Divorce can be a challenging and emotional process, and it’s not just your assets that are at stake. One pressing question that often arises during a divorce is, “What happens to our joint debts?” It’s a valid concern, as financial obligations can have a significant impact on your post-divorce life. In this article, we will explore the intricacies of dividing joint debts in a divorce and provide you with valuable insights to navigate this aspect of the process.

When two individuals decide to separate, it’s not just their lives that become untangled; their financial responsibilities also come under scrutiny. Joint debts, such as mortgages, car loans, credit card bills, and personal loans, are debts that were incurred by both spouses during the course of their marriage. It’s important to understand how these debts are divided in a divorce to ensure a fair and equitable outcome for both parties. So, let’s dive into the world of joint debts in divorce and shed light on what you can expect when it comes to this challenging aspect of the process.

What Happens to Our Joint Debts in a Divorce?

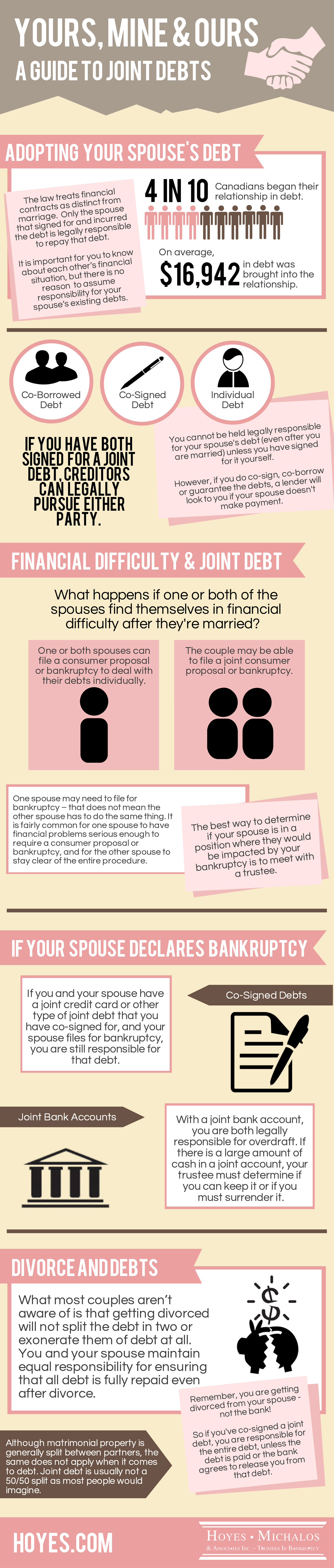

Divorce is a challenging and emotional process that often involves the division of assets and debts. One important aspect to consider is what happens to joint debts in a divorce. Joint debts are those that both spouses are responsible for, such as mortgages, car loans, and credit card debt. It’s essential to understand how these debts will be handled during the divorce proceedings and how they can impact your financial future.

When going through a divorce, it’s crucial to address the division of joint debts to ensure a fair and equitable outcome. The specific rules and regulations regarding joint debts vary depending on the jurisdiction, so it’s essential to consult with a legal professional who specializes in family law. They can provide guidance on the specific laws in your area and help you navigate the complexities of dividing joint debts.

How Are Joint Debts Divided in a Divorce?

During a divorce, the court will typically allocate joint debts between the spouses. The division of debts can be done in several ways:

- Agreement between spouses: In some cases, the divorcing couple may be able to reach an agreement on how to divide their joint debts. This can be done through negotiation or mediation, where both parties work together to come up with a fair and reasonable division of debts.

- Court decision: If the divorcing couple cannot agree on how to divide their joint debts, the court will step in and make a decision. The court will consider various factors, such as each spouse’s income, financial resources, and ability to pay the debts. They will aim to divide the debts in a way that is fair and equitable.

Factors Considered in Dividing Joint Debts

When determining how to divide joint debts in a divorce, the court will consider several factors:

- Income and earning capacity of each spouse: The court will assess each spouse’s income and earning potential to determine their ability to repay the debts. This includes considering factors such as education, work experience, and current employment status.

- Financial contributions during the marriage: The court will also take into account each spouse’s financial contributions during the marriage. This can include income earned, assets acquired, and debts incurred.

The court may also consider other factors such as the length of the marriage, the age and health of each spouse, and any other relevant circumstances. It’s important to note that the division of joint debts may not always be a 50/50 split. The court will strive to achieve a fair and equitable division based on the specific circumstances of the case.

Options for Handling Joint Debts

When it comes to handling joint debts in a divorce, there are several options available:

- Paying off the debts: One option is for both spouses to agree to pay off the joint debts together. This can be done through a lump sum payment or by dividing the debts and each spouse taking responsibility for their share.

- Transferring debts: Another option is to transfer the debts into one spouse’s name. This can be done through refinancing loans or transferring credit card balances. It’s important to note that transferring debts does not remove the responsibility for repayment; it simply shifts it to one spouse.

Importance of Consulting with a Legal Professional

Dealing with joint debts in a divorce can be complex, and the laws surrounding this issue can vary. It’s crucial to consult with a legal professional who specializes in family law to ensure that your rights are protected and that you understand your obligations.

