Can child support enforcement garnish wages? It’s a question that may be on the minds of many parents who are responsible for paying child support. Well, the short answer is yes, child support enforcement agencies do have the power to garnish wages. But let’s dive deeper into what this means and how it works.

When it comes to ensuring that child support payments are made, child support enforcement agencies have various tools at their disposal. One of these tools is wage garnishment. This means that if a parent falls behind on their child support payments, the enforcement agency can legally take a portion of their wages directly from their paycheck.

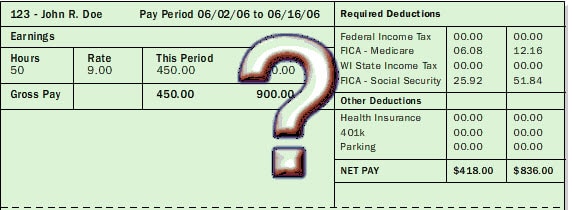

Now, you might be wondering how exactly this process works. Well, it typically starts with the child support enforcement agency obtaining a court order for wage garnishment. This court order is then sent to the employer, who is required by law to withhold the specified amount from the parent’s wages and send it directly to the agency. The agency will then distribute the funds to the custodial parent or directly to the state if the family is receiving public assistance. It’s important to note that the amount that can be garnished varies by state, but it is typically a percentage of the parent’s income.

So, if you find yourself falling behind on your child support payments, it’s crucial to understand that child support enforcement agencies have the power to garnish your wages. This is done in order to ensure that the financial needs of the child are being met. It’s always best to stay proactive and communicate with the enforcement agency if you’re facing difficulties in making your payments. Remember, it’s in the best interest of the child to receive the support they are entitled to, and wage garnishment is one tool that can be used to make that happen.

Can Child Support Enforcement Garnish Wages?

Child support is a legal obligation that parents have to financially support their children. In cases where one parent fails to meet their child support obligations, child support enforcement agencies can take various measures to ensure that the child receives the financial support they are entitled to. One of the methods used by these agencies is wage garnishment.

Wage garnishment, also known as wage withholding, is a legal process where a portion of an individual’s wages is withheld by their employer and paid directly to the child support enforcement agency. This ensures that the child support payments are made consistently and on time. But how does wage garnishment work, and what are the implications for both the paying parent and the employer?

Understanding Wage Garnishment for Child Support

Wage garnishment for child support involves the legal deduction of a specific amount from the paying parent’s wages. This amount is determined by a court order or an administrative agency. The employer is responsible for deducting the specified amount from the employee’s wages and forwarding it to the child support enforcement agency.

The process begins with the child support enforcement agency issuing an income withholding order to the paying parent’s employer. This order contains instructions on the amount to be withheld and the frequency of the deductions. The employer must then comply with the order and withhold the specified amount from the employee’s wages.

Implications for the Paying Parent

For the paying parent, wage garnishment can have significant financial implications. The amount that is withheld from their wages is typically a percentage of their income, which can vary depending on factors such as the number of children and the paying parent’s income level. This means that the paying parent will have a reduced take-home pay, which can impact their ability to meet their other financial obligations.

It’s important for the paying parent to understand their rights and responsibilities when it comes to wage garnishment. They have the right to dispute the amount being withheld if they believe it is incorrect or if they are facing financial hardship. It is advisable for the paying parent to seek legal advice if they wish to challenge the garnishment order.

Implications for the Employer

From the employer’s perspective, wage garnishment for child support can involve additional administrative tasks. The employer is responsible for accurately calculating and deducting the specified amount from the employee’s wages. They must also ensure that the deducted amount is promptly forwarded to the child support enforcement agency.

Employers must carefully comply with the income withholding order and adhere to the regulations set forth by the child support enforcement agency. Failure to do so can result in penalties and legal consequences for the employer. It is crucial for employers to establish efficient systems and procedures to ensure compliance with wage garnishment orders.

Benefits of Wage Garnishment for Child Support

Wage garnishment for child support offers several benefits for both the child and the receiving parent. Firstly, it provides a reliable and consistent source of income for the child, ensuring that their financial needs are met. This can contribute to their overall well-being and quality of life.

From the perspective of the receiving parent, wage garnishment eliminates the need to constantly chase the paying parent for child support payments. The payments are automatically deducted from the paying parent’s wages, reducing the burden on the receiving parent and providing them with a sense of financial stability.

Wage garnishment also benefits the child support enforcement agencies by streamlining the collection process. By working directly with the employer, the agencies can ensure that the payments are made consistently and on time, minimizing the need for enforcement actions.

