When it comes to divorce and the financial aspects that follow, one important factor to consider is how child support impacts spousal support amounts. This intricate relationship between child support and spousal support can have a significant impact on the overall financial arrangement between divorcing couples. In this article, we will delve into the dynamics of child support and spousal support, exploring how they intertwine and influence each other.

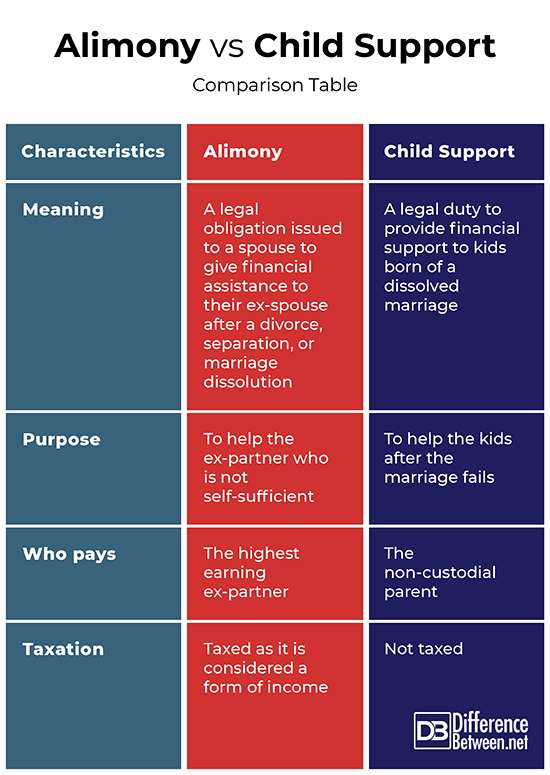

Child support and spousal support are two distinct forms of financial assistance that can be awarded in divorce cases. Child support is typically provided by one parent to the other for the well-being and upbringing of their children. On the other hand, spousal support, also known as alimony, is the financial support provided by one spouse to the other after the dissolution of their marriage. While these two types of support may seem unrelated, they can actually impact each other in various ways.

Understanding the connection between child support and spousal support is crucial for divorcing couples, as it can have a substantial effect on their financial arrangements. By exploring how child support influences spousal support amounts, individuals can make informed decisions and negotiate fair agreements during the divorce process. So, let’s dive into the intricacies of this relationship and shed light on the impact child support can have on spousal support amounts.

How Does Child Support Impact Spousal Support Amounts?

Child support and spousal support are two important components of divorce or separation cases. Understanding how child support impacts spousal support amounts is crucial for both parties involved. Child support refers to the financial payments made by one parent to the other for the benefit of their children. On the other hand, spousal support, also known as alimony, is the financial support provided by one spouse to the other after a divorce or separation.

The Relationship Between Child Support and Spousal Support

Child support and spousal support are separate legal obligations, and they are typically determined by different factors. However, in some cases, child support can indirectly impact the amount of spousal support that is awarded.

When calculating spousal support, the court takes into consideration the income and financial resources of each spouse. If one spouse is awarded a significant amount of child support, it may reduce their need for spousal support. For example, if the custodial parent receives substantial child support payments, they may not require as much spousal support to maintain their standard of living.

Factors Considered in Determining Spousal Support

There are several factors that courts consider when determining spousal support amounts. Some of these factors include:

1. Income and earning capacity of each spouse: The court will examine the income and potential earning capacity of both spouses. If one spouse has a significantly higher income or earning capacity, they may be required to pay spousal support to the other.

2. Length of the marriage: The duration of the marriage is an important factor in determining spousal support. Longer marriages may result in higher spousal support payments.

3. Standard of living during the marriage: The court will consider the lifestyle and standard of living enjoyed by the couple during the marriage. The goal is to ensure that both spouses can maintain a similar standard of living after the divorce.

4. Age and health of each spouse: The age and health of each spouse can also impact the amount of spousal support awarded. If one spouse has health issues or is nearing retirement age, they may require additional financial support.

5. Contributions to the marriage: The court will assess the contributions made by each spouse during the marriage. This includes both financial contributions and non-financial contributions, such as homemaking or supporting the other spouse’s career.

Child Support’s Impact on Spousal Support Amounts

Child support payments can indirectly affect the amount of spousal support awarded. As mentioned earlier, if the custodial parent receives substantial child support, their need for spousal support may be reduced. This is because child support is intended to cover the financial needs of the children, including housing, education, and healthcare expenses.

Courts consider the overall financial picture of both spouses when determining spousal support. If one spouse is already receiving significant child support, it may be deemed sufficient to cover their financial needs, and therefore, the court may award a lower amount of spousal support.

It is important to note that child support and spousal support are separate legal obligations, and they serve different purposes. Child support is focused on the well-being of the children, while spousal support is intended to help the lower-earning spouse maintain their standard of living after the divorce.

Example Scenario

To better understand the impact of child support on spousal support amounts, let’s consider an example scenario. John and Sarah are getting a divorce, and they have two children. Sarah has primary custody of the children, and John is ordered to pay child support.

In this scenario, the court determines that the child support payments adequately cover the children’s expenses, including housing, education, and healthcare. When calculating spousal support, the court takes into consideration Sarah’s reduced financial needs due to the child support payments. As a result, the court may award a lower amount of spousal support to Sarah, as her financial needs are being partially met through child support.