A legal professional can help you navigate the intricacies of dividing joint debts and provide guidance on the best course of action based on your specific situation. They can also assist in negotiating settlements and representing your interests in court if necessary.

Conclusion

Dividing joint debts in a divorce is an important aspect that should not be overlooked. It’s essential to understand the options available and work towards a fair and equitable division of debts. Consulting with a legal professional who specializes in family law is crucial to ensure that your rights are protected and that you have a clear understanding of your financial obligations moving forward. With the right guidance, you can navigate this challenging process and set yourself up for a secure financial future.

Key Takeaways: What Happens to Our Joint Debts in a Divorce?

- 1. Joint debts are typically divided between the divorcing spouses.

- 2. Both parties are still responsible for repaying the joint debts, even after the divorce.

- 3. It’s important to close joint accounts and open individual accounts to avoid future liabilities.

- 4. Communication and cooperation between the ex-spouses are crucial to manage joint debts effectively.

- 5. Seeking legal advice can help navigate the complexities of dividing joint debts in a divorce.

Frequently Asked Questions

Question 1: How are joint debts divided in a divorce?

When it comes to joint debts in a divorce, the division is typically based on the laws of the specific jurisdiction and the agreement reached between the divorcing couple. In some cases, the debts may be divided equally between both parties, while in others, the division may be based on factors such as each spouse’s income, ability to pay, and contribution to the debt. It’s important to consult with a divorce attorney who can guide you through the process and help you understand how joint debts will be divided in your specific situation.

It’s worth noting that even if a divorce decree assigns responsibility for a joint debt to one spouse, creditors may still hold both parties responsible for the debt. This means that if the spouse responsible for the debt fails to make payments, creditors can pursue the other spouse for payment. To protect your financial interests, it’s important to have a clear understanding of your rights and obligations regarding joint debts during the divorce process.

Question 2: Can joint debts be refinanced after a divorce?

Yes, joint debts can be refinanced after a divorce. Refinancing involves replacing an existing loan with a new loan that is in the name of only one spouse. This can be done by either paying off the joint debt with a new loan or transferring the debt to one spouse’s name through a refinancing process.

Refinancing joint debts after a divorce can be beneficial as it allows one spouse to assume sole responsibility for the debt and removes the other spouse’s name from the loan. However, it’s important to note that refinancing is subject to the approval of the lender and the creditworthiness of the spouse seeking to refinance the debt. Consulting with a financial advisor or mortgage specialist can help you understand the refinancing options available to you and guide you through the process.

Question 3: What happens if one spouse fails to pay their share of the joint debts?

If one spouse fails to pay their share of the joint debts, it can have serious consequences for both parties. Creditors can pursue the non-paying spouse for payment, regardless of any agreement made during the divorce process. This means that even if the divorce decree assigns responsibility for the debt to one spouse, creditors can still hold the other spouse responsible if payments are not made.

To protect yourself from the financial repercussions of a non-paying spouse, it’s important to consider options such as refinancing the joint debts in your name alone or negotiating a payment plan with the creditor. Consulting with a divorce attorney can provide guidance on how to navigate these situations and protect your financial interests.

Question 4: Can joint debts be discharged in bankruptcy during a divorce?

Joint debts can be discharged in bankruptcy during a divorce, but it’s important to understand that bankruptcy can have significant consequences for both parties involved. Filing for bankruptcy can provide relief from joint debts by eliminating or restructuring the debt, but it can also impact credit scores and financial standing.

Before considering bankruptcy as an option, it’s advisable to consult with a bankruptcy attorney who can assess your situation and provide guidance on the potential consequences and alternatives available. Additionally, it’s important to note that not all joint debts may be dischargeable in bankruptcy, and the specific rules and regulations may vary depending on the jurisdiction.

Question 5: How can I protect myself from joint debts during a divorce?

To protect yourself from joint debts during a divorce, it’s essential to gather all relevant information about the debts, including account statements, loan agreements, and credit reports. Consulting with a divorce attorney who specializes in family law can help you understand your rights and obligations regarding joint debts.

You may also consider options such as refinancing joint debts in your name alone or negotiating a settlement agreement with the other spouse to allocate responsibility for the debts. It’s important to approach these matters with caution and seek professional advice to ensure that your interests are protected and that you have a clear understanding of your financial obligations.

⭐️ What Happens To Property (& Joint Debts) In A Divorce? (2022) | Jennifer Hargrave Show E49

Final Summary: What Happens to Our Joint Debts in a Divorce?

So, we’ve delved into the complex world of joint debts and divorce, and it’s clear that navigating these financial waters can be quite challenging. But fear not, because now you have a better understanding of what happens to your joint debts when you’re going through a divorce.

In conclusion, the fate of your joint debts will depend on several factors, including the type of debt, the state you live in, and the agreements you make with your ex-spouse. It’s important to communicate openly and honestly with your ex-spouse and seek legal advice if needed. Remember, the court’s primary concern is to ensure a fair distribution of assets and debts, taking into account various factors such as each party’s financial situation and contributions to the debts.

While divorce can be emotionally and financially draining, it’s crucial to approach the division of joint debts with a level head and a focus on finding a mutually beneficial solution. By understanding your rights and obligations, you can better navigate this challenging process and emerge on the other side ready to embark on your new chapter with a clean financial slate.