Alimony, that’s a word you’ve probably heard before. But what exactly is it, and how is it determined? Well, my friend, you’ve come to the right place. In this article, we’ll unravel the mysteries of alimony and give you a clear understanding of what it entails and how it’s calculated. So, grab a cup of coffee, sit back, and let’s dive into the fascinating world of alimony.

Now, you might be wondering, “What is alimony?” Simply put, alimony is financial support that one spouse pays to the other after a divorce or separation. It’s meant to provide assistance to the lower-earning or non-earning spouse to help maintain their standard of living. But here’s the interesting part – the determination of alimony is not a one-size-fits-all process. It involves a careful evaluation of various factors, such as the length of the marriage, the income and earning potential of both spouses, and the financial needs and contributions of each party. So, buckle up and get ready to explore the intricacies of alimony and how it’s calculated.

What is Alimony and How is It Determined?

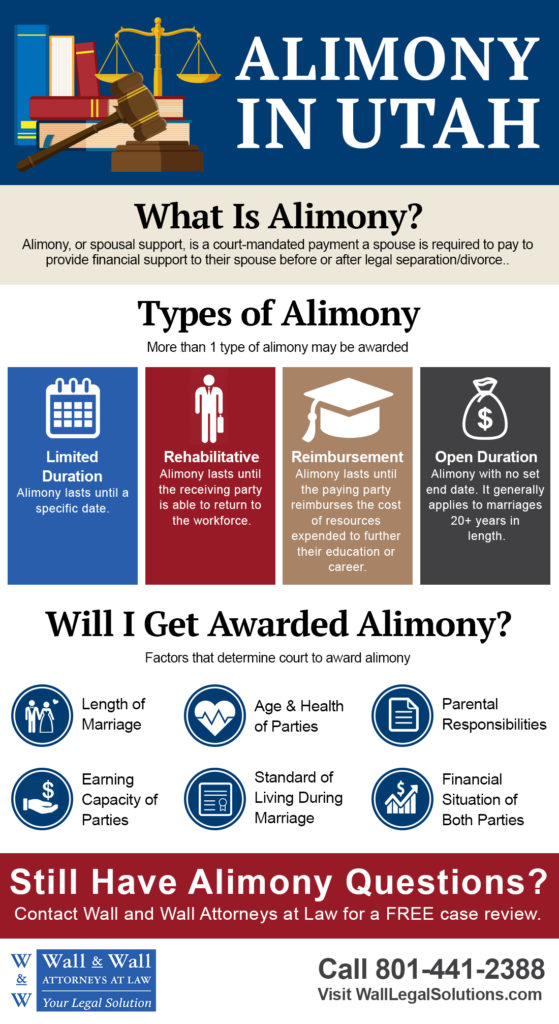

Alimony, also known as spousal support, is a legal obligation for one spouse to provide financial assistance to the other after a divorce or separation. The amount and duration of alimony payments are determined by several factors, including the length of the marriage, the earning capacity of each spouse, and the standard of living during the marriage. Courts consider each case individually to ensure a fair outcome for both parties involved.

Understanding Alimony

Alimony, also known as spousal support or maintenance, is a legal obligation for one spouse to provide financial support to the other spouse after a divorce or separation. It is intended to help the financially disadvantaged spouse maintain a similar standard of living that they had during the marriage. Alimony is not automatically granted in every divorce case, and the determination of whether or not alimony will be awarded depends on various factors.

Factors Considered in Determining Alimony

When determining alimony, courts take into consideration several factors. One of the primary factors is the financial need of the recipient spouse. This includes their income, earning capacity, and ability to support themselves. The court will also consider the financial ability of the paying spouse to meet the support obligation. This includes their income, assets, and financial obligations.

Another factor considered is the duration of the marriage. Generally, longer marriages are more likely to result in alimony awards, as there is often a greater disparity in earning potential between the spouses. The court will also consider the standard of living during the marriage and the contributions each spouse made to the marriage, both financially and non-financially.