It’s important to consult with a family law attorney to understand how child support and spousal support may interact in your specific situation. Every case is unique, and the court will consider various factors when making determinations.

Child Support and Spousal Support: Legal Considerations

When it comes to child support and spousal support, it’s crucial to understand the legal considerations involved. Each jurisdiction may have its own laws and guidelines for calculating child support and spousal support amounts.

It’s important to consult with a family law attorney who specializes in divorce and separation cases. They can provide guidance on the legal requirements and help you navigate the complexities of child support and spousal support.

In conclusion, child support can indirectly impact the amount of spousal support awarded. Courts consider factors such as the income and financial resources of each spouse, the length of the marriage, the standard of living during the marriage, the age and health of each spouse, and the contributions made to the marriage. Child support payments cover the financial needs of the children, and if the custodial parent receives substantial child support, it may reduce their need for spousal support. However, it’s important to consult with a family law attorney to understand the specific legal considerations in your jurisdiction.

Key Takeaways: How Does Child Support Impact Spousal Support Amounts?

- Child support can affect the amount of spousal support awarded in a divorce.

- If a parent is already paying child support, this may reduce their obligation to pay spousal support.

- The court considers the financial needs of both parties and the best interests of the children when determining spousal support.

- Child support payments are generally prioritized over spousal support payments.

- Child support and spousal support are separate legal obligations with different guidelines and calculations.

Frequently Asked Questions

When it comes to divorce or separation, child support and spousal support are two important factors that need to be considered. Understanding how child support impacts spousal support amounts is crucial for both parties involved. Here are some commonly asked questions and answers regarding this topic.

1. Can child support affect the amount of spousal support?

Yes, child support can have an impact on the amount of spousal support. In many cases, the court will take into consideration the amount of child support being paid when determining the spousal support amount. This is because child support is intended to cover the financial needs of the children, which can reduce the financial burden on the receiving spouse.

However, it’s important to note that child support and spousal support are separate legal obligations. The court will consider various factors, such as the income and earning potential of each spouse, to determine a fair spousal support amount. Child support payments alone may not fully offset the financial needs of the receiving spouse, especially if they have additional expenses.

2. Does the custodial parent receive both child support and spousal support?

It is possible for the custodial parent to receive both child support and spousal support. The court will consider the financial circumstances of both parties and make a decision based on what is deemed fair and reasonable. If the custodial parent has a lower income or is unable to work due to child-rearing responsibilities, they may be awarded spousal support in addition to child support.

However, it’s important to keep in mind that every case is unique and the court will consider various factors when determining spousal support. The goal is to ensure that both parties can maintain a reasonable standard of living post-divorce while also providing for the needs of the children.

3. Can child support be used to fulfill spousal support obligations?

No, child support cannot be used to fulfill spousal support obligations. Child support and spousal support are separate legal obligations and serve different purposes. Child support is intended to cover the expenses related to raising children, such as food, clothing, education, and medical care.

On the other hand, spousal support is meant to provide financial assistance to the receiving spouse to help them maintain a reasonable standard of living after the divorce. The court will consider the income and earning potential of both parties to determine a fair spousal support amount, which cannot be fulfilled by child support payments.

4. Can child support payments be modified if there are changes in spousal support?

In some cases, changes in spousal support may warrant a modification of child support payments. If the spousal support amount changes significantly, it can impact the financial circumstances of both parties, including the ability to provide for the children’s needs. In such situations, either party can request a modification of child support to reflect the new spousal support arrangement.

The court will review the circumstances and determine whether a modification is necessary. It’s important to follow the proper legal procedures and provide evidence to support the request for modification.

5. How can child support and spousal support be calculated?

The calculation of child support and spousal support amounts can vary depending on the jurisdiction and specific circumstances of the case. In general, child support is often determined based on factors such as the income of both parents, the number of children, and any special needs or expenses related to the children.

Spousal support, on the other hand, may be calculated based on factors such as the income and earning potential of each spouse, the length of the marriage, and the standard of living during the marriage. It’s important to consult with a family law attorney or seek guidance from your local court to understand the specific guidelines and formulas used for calculating child support and spousal support in your jurisdiction.

How Child Support Affects Alimony

Final Summary: The Impact of Child Support on Spousal Support Amounts

After exploring the intricacies of child support and spousal support, it is evident that these two forms of financial assistance are closely intertwined. The presence of child support can significantly impact the amount of spousal support awarded in a divorce settlement.

When determining spousal support, courts take into account various factors such as the income and earning capacity of both parties, the length of the marriage, and the standard of living during the marriage. However, the addition of child support payments can affect these calculations. Child support payments are typically prioritized by the courts to ensure the well-being of the children involved. As a result, the spouse paying child support may have less available income to contribute towards spousal support, leading to potentially lower spousal support amounts.

It is important for individuals going through a divorce to understand the intricate relationship between child support and spousal support. By consulting with a knowledgeable attorney and understanding the specific laws and guidelines in their jurisdiction, individuals can better navigate these financial considerations. Ultimately, the impact of child support on spousal support amounts will vary depending on the unique circumstances of each case.