different options, such as negotiation, mediation, and collaborative divorce, couples can find a resolution that takes into account their unique circumstances and ensures a fair and just division of assets.

Key Takeaways: Are Business Interests Considered Marital Property?

- Business interests acquired during marriage are generally considered marital property.

- Factors such as the source of funds used to acquire the business and the contributions of each spouse may affect the division of business interests.

- A prenuptial or postnuptial agreement can outline how business interests will be treated in the event of divorce.

- In some cases, a business may be considered separate property if it was owned prior to the marriage or acquired through inheritance or gift.

- It is important to consult with a qualified attorney to understand the specific laws and regulations regarding business interests in your jurisdiction.

Frequently Asked Questions

What are business interests?

Business interests refer to any ownership or financial stake in a business entity. This can include shares of stock, partnerships, limited liability companies (LLCs), or sole proprietorships. Business interests can also include intellectual property, such as patents or trademarks, that are associated with a business.

In the context of marriage, business interests can become an important factor in determining the division of assets during a divorce. If one or both spouses own or have an interest in a business, it may be considered marital property subject to division.

How are business interests treated in divorce?

When it comes to divorce, the treatment of business interests as marital property can vary depending on the jurisdiction. In general, if the business interest was acquired during the marriage, it is likely to be considered marital property and subject to division.

The court will consider factors such as the length of the marriage, the contributions of each spouse to the business, and the value of the business in determining how to divide the business interests. It is important to note that the court may not necessarily divide the business itself, but rather assign a value to the business interests and distribute other marital assets to achieve a fair division.

Are business interests always considered marital property?

Not necessarily. In some cases, business interests may be considered separate property if they were acquired before the marriage or inherited by one spouse during the marriage. However, if the business interests have been commingled with marital assets or if both spouses have actively participated in the business during the marriage, they may be considered marital property.

It is also worth noting that prenuptial or postnuptial agreements can play a role in determining the classification of business interests as marital or separate property. These agreements can outline how business interests should be treated in the event of a divorce, providing clarity and potentially avoiding disputes.

How is the value of business interests determined?

The valuation of business interests can be a complex process. It typically involves assessing the financial statements, cash flow, assets, liabilities, and market value of the business. Appraisers may be hired to determine a fair market value, taking into account factors such as industry trends and comparable sales.

The court may also consider the future earning potential of the business, the contributions of each spouse to its growth, and any tax implications associated with dividing the business interests. Seeking the assistance of financial experts or forensic accountants can help ensure an accurate and fair valuation.

What options are there for dividing business interests in divorce?

When it comes to dividing business interests in divorce, there are several options available. One option is for one spouse to buy out the other spouse’s share of the business, either through cash payments or by trading other marital assets.

If neither spouse wishes to continue the business, the business interests may be sold, and the proceeds divided between the spouses. Alternatively, the spouses may choose to continue operating the business together, although this can be challenging and may require clear agreements and ongoing communication.

Conclusion: Making Sense of Business Interests and Marital Property

After delving into the complex world of business interests and marital property, it becomes clear that there is no one-size-fits-all answer to the question of whether business interests are considered marital property. The determination depends on various factors such as the jurisdiction, the nature of the business, and the contributions of both spouses.

While some jurisdictions may view business interests as separate property if they were acquired before the marriage or through inheritance, others may consider them marital property if they were acquired during the marriage or with joint funds. It is crucial for couples to consult with legal professionals who specialize in family law to understand the specific laws and regulations that apply to their situation.

The key takeaway is that communication, transparency, and legal guidance are essential when it comes to navigating the complexities of business interests and marital property. Couples should proactively discuss their expectations and concerns regarding their business interests before and during the marriage. By seeking professional advice and taking the necessary steps to protect their interests, couples can ensure a fair and equitable division of assets in the event of a divorce.

Remember, every situation is unique, and what may apply in one jurisdiction may not hold true in another. It is always best to consult with legal experts who can provide personalized guidance based on the specific circumstances. With proper understanding and proactive measures, couples can safeguard their business interests while maintaining a solid foundation for their marriage.