Type of Alimony

There are different types of alimony that may be awarded depending on the circumstances of the case. Permanent alimony is awarded when the receiving spouse is unlikely to become self-supporting in the future due to age, disability, or other factors. This type of alimony continues until the death or remarriage of the receiving spouse.

Rehabilitative alimony is awarded for a specific period of time to allow the receiving spouse to acquire the necessary education or skills to become self-supporting. This type of alimony is often granted when one spouse gave up educational or career opportunities to support the other spouse during the marriage.

Durational alimony is awarded when a specific period of time for support is deemed appropriate. This is often the case in marriages of shorter duration where the receiving spouse needs temporary financial assistance.

Calculating Alimony

The calculation of alimony varies from state to state and is based on a number of factors. Some states have specific guidelines or formulas to determine the amount and duration of alimony, while others give judges more discretion in making these decisions.

In states with guidelines, factors such as the length of the marriage, income of both spouses, and the presence of children are taken into account. These guidelines provide a framework for judges to determine a fair and reasonable amount of alimony.

In states without specific guidelines, judges consider the same factors but have more flexibility in their decision-making process. They will assess the financial needs of the recipient spouse, the paying spouse’s ability to meet those needs, and any other relevant factors.

Regardless of the method used to calculate alimony, it is important to note that the court’s primary concern is fairness and ensuring that both parties can maintain a reasonable standard of living after the divorce.

Benefits of Alimony

Alimony serves several important purposes in divorce cases. It helps to ensure that the financially disadvantaged spouse is able to maintain a similar standard of living that they had during the marriage. This can be particularly important if one spouse sacrificed career opportunities or educational pursuits to support the other spouse and the family.

Alimony also provides a degree of financial security for the recipient spouse, especially in cases where they may have limited earning potential or face challenges in reentering the workforce. It can help them cover living expenses, educational costs, and other necessary expenses while they work towards becoming self-supporting.

Additionally, alimony can help to address any financial imbalances that may exist between the spouses, particularly in cases where one spouse has significantly higher earning potential or resources. It can help to level the playing field and ensure a fair distribution of financial resources post-divorce.

Common Challenges and Tips

Determining alimony can be a complex and contentious process. Both parties may have different perspectives on what is fair and reasonable. It is important to approach the negotiation or court proceedings with a clear understanding of the relevant laws and guidelines in your jurisdiction.

Consulting with an experienced family law attorney can help you navigate the process and ensure that your rights and interests are protected. They can provide guidance on the factors that may be considered in your case and help you present the strongest possible argument for your desired outcome.

It is also important to gather all relevant financial documents and information to support your case. This includes income statements, tax returns, bank statements, and documentation of any assets or debts. Having a clear understanding of your financial situation and being able to present this information effectively can strengthen your position in alimony negotiations.

In conclusion, alimony is a complex and important aspect of divorce proceedings. It is intended to provide financial support to the financially disadvantaged spouse and ensure a fair distribution of resources post-divorce. Understanding the factors that are considered in determining alimony and seeking professional guidance can help you navigate this process successfully.

Key Takeaways: What is Alimony and How is It Determined?

- Alimony is a financial support that one spouse may be required to pay to the other after a divorce or separation.

- The amount of alimony is determined based on factors such as the length of the marriage, the earning capacity of each spouse, and the standard of living during the marriage.

- Alimony can be awarded on a temporary or permanent basis, depending on the circumstances.

- Courts consider the needs of the receiving spouse and the ability of the paying spouse to meet those needs when determining alimony.

- Alimony can be modified or terminated if there are significant changes in the financial situations of either spouse.

Frequently Asked Questions

What factors are considered when determining alimony?

When determining alimony, several factors are taken into consideration. These factors may vary depending on the jurisdiction, but common factors include:

1. Length of the marriage: The duration of the marriage is an important factor in determining alimony. Generally, longer marriages are more likely to result in alimony payments.

2. Income and earning capacity: The income and earning capacity of both spouses are considered. This includes not only their current income but also their potential future earnings.