In conclusion, wage garnishment is a powerful tool used by child support enforcement agencies to ensure that children receive the financial support they are entitled to. It involves the deduction of a specified amount from the paying parent’s wages, which is then paid directly to the child support enforcement agency. While it may have financial implications for the paying parent and additional administrative tasks for the employer, it offers numerous benefits in terms of consistent support for the child and a streamlined collection process.

Key Takeaways: Can Child Support Enforcement Garnish Wages?

- Child support enforcement can garnish wages to ensure timely payments.

- Garnishing wages means deducting money directly from a person’s paycheck.

- This process helps enforce child support orders and hold parents accountable.

- Garnished wages are sent to the child support agency and then to the custodial parent.

- Garnishment can continue until the owed child support is fully paid.

Frequently Asked Questions

How does child support enforcement garnish wages?

Child support enforcement agencies have the authority to garnish wages in order to collect unpaid child support. This process involves the agency obtaining a court order that directs the employer to withhold a portion of the noncustodial parent’s wages and send it directly to the child support agency. The amount that can be garnished varies depending on state laws and the individual’s income.

Once the court order is in place, the employer is legally obligated to comply with the wage garnishment. They will deduct the specified amount from the noncustodial parent’s paycheck and send it to the child support agency. The agency will then distribute the funds to the custodial parent or use them to satisfy the outstanding child support debt.

What are the consequences of wage garnishment for child support?

Wage garnishment for child support can have significant consequences for the noncustodial parent. Firstly, it can affect their overall income and financial stability, as a portion of their wages will be withheld. This can make it more difficult for them to meet their other financial obligations.

In addition, failing to comply with a child support wage garnishment order can lead to further consequences. The noncustodial parent may be subject to penalties, such as fines or even imprisonment, for non-payment. Their credit score may also be negatively impacted, making it harder for them to secure loans or obtain credit in the future.

Can child support enforcement garnish wages without a court order?

No, child support enforcement agencies cannot garnish wages without a court order. In order to initiate wage garnishment, the agency must first go through the legal process of obtaining a court order. This typically involves filing a petition with the court, providing evidence of the noncustodial parent’s delinquent child support payments, and requesting a wage garnishment order.

Once the court order is obtained, the agency can then proceed with garnishing the noncustodial parent’s wages through their employer. It is important to note that the court order will specify the amount to be garnished and the duration of the wage garnishment.

Can child support enforcement garnish wages if the noncustodial parent is self-employed?

Yes, child support enforcement agencies can still garnish wages if the noncustodial parent is self-employed. In these cases, the agency may work with the noncustodial parent’s clients or customers directly to collect the owed child support. They may issue a notice to the individual’s clients, instructing them to redirect a portion of the payments to the child support agency.

If the noncustodial parent is not compliant with the wage garnishment order, they may face legal consequences, such as fines or other penalties. It is important for self-employed individuals to understand their obligations and cooperate with child support enforcement agencies to avoid these repercussions.

Can child support enforcement garnish wages from multiple jobs?

Child support enforcement can garnish wages from multiple jobs if the noncustodial parent has more than one source of income. Each employer will receive a separate wage garnishment order and will be responsible for deducting the specified amount from the noncustodial parent’s wages. The child support agency will then receive the garnished funds from each employer and distribute them accordingly.

It is important for the noncustodial parent to inform all of their employers about the wage garnishment orders to ensure proper compliance. Failure to do so may result in non-payment or underpayment of child support, which can lead to legal consequences. The child support agency may also periodically review the noncustodial parent’s income sources to ensure accurate wage garnishment.

Child Support: Stop Wage Garnishment With A Simple Request!

Final Summary: Can Child Support Enforcement Garnish Wages?

After exploring the topic of child support enforcement and wage garnishment, it is evident that child support enforcement agencies have the authority to garnish wages to ensure that parents fulfill their financial obligations towards their children. Wage garnishment is a powerful tool used to collect overdue child support payments, providing a way for custodial parents to receive the financial support they need to raise their children.

In conclusion, if you find yourself in a situation where child support payments are not being made, it is crucial to understand that child support enforcement agencies have the legal right to garnish wages. This method serves as an effective means to ensure that parents meet their financial responsibilities and provide for their children’s wellbeing. It is important to consult with a legal professional or child support enforcement agency to understand the specific laws and regulations in your jurisdiction. By prioritizing child support payments, both parents can contribute to the welfare of their children and ensure a stable and secure future for them. Remember, supporting your child is not just a legal obligation but an essential responsibility that shapes their lives positively.