3. Standard of living during the marriage: The standard of living enjoyed by the couple during the marriage is often used as a benchmark for determining alimony. The goal is to allow the supported spouse to maintain a similar standard of living post-divorce.

4. Financial needs and resources: The financial needs and resources of both spouses are evaluated. This includes their expenses, debts, assets, and any other financial obligations.

What are the different types of alimony?

There are several types of alimony that can be awarded depending on the circumstances of the case:

1. Temporary alimony: This type of alimony is awarded during the divorce proceedings and is meant to provide financial support until a final decision is made.

2. Rehabilitative alimony: Rehabilitative alimony is awarded to a spouse who needs financial assistance while they acquire the necessary skills or education to become self-supportive.

3. Permanent alimony: Permanent alimony is awarded when one spouse is unable to become self-supportive due to age, disability, or other factors. This type of alimony may continue indefinitely or until the recipient remarries or passes away.

4. Lump-sum alimony: Instead of periodic payments, lump-sum alimony is awarded as a one-time payment. This type of alimony is often used to provide a clean break between the divorcing spouses.

Can alimony be modified or terminated?

Yes, alimony can be modified or terminated under certain circumstances. Common reasons for modification or termination of alimony include:

1. Change in financial circumstances: If either spouse experiences a significant change in income, the court may consider modifying the alimony order. This could include a job loss, promotion, or a decrease in earning capacity.

2. Remarriage or cohabitation: In some cases, alimony may be terminated if the recipient spouse remarries or begins cohabitating with a new partner. This is because the recipient may have a new source of financial support.

3. Retirement: If the paying spouse reaches retirement age and experiences a decrease in income, they may request a modification or termination of alimony.

It’s important to note that the specific rules regarding modification or termination of alimony may vary depending on the jurisdiction and the terms outlined in the original alimony agreement.

Is alimony tax-deductible for the paying spouse?

Prior to 2019, alimony payments were tax-deductible for the paying spouse and considered taxable income for the recipient spouse. However, under the Tax Cuts and Jobs Act, which went into effect on January 1, 2019, alimony is no longer tax-deductible for the paying spouse, and the recipient spouse no longer needs to report it as taxable income.

It’s important to consult with a tax professional or financial advisor to understand the specific tax implications of alimony in your situation, as tax laws may vary and change over time.

What happens if someone fails to pay alimony?

If a person fails to pay alimony as ordered by the court, they may be held in contempt of court. The consequences for non-payment of alimony can vary depending on the jurisdiction and the specific circumstances, but common enforcement measures include:

1. Wage garnishment: The court may order the paying spouse’s employer to withhold a portion of their wages to satisfy the alimony obligation.

2. Liens and asset seizure: The court may place a lien on the paying spouse’s property or assets and may even seize assets to satisfy the unpaid alimony.

3. Legal action: The recipient spouse may take legal action to enforce the alimony order, which could result in fines, penalties, or even imprisonment for the non-compliant spouse.

If you are experiencing difficulties with alimony payments, it is recommended to consult with an attorney to explore your options and seek legal advice.

Final Summary: Understanding Alimony and Its Determination

So, there you have it! Now you know what alimony is and how it is determined. Alimony is a financial arrangement that enables one spouse to provide financial support to the other after a divorce or separation. It is designed to help ensure that both parties can maintain a similar standard of living to what they had during the marriage. The amount and duration of alimony payments are determined by various factors, including the length of the marriage, the income and earning potential of each spouse, and the financial needs and obligations of both parties.

Determining alimony can be a complex process, as it requires careful consideration of multiple factors. Courts take into account the financial circumstances of both spouses, including their income, assets, and expenses. They also consider the contributions each spouse made to the marriage, both financially and non-financially. By considering these factors, courts aim to reach a fair and equitable decision that takes into account the unique circumstances of each case.

In conclusion, alimony is a crucial aspect of divorce proceedings that aims to provide financial support to the spouse in need. It is determined by considering various factors that ensure a fair and equitable arrangement. Understanding the concept of alimony and its determination can help individuals navigate the divorce process more effectively and make informed decisions for their future financial well-